🎳One to Watch: Pinstripes Holdings Inc. ($PNST)🎳

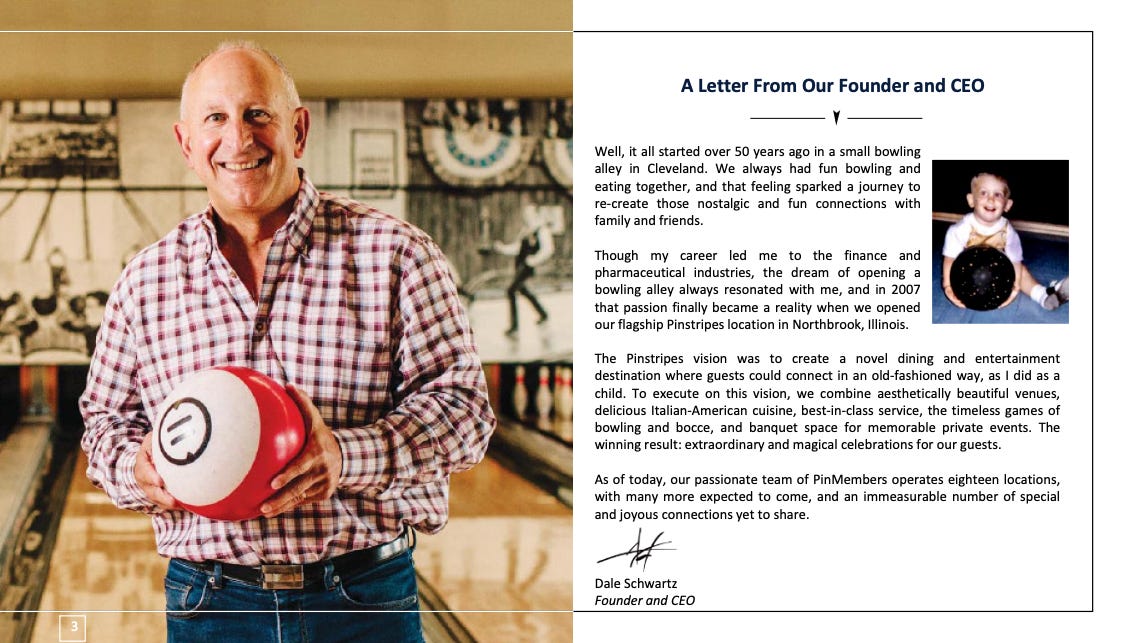

Illinois-based Pinstripes Holdings, Inc. ($PNST) is an experiential dining and entertainment concept “where magic strikes,” lol, over (i) “exceptional” Italian-American cuisine, (ii) bowling (🤔), and (iii) … is this serious? … yes … bocce (🤔🤔). Repeat: bocce. Like, yes: this concept actually exists.

The question is “why?” And the answer is, apparently, nostalgia👇!

Or something.

Founded in ‘07, PNST operates in ten states and Washington D.C.* Naturally, a bowling centric dining experience demands plenty of space so each location has between 26k and 38k square feet of interior — enough to include 11 to 20 bowling lanes, 6 to 12 bocce courts, and accommodate up to 900 guests at a time (including, allegedly, wedding parties, LOL, and other joyous group occasions). Here is an outside shot of the company’s very chic Bethesda, Maryland location:

Sick right? That fire pit will come in handy (keep reading).

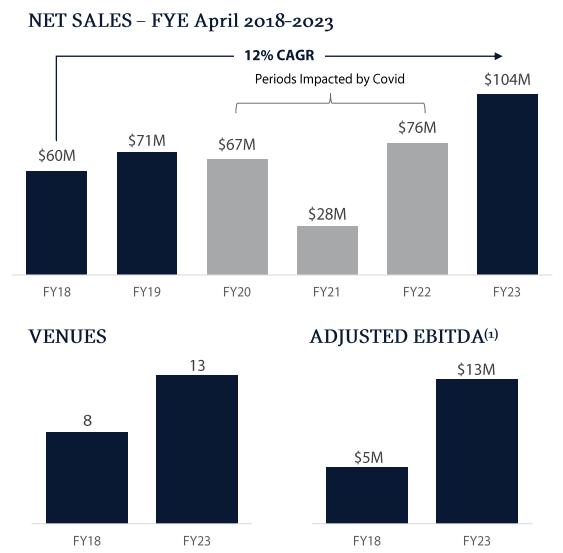

From ‘07 to ‘23 growth was … incremental. Indeed, by ‘23 there were 13 locations performing like this:

