⏩One to Watch: Office Properties Income Trust ($OPI)⏩

The RMR Group ($RMR)-managed Office Properties Income Trust ($OPI) (“OPI” or the “trust”) is a Newton, Massachusetts-based REIT with 125 properties and 17.3mm square feet across the United States. Formed in ‘09 as the Government Properties Income Trust, OPI originally had 33 properties with almost all rent coming from government tenants; it remained focused on its government leasing strategy during its early years and quickly grew to 71 properties by ’11, a number that, roughly anyway, it maintained for years, with the majority of the properties leased to government tenants. OPI enjoyed high occupancy rates (93%+) and grew same property rental income as a result.

Then, in ’17 and ’18, the trust tripled in size through two major deals. First, it acquired the First Potomac Realty Trust and its 39 properties for $1.4b in ’17, doubling down on its government strategy and going all-in on the D.C. metro area.

In ’18, the trust, facing significant near-term lease expirations (29% of annual income expiring in ’18 and ’19) and uncertainty about renewals, decided to merge with another large REIT, Select Income REIT. The merger closed at the end of ’18, and the combined company became the OPI with 211 properties across 38 states and D.C. Post-merger, OPI was to benefit from (i) greater scale, (ii) diversification away from only government tenants and into new geographies, and (iii) better laddering of lease expiration dates.

The merger was also de-leveraging for the trust, particularly after OPI executed its plans to sell off a number of older properties for $870mm. Leverage reached its lowest post-merger level in ’19, and management entered ’20 patting themselves on the back for reducing leverage below their target and touting their positioning post-merger.

And then … COVID. Net Operating Income fell 9% in ’20 and a further 8% in ’21. NOI has declined in all but one year and same property NOI has declined every single year since ’20 as the trust’s portfolio has suffered from weakening demand for office space due to post-pandemic changes in office utilization and remote work. The proportion of OPI’s portfolio that is occupied keeps falling.

Leasing office property has been a struggle for everyone post-COVID. OPI President and COO Yael Duffy explained on OPI’s 1Q25 earnings call that in the current environment, “…leasing demand has been concentrated towards trophy assets as tenants seek amenity rich buildings that will entice employees back to the office.”

And OPI’s properties are not that enticing …

… to say the least.

Holy hell. Someone check the suicide rate in Virginia.

Moreover, the cost to re-vamp and re-position OPI’s portfolio of primarily older buildings is out of reach for the debt-laden company (PETITION NOTE: don’t worry dear readers, this sh*t show of a cap stack is explored 👇).

On top of the post-COVID workplace shifts and unfavorable leasing dynamics, OPI is facing additional headwinds in its top market, Washington, D.C. Nearly a quarter of OPI’s annual rental income comes from the greater D.C. area and the U.S. government is its largest tenant by far at 17% of annual rental income. According to the company, the D.C. market vacancy rate is over 23%, and conditions are worsening as leasing to the federal government seems increasingly unstable in light of the “Department of Government Efficiency” (“DOGE”) setting its sights on reducing the government’s real estate footprint. (Yes, DOGE is still supposedly DOGE-ing without Elon Musk, according to Politico).

As it has become increasingly clear that the post-COVID shifts in office real estate markets represent not a blip but a wholesale change, OPI began scrambling to improve its lot amidst an increasingly dour market backdrop.

In ’23, it attempted to execute another diversifying and hopefully stabilizing merger with another RMR-managed REIT Diversified Healthcare Trust ($DHC). The deal ultimately fell through after DHC investors, including The D.E. Shaw Group, Flat Footed, H/2 Capital Partners and Lonestar Capital, mounted opposition to the merger.

In January ’24, a quarter after the merger died, OPI cut its quarterly dividend to $0.01/share in order to preserve cash.

OPI, advised by Moelis & Company LLC ($MC), then began to address its looming debt maturities through a series of transactions:

📍In February ’24, OPI issued $300mm of 9% senior secured notes due March ’29. The following month it redeemed at par all $350mm of its 4.25% senior notes due Dec ’24.

📍In June and October ’24, OPI exchanged $895mm of existing unsecured notes. variously maturing in ’25, ’26, ’27 and ’31, for $610mm of new 9% senior secured notes due September ’29 at an average of 68 cents on the dollar.

