💥Oonts Oonts💥

Updates: Avant Gardner LLC, LifeScan Global Corp., Del Monte Foods Corporation II Inc. & More.

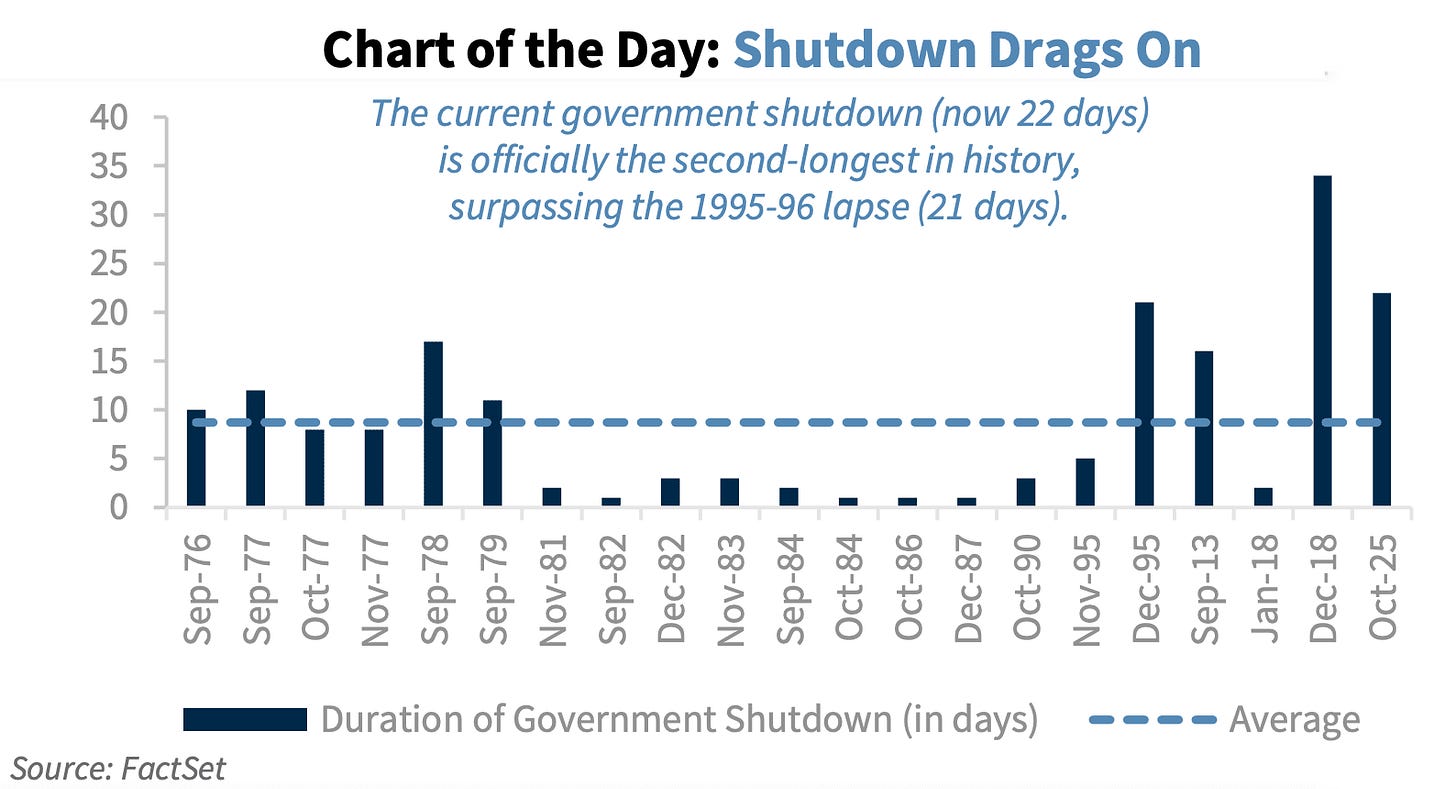

The United States government is currently shut down — a not-unprecedented sitch but nevertheless significant in that (i) this is the second longest full shutdown ever “with no end in sight” and (ii) nobody seems to give a flippity f*ck.

While representatives in Congress use this time “off” to shore up their coffers, President Trump is doing a little bit of redecorating, anti-counterfeiting, shakedowning, and tariff threatening. The zone is definitely flooded.

Putting aside all of that not-inconsequential stuff, you have to hand it to the administration: it played a game of chicken with tariffs/inflation and … gulp … dare we say it … won…?

On Friday, October 24, 2025, the US Bureau of Labor Statistics released its latest-yet-shutdown-delayed consumer price index (“CPI”) report and — ⚡️BOOM!⚡️— core CPI came down 0.1% sequentially while overall CPI went up 0.1%. Wait, what? Yes, the CPI was up but … ⚡️BUT!⚡️... it was up … 😉 … less than the expected 0.2%., 🙄. Uh, so yeah, a declaration of victory is a bit premature but these figures do appear to provide support for the Fed staying the course with rate cuts.*

The market bets that it will; it continues to strongly predict (98%) a 25 bps cut next week followed by another 25 bps cut mid-December (91%, up meaningfully from a month ago but down somewhat from last week, 🤔).

The stock market popped on Friday (but faded a bit into the close). Meanwhile, in case you stopped paying attention, the US 10-Year Treasury Yield is hovering just over 4%, a significant drop from its sustained elevated levels earlier this year (post Liberation Day).

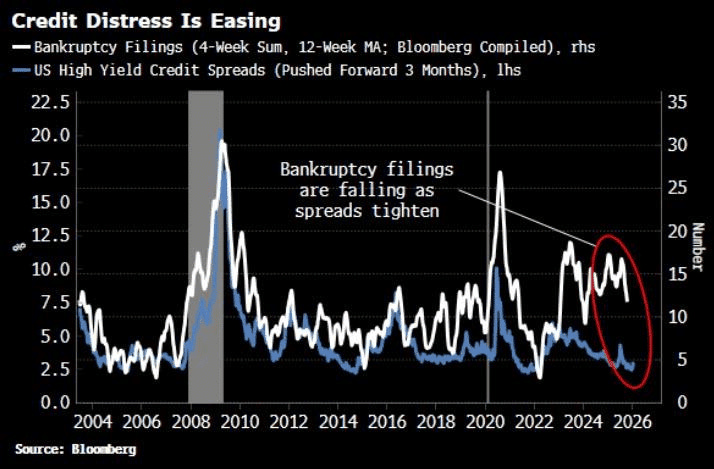

Speaking of significant drops…

… October continues to be a dead zone for chapter 11 bankruptcy activity. Yes, we’ve seen a few names file (and, yes, we’ll get to PrimaLend Capital Partners LP at a later date) but this level of size/activity is frankly pathetic AF and we’re not entirely sure things will dramatically improve. “Wait a second PETITION, reel that dumb f*ck Johnny in and don’t sugarcoat what’s going on in private credit and what the recent filings might portend for activity,” said our strawman. Well, don’t listen to us, listen to Peter Orszag, CEO & Chairman of Lazard Inc. ($LAZ):**