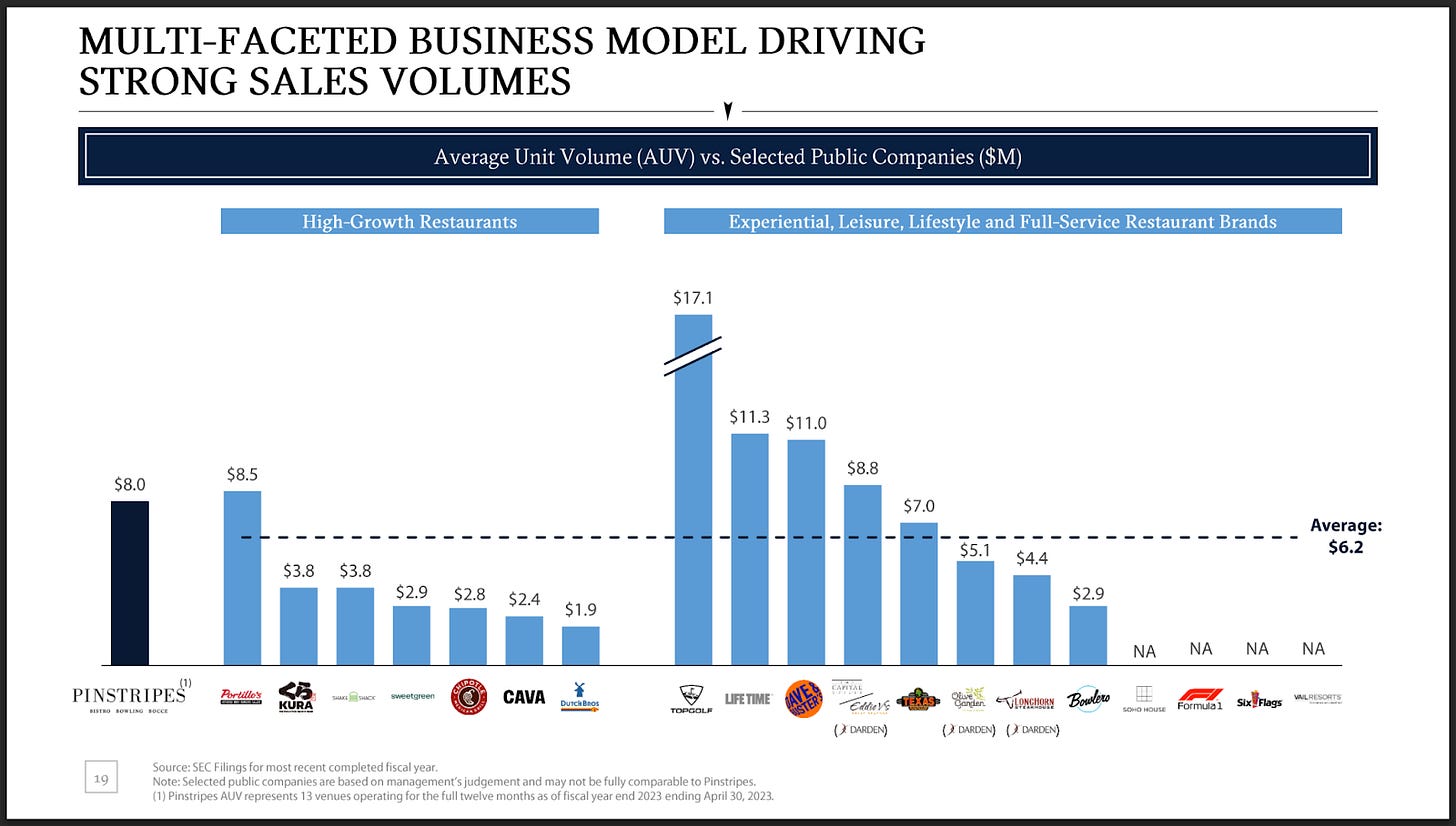

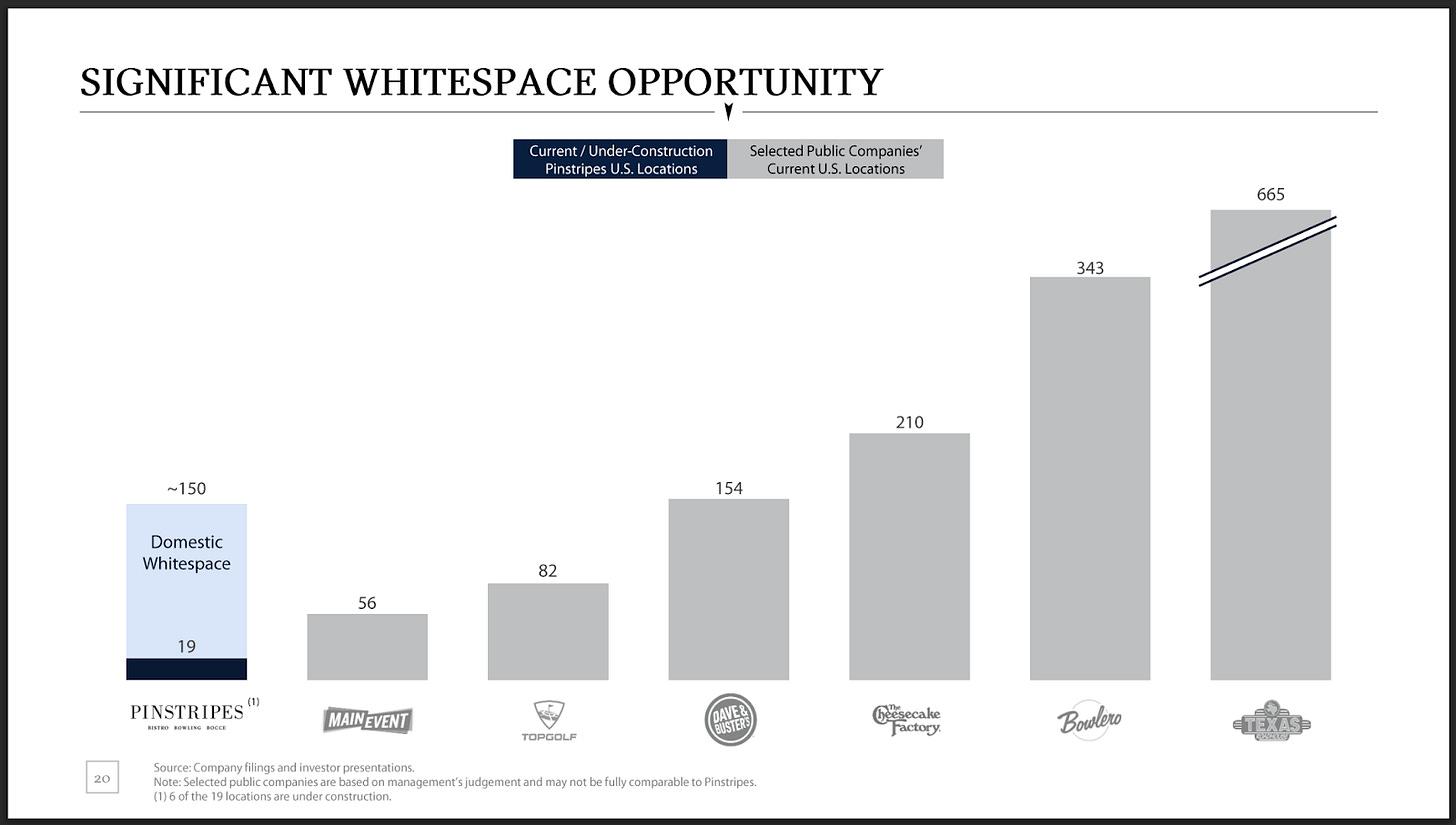

In June ‘23, PNST decided it needed growth capital and entered into a deSPAC agreement with Middleton Partners-affiliated, Banyan Acquisition Corporation (“Banyan”). The plan was to hit 20% annual total sales and adjusted EBITDA growth targets — yes, plural — and, by the end of December ‘24, have 25 venues at $185-195mm of net sales and $30-$33mm of adjusted EBITDA. Touting $8mm of average unit volume per location in an environment with a lot of alleged “whitespace,” the company attempted to convince investors that these figures were realistic. Simple math dictates that the calculations weren’t necessarily bonkers, subject, of course, to people actually giving a flying f*ck about bocce like they do about, say, golf (TopGolf!) or arcade games (Dave & Buster’s Entertainment Inc., $PLAY).