📍The trust executed a third exchange transaction in December ’24, exchanging $445mm of new 3.250% senior secured notes due March ’27 plus roughly $16mm of common equity for $282mm of 4.5% senior unsecured notes due ’25. This transaction enabled OPI to take out almost two-thirds of its ‘25 notes. It redeemed the remaining $172mm of ’25 notes in Jan ’25 at par.

📍In March ’25, OPI exchanged $14mm of new 8% senior priority guaranteed unsecured notes due ‘30 for $21mm of existing senior unsecured notes.

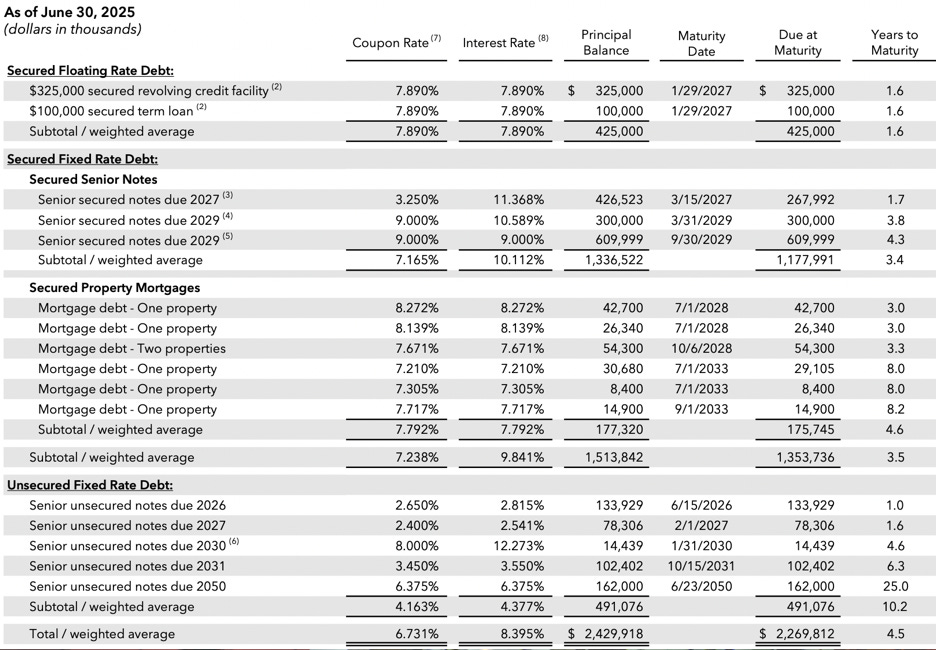

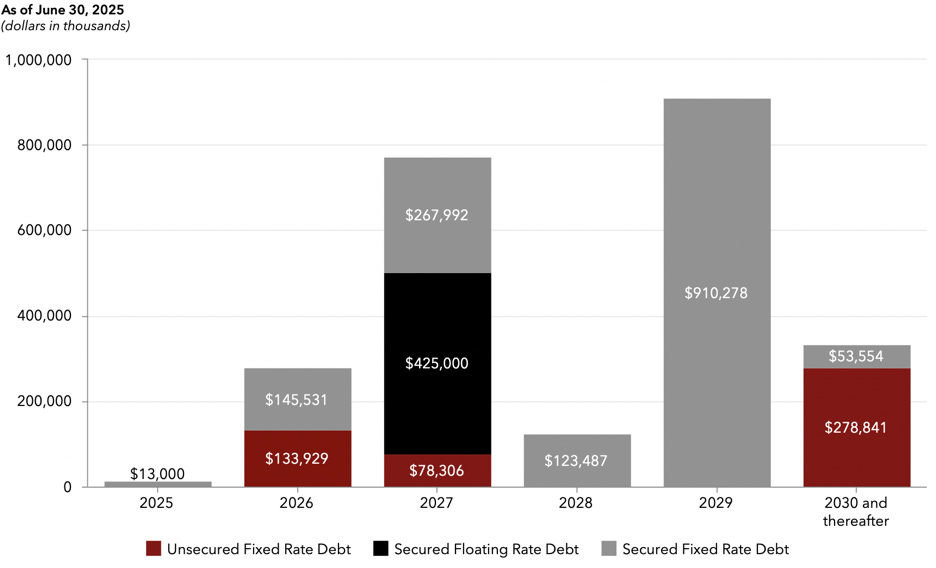

These transactions, plus other mandatory amortization and required paydowns upon the sale of collateral, have left OPI with the following complicated capital structure:

Through all of these transactions OPI has managed to address all but a sliver of its ’25 maturities, but it has another $279mm due next year (inclusive of amort payments) and $771mm the year after that.