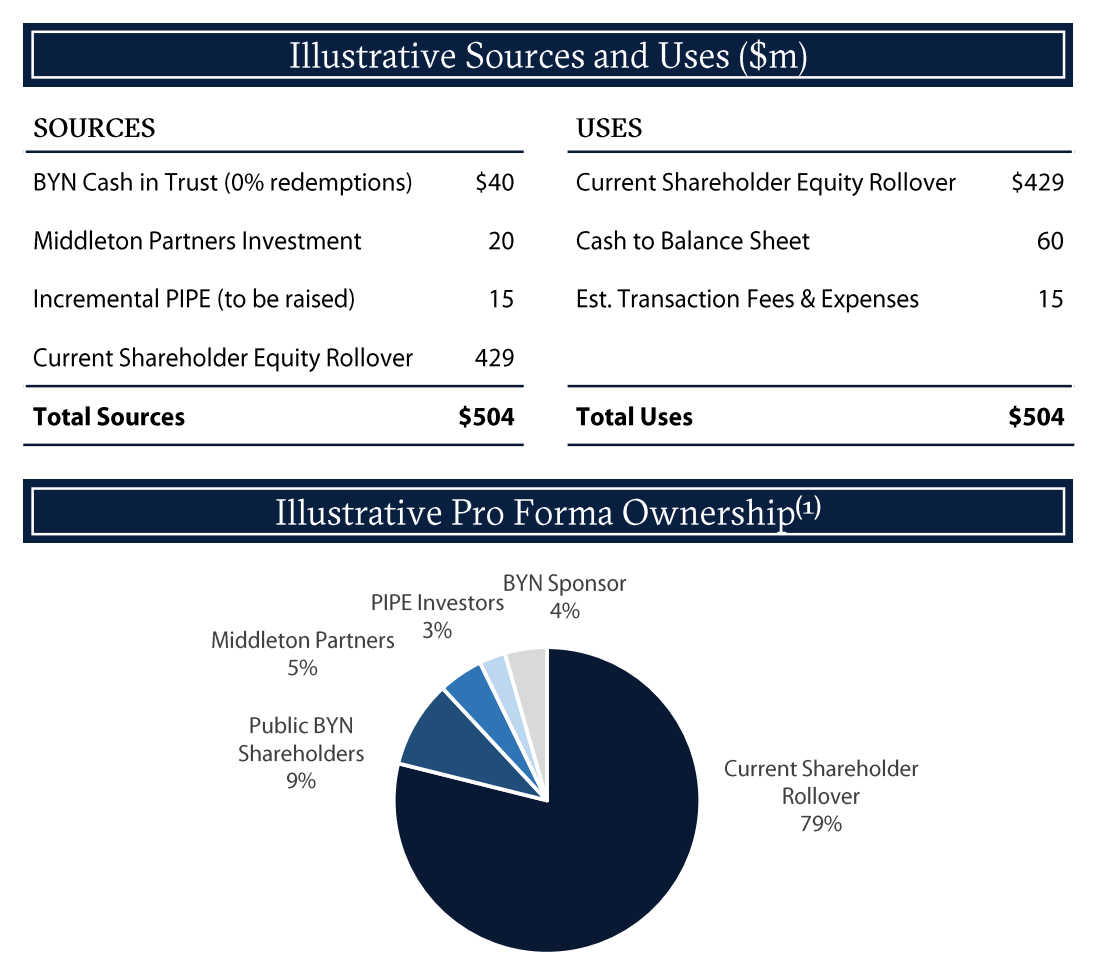

As originally contemplated, the deal would’ve generated $75mm in gross cash proceeds from Banyan’s $40mm cash in trust, a $20mm investment from Middleton Partners, and a $15mm PIPE investment.

But note (a) the 20% transaction fees/expenses and (b) the massive assumption baked into the “Sources” column.

Fast forward five months to December ‘23 and it became damn clear that the “0% redemptions” assumption was destined for the gutter.

Indeed, over 99% of Banyan’s shareholders collectively noped the f*ck out and redeemed their shares …

… depleting Banyan’s cash in trust to a measly $347k. The $15mm PIPE also fell apart. PNST waived the minimum cash condition just to close the transaction and take the company public but it obviously still needed money to fuel its growth strategy.

Which sets the stage for the company’s current capital structure. After the Banyan deal collapsed, in walked Oaktree Capital Management (“Oaktree”). It placed a two-tranche $90mm senior secured term loan maturing on December 29, 2028 and initially carrying a 12.5% interest rate payable in cash or in kind (company’s option). The first tranche of $50mm closed in late ‘23 and the second tranche of $40mm remained available for 12 months following the Banyan transaction at Oaktree’s sole discretion. The parties contemplated that Tranche 2 would repay amounts due to existing senior term lender, Silverview Credit Partners (“Silverview”), which was initially owed $35mm pursuant to a dual-tranche ‘27 term loan. Spoiler alert: Oaktree didn’t fund anything out of Tranche 2 (at that juncture) and that repayment didn’t happen.

PNST promptly put its new found dry powder to work and opened up 5 additional locations — getting the company to its now-existing 18 location footprint. This drove YoY revenue growth of 6.9%, 18.9%, 7.5%, and 10.4% for FY’24, 1Q’25, 2Q’25, and 3Q’25, respectively — notably significantly below the original 20% growth target. PNST booked same store sales declines for the past three quarters — (2.4%), (9.4%), and (7.7%) for 1Q’25, 2Q’25, and 3Q’25, respectively — and a disappointing LTM adjusted EBITDA of negative $9.4mm. Again, far from that projected 20% growth target. Clearly Banyan’s investors were right to peace the f*ck out. In its 1Q’25 10-Q filed in September ‘24, PNST issued a going concern warning. It was clear that Silverview and Oaktree had to roll up their sleeves.

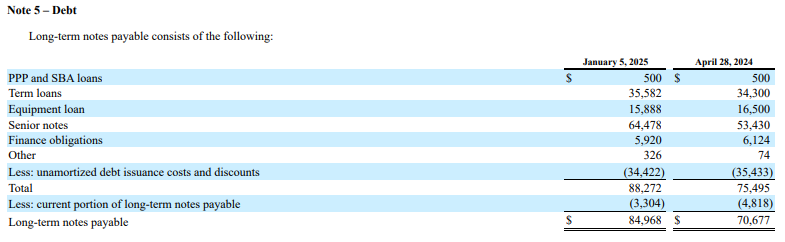

In mid-January ‘25, the company entered into a series of amendments. One, with Oaktree, pursuant to which Oaktree finally funded some money out of Tranche 2 ($6mm). This amendment also had the effect of altering the company’s interest nut to 20% PIK (from a previously amended/increased 12.5% cash/7.5% PIK in December ‘24). Two, with Silverview, which had the effect of (i) decreasing its interest rate, (ii) converting payment to a company cash/PIK option, (iii) eliminating financial covenants, and (iv) forbearing any exercise of rights/remedies. And, finally, with equipment lessor Granite Creek Capital Partners LLC (“Granite”), which opted to amend its ‘27 12% equipment loan, pursuant to which it is owed ~$15.5mm. Notably, both the Silverview facility and the Granite loan rank above the Oaktree loan in priority. As of the company’s last 10-Q, the company’s debt stack looks as follows:

In February ‘25, the company’s CFO resigned — always a good sign. In mid-March ‘25, the company appointed an interim CFO from the performance improvement division of AlixPartners LLP (“Alix”). We reckon he had his colleagues in RX on speed dial pretty much from the get-go.