Much of this debt is pricing like …

The unsecured 26s are (understandably) pricing in the mid-20s while the unsecured 31s are in the low-20s (both as of September 22, 2025). Juxtapose that against the secured 27s and 29s which are pricing in the low 80s and and low 70s, respectively.

In addition to ongoing negotiations with lenders, the trust has sought to address its debt burden and constrained liquidity by selling off assets. But even disposing of properties has proved challenging.

On the 2Q25 earnings call, Duffy explained:

“As property valuations continue to decline and the potential buyer pool targeting office acquisitions is limited, dispositions remain challenging. We have found that transaction timelines have significantly lengthened and often require a relaunching of marketing efforts as buyers are unable to transact. Despite these dynamics, we continue opportunities that may mitigate occupancy risk and reduce the carrying costs associated with vacant properties.”

As of June ’25, OPI had only managed to sell off three properties for a combined gross sale price of $27mm in ’25. In July ’25, the trust fully suspended its dividend to retain approximately $3mm of cash annually.

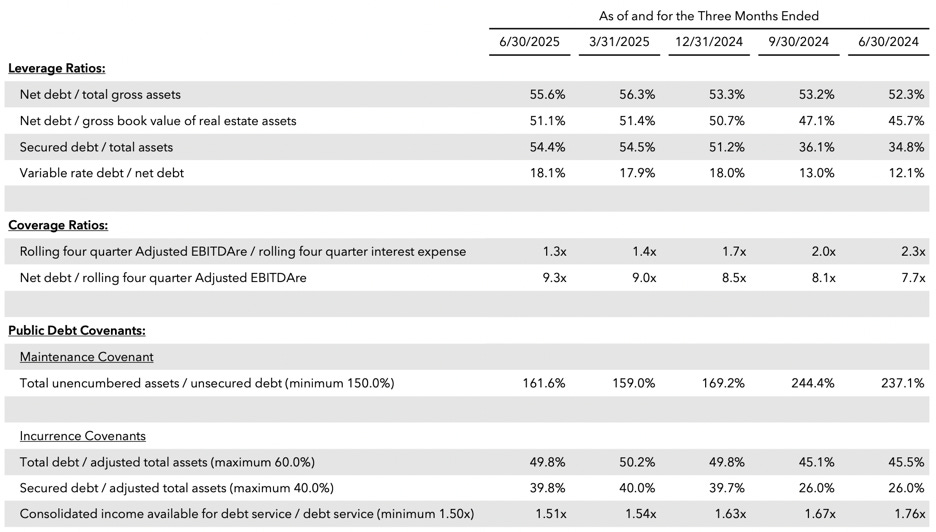

OPI’s ability to sell assets or otherwise engage in liability management is also constrained by covenants across its $2.4b debt load. It is close to busting its 150% total unencumbered assets to unsecured debt maintenance covenant (162% as of June 30, 2025) and has little headroom under its three incurrence covenants.

On September 15, 2025, the Board, which had previously added RX vet Timothy Pohl’s evil twin Timonthy and his amazing head shot to its ranks …

… appointed John Castellano of AlixPartners LLP to serve as Chief Restructuring Officer. The stock (inexplicably) rose briefly ahead of and after the announcement before (rightfully) dropping back down like Wile E. Coyote the following day.

7.5% of OPI’s leases are expiring in the next year, and it’s not exactly negotiating with its large government and corporate tenants from a position of strength. Layer on its inability to invest in building upgrades, its struggles to sell off assets to reduce carrying costs, and its upcoming debt maturities, and the trust is at risk of finally succumbing to the doom loop it’s been barely avoiding for years now. It’s no wonder rumors of a forthcoming bankruptcy filing have begun to swirl around OPI. After staying just ahead of its obligations for several years, OPI may have finally exhausted its out of court options.