Behind the scenes, PNST was working with its financial advisor, Piper Sandler & Co., on possible strategic alternatives. That ended up materializing as a binding letter of intent with Oaktree (the “LOI”) in March. Under the LOI, Oaktree would toss its paper into that handy-dandy bonfire 👆🔥 in a good ol’ fashioned debt for equity exchange. In the end, PNST would issue new common stock to Oaktree such that Oaktree would hold 85% of PNST’s outstanding common stock (plus 8% dividend preferred stock as a make-whole payment). In addition to wiping out most of its debt, Oaktree would provide an additional $7.5mm under the tranche 2 loan, waive all prior defaults, and eliminate financial covenants. For their part, existing shareholders would receive warrants at TEVs of $300mm, $400mm, and $750mm so that they can at least participate in any future upside. Per the company’s press release, “The closing of the recapitalization transaction contemplated by the LOI is subject to negotiation and finalization of definitive documentation and the satisfaction or waiver of customary conditions to closing.”

Around the same time, the New York Stock Exchange delisted the company — a mercy killing if we’ve ever seen one.

Which brings us to today. We have a lot of questions. Is Alix still in there? Is Oaktree going forward with the LOI? Or did it uncover something sketch and get cold feet? 🤷♀️, it’s been nearly three months and the company’s investor relations page is oddly quiet. Given the current bankruptcy environment, we reckon Oaktree is turning every stone to see whether there’s a “bankruptcy alternative” out there that makes sense in lieu of a chapter 11 filing.**

*The ten states include Florida, Connecticut, Illinois, Ohio, Kansas, New Jersey, Minnesota, Texas, Maryland, and California.

**If this does end up filing a chapter 11, we have a hard time imagining a company of this size will ultimately use Alix as its in-court financial advisor. Oaktree doesn’t typically enjoy incinerating its cash.

💨One to Watch: TPI Composites Inc. ($TPIC)💨

Founded in ‘68, but in its current business since ‘01, TPI Composites Inc. ($TPIC) (collectively with its direct and indirect subsidiaries, the “company”) is an independent manufacturer of composite wind blades. If you’ve ever road tripped across America, you’ll have no doubt noticed gargantuan turbines scattered across wide-open fields sporting ‘em.

So, obviously, the company is a green energy play. More granularly, when wind turbine original equipment manufacturers, like big hitters Vestas ($VWDRY), GE Vernova ($GEV), Nordex ($NRXXY), and ENERCON GmbH (“ENERCON”),* need to outsource production, they call up the company, which busts out big-a$$ blades ranging from 30 to 80 meters in length at its facilities in Mexico, Türkiye, India, and — very recently — the US, where production restarted in May ‘25 after having been shuttered in 4Q’21.

And while the company sees long-term growth opportunities in the wind industry, citing “… energy independence and security,” “climate change …” and a “… growing need for data centers, semiconductor chip manufacturers, the adoption of electric vehicles, and the electrification of buildings…,” the near- and medium-term are, um, more problematic.

Yes, tariffs are an issue. Both domestically for the Iowa-based US plant on account of raw materials, and internationally for the other sites because historically more than half of the wind blades the company pumps out find a home in the US. And when the administration can’t make up its mind on the when, where, and how of import taxes, markets tend to notice and the company’s customers plan accordingly.**

In addition to that, the company notes “… the U.S. market has been impacted by recent policy uncertainty for renewable energy coming from the current administration.” Benign as it gets. Others — admittedly self-interested — put it another way.

Which ain’t great news if wind is your entire biz. The uncertainty “… resulted in a reduction in orders and investment dollars flowing into wind projects during the first quarter of 2025.”

But it’s not just US policy that is holding the company back. Mexico and Türkiye, which accounted for 86% of net sales in ‘24 ($697mm Mexico, $447.9mm Türkiye), have their own challenges. Specifically through the minimum wage, which has sharply risen in each in recent years — for ‘23, ‘24, and ‘25, 20%, 20%, and 12% in Mexico and 55%, 34%, and 30% in Türkiye. The company hasn’t been able to fully pass those ⬆️ labor costs to customers.