⚡Update: QVC Group, Inc. ($QVCGA)⚡

We last checked in on live shopping company Qurate Retail Group, which rebranded in February ‘25 to QVC Group, Inc. ($QVCGA)* (“QVC” or the “company”), nearly two years ago in December ‘23.

Folks older than 40 — and young, faithful (🙏) readers of PETITION — will recall that “live shopping” is a euphemism for a never-ending, 24/7/365 infomercial with a rotating assortment of products … and characters. Like Kevin Hart and his latest hustle, the “ONE Superfood Plant-Based Protein Shake” VitaHustle:

The business seemingly should have already gone the way of the (soon to be resurrected?) dodo, but it limps on and, as we’ll discuss 👇, some apparently even see a future in it.

But before we go there, let’s jump back into this set-top-box era co.’s financials. Just as last time, it continues to report in four segments, QxH, QVC International, Cornerstone Brands Inc. (“CBI”), and Corporate and Other. QxH and QVC International are still your vintage “as seen on TV” teleshopping experience, although we’d be remiss not to note how damn dated the phrase itself is. Even the logo is in the shape of a decades-dead technology, the CRT television:

Anyway, QxH operates in the US, where it’s distributed “… to approximately 87 million television households …” while QVC International does the same thing in other markets, reaching ~124mm households, mainly in Europe and Japan. Meanwhile, CBI is a portfolio of “aspirational” brands in the home furniture and apparel space and Corporate and Other is … uh … pretty much empty. It used to house Zulily, an e-commerce platform, but QVC divested it in May ‘23 and recorded a $64mm net loss. Nevertheless, the segment lives on in memory on the balance sheet.

With a foothold in a bygone era, you might guess the post-COVID years haven’t been kind to the business’s cash flows. Well, guess what, bucko.

Here’s the damage:

Nothing. Pretty. About. That. It’s is still a melting ice cube … in a microwave (callback!) … plummeting into an active volcano.

But there is good news! Since we last tuned in, in March ‘24, the company paid off its remaining $423mm balance on its notes due ‘24.

Then, in September ‘24 and to buy time, QVC offered to exchange all of its then-existing $575mm and $500mm, respectively, in 4.75% notes due ‘27 and 4.375% notes due ‘28. For each $1k participated, ‘27 noteholders would receive $650 cash and $350 in new notes due April ‘29 (the “‘29 notes”), while ‘28 noteholders would swap 1:1 for ‘29 notes. Nearly everyone came to play: The transaction closed a couple of weeks later, with 92.4% of ‘27 noteholders and 85.5% of ‘28 noteholders tendering.

Finally, in February ‘25, the company followed up the prior year’s payoff with another. This time, it extinguished its $585mm in notes due ‘25, although that one is tempered by the fact the cash came from a draw on QVC’s $3.25b revolver.

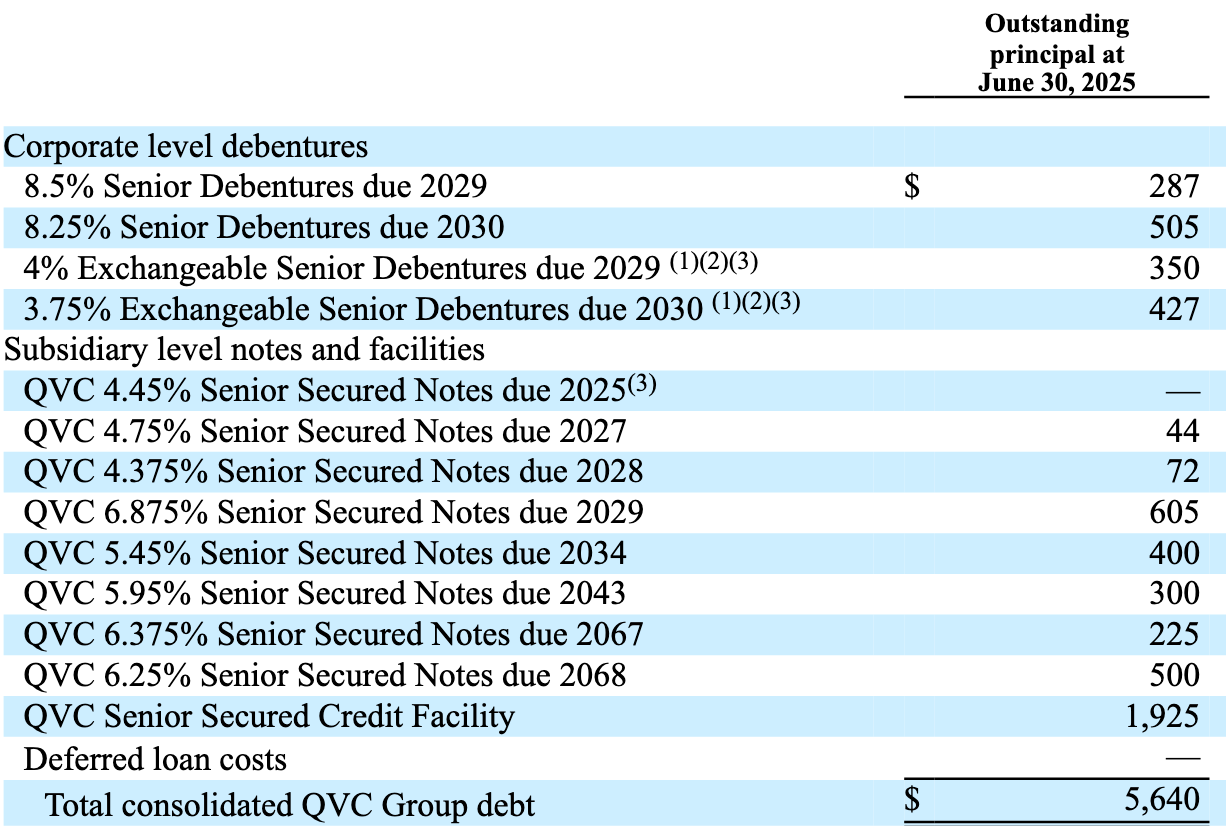

The as-exchanged-and-paid-off cap structure now looks like this …

… which is net-net about half a bil down from our last report.

And QVC ain’t just focused on its debt. This ol’ dog is trying to learn new business tricks. In August ‘24, QVC joined the kids on TikTok, and this past April, took it a step further by launching a 24/7 “social shopping experience” on the platform. That said, we’re curious if it’ll work out; we wouldn’t think the Venn diagram of TikTok’s userbase and live shopping enthusiasts provides much overlap.

Even with the bold thinking, QVC ain’t out of the woods. For one, that $3.25b revolver mentioned ☝️, it matures in October next year.

For a second, in May ‘25, the company had to do a 50:1 reverse stock split to keep its series A common stock ($QVCGA) compliant with Nasdaq’s $1/share listing rule. As for the series B ($QVCGB), that was a lost cause, and post-reverse-split, the company voluntarily delisted it the same month.

As a third, covenant compliance is a problem on the horizon. As of March 31, 2025, the company exceeded a 3.5x gross leverage covenant under its notes indenture, which, while unremedied, prohibits it from paying dividends and, subject to specific carveouts (e.g., taxes), making other restricted payments. The solution? Here’s CFO, Bill Wafford, on the 2Q’25 earnings call:

“In light of the numerous macroeconomic factors and current leverage levels as we previously announced on May 23, 2025, the Board of Directors unanimously decided to suspend payment of our quarterly dividend for preferred stockholders.”

Which quickly led to fallout.

QVC also has another covenant issue looming, and it ain’t so easy a solve. It’s the revolver’s maintenance-based 4.5x net leverage text, and as of June 30, 2025, QVC is creeping close, sitting at 3.9x.

In fact, unless something changes dramatically, it’ll probably exceed the threshold before long. In May ‘25, Fitch Ratings (“Fitch”) downgraded the company from B- to CCC+ and then, in August ‘25, S&P Global Ratings followed suit, dropping it from from CCC+ to CCC. Fitch had this to say:

“LTM 1Q25 revenue was $9.8 billion, meaningfully below the 2020 peak of $12.5 billion (adjusting for Zulily’s sale). EBITDA fell by half to $1.0 billion from about $2.1 billion during this period. With projected EBITDA for 2025 and beyond in the low-to-mid $800 million range, EBITDAR leverage will likely trend in the low-7x level.”

Is a restructuring up next? It’s certainly an option on the menu, and advisors are circling. Per the WSJ this past August:

“The company hired Kirkland & Ellis and Evercore to advise on managing its debt. Creditors at a QVC unit have engaged PJT Partners and Davis Polk & Wardwell, with bondholders advised by Akin Gump Strauss Hauer & Feld and Centerview Partners.”

And earlier in the same article:

“The lenders, holders of the retailer’s $3.25 billion revolving credit facility, have been working with law firm Simpson Thacher & Bartlett and financial adviser Lazard in recent weeks to form a cooperation group, the people said.”

Plus, DLA Piper LLP’s chairman emeritus Roger Meltzer and RX pro Carol Flaton joined QVC’s board in June ‘25.** And there are other indications.***

Hope, however, springs eternal. Did you, by chance, notice anything about that stock chart above? If you zoom in and focus in on more recent weeks, and even though, per FINRA, the ‘29 notes trade at 55c, it paints a nicer picture:

During the same period, the series A common rode a 🚀 to the 🌕:

Among the folks expecting a miraculously turnaround (and return) is Permit Capital, LLC, which, in early September ‘25, gobbled up another ~302.6k shares of $QVCGA at $8.15 a pop to increase its collective holdings to ~452.6k shares.

We can’t help but watch. The stock performance, not QVC’s stale programming.

We’ll circle back to this one as the show plays out.

*That’s the series A common stock. QVC also uses the ticker $QVCGP for its pref shares and, formerly, used $QVCGB for its series B common. But QVC voluntarily delisted that last one from Nasdaq back in May ‘25 in connection with the announcement of a 50-to-1 reverse split.

**For which they’ll take home a very cool $50k per month each.

***If you’re too lazy to click the link, the company revised its bonus incentive policy to lean more heavily into cash payments, including going 100% cash pay in ‘26 for President and CEO David Rawlinson, CFO Bill Wafford, and seven other senior execs.

Separately, back in January ‘25, QVC announced the closing of its St. Petersburg, FL campus, consolidating operations in its West Chester, PA studio, with a firing of ~900 of its 17k workforce (~5.2%) following a couple months later in March ‘25.

📚Resources📚

We have compiled a list of a$$-kicking resources on the topics of restructuring, tech, finance, investing, and disruption. 💥You can find it here💥.

📤 Notice📤

Brett Goodman (Partner) joined Polsinelli from ArentFox Schiff.

Brian Rosen (Senior Counsel) joined Invesco from Latham & Watkins LLP.

Forrest Drucker (Vice President) joined Cerberus Capital Management from Moelis & Company.

Lucas Barrett (Principal) joined Choate Hall & Stewart LLP from McDermott Will & Schulte LLP.

Mason Zurek (Associate) joined Ice Miller LLP from Kirkland & Ellis LLP.

🍾Congratulations to…🍾

AlixPartners LLP (David MacGreevey) for securing the financial advisor mandate on behalf of the official committee of unsecured creditors in the ModivCare Inc. chapter 11 bankruptcy cases.

FTI Consulting, Inc. (Matthew Diaz) for securing the financial advisor mandate on behalf of the official committee of unsecured creditors in the Valves and Controls US, Inc. chapter 11 bankruptcy case.

Jon Jordan, former King & Spalding LLP counsel, for getting sworn in last week as a new bankruptcy judge in the Northern District of Georgia (Atlanta).

The Numbers Group, LLC (Patricia Missal) for securing the financial advisor mandate on behalf of the official committee of unsecured creditors in the Aleon Metals, LLC chapter 11 bankruptcy cases.

Willkie Farr & Gallagher LLP (Brett Miller, Todd Goren, James Burbage, Jessica Graber) for securing the legal mandate on behalf of the official committee of unsecured creditors in the Spirit Aviation Holdings, Inc. chapter 11 bankruptcy cases.