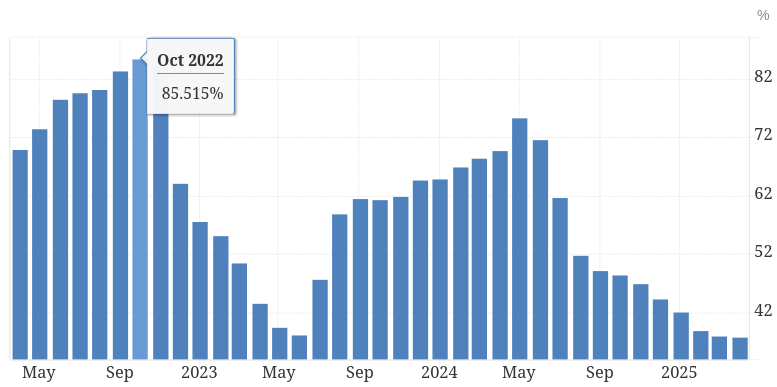

Moreover, Türkiye’s currency, the lira, continues to suffer from hyperinflation, has no signs of fully abating, and the country’s “… monetary policy continues to limit Turkish Lira devaluation, resulting in a very challenging environment to export goods out of Türkiye.”

How bad has it been? It, lol, “eased” to 37.9% YoY in April ‘25 …

To right the ship, the company adopted a Türkiye-focused restructuring plan in December ‘24 to combat inflation, as well as “… lower forecasted demand amid intense Chinese competition …” as manufacturers there push, with the backing of the Chinese government, to expand into Europe and undercut the company on pricing. The move? Tried and true, a culling of employees.*** 20% of the workforce, but because the company only has two locked-in manufacturing extensions beyond ‘25, it expects to make even further cuts as the year carries on.

The cumulative effect of all those inputs has been devastating to the company’s share price, which, while recovering in recent weeks, has fallen from a February ‘21 high of $78.74 to $[1.34] as of [June 3, 2025] and is down [25.4]% YTD.****

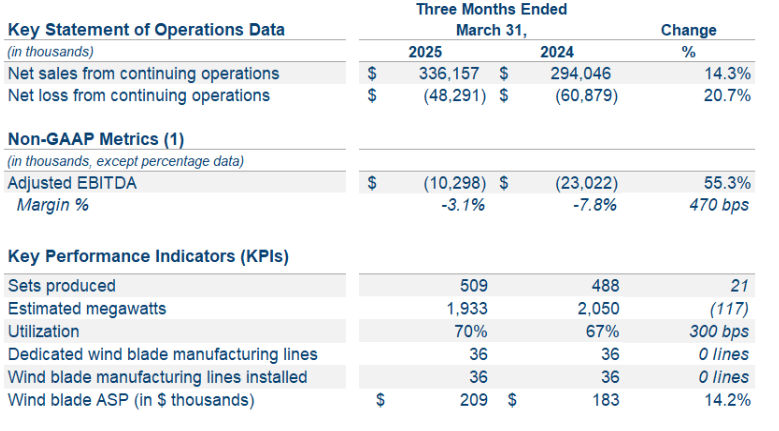

Will things turn around? Probably not. On May 12, 2025, the company released its 1Q’25 results, and while there was YOY growth, it wasn’t great …

… and the company revised down its FY25 guidance from 2-4% in adjusted EBITDA margin from continuing operations to 0-2%.

Time for strategic alternatives. On the same day, the company announced Neal Goldman and Timothy Pohl had joined TPIC’s board (each for $45k/month) and, if that weren’t enough, TPIC’s president and CEO, Bill Siwek, chimed in to let everyone know that “...we are working with a committee of our Board of Directors and with advisors to conduct a strategic review of our business and evaluate potential strategic alternatives focused on optimizing our capital structure for the current and future environment.”

Time to call up Oaktree Capital Management (“Oaktree”). The company has $696.4mm in debt (excluding $80.1mm in debt issuance costs and discounts) to consider, composed of an Oaktree-provided $453.3mm secured term loan (due March ‘27),***** $132.5mm in convertible unsecured notes (due March ‘28), $103mm in unsecured EMEA financing, $6mm in Indian secured and unsecured working capital, and $1.5mm in financing leases. Debt, which, no one is expecting it to fully pay back; as of June 2, 2025, the converts were pricing at a mere 8.4c on the dollar. As of March 31, 2025, the company had $171.9mm in unrestricted cash and no pending defaults but if multi-directional headwinds persist, a restructuring of some kind may nevertheless be on the horizon.

*VWDRY, GEV, NRXXY, and ENERCON account for 88% of the US onshore wind turbine market and 77% of the global onshore wind turbine market “ excluding China.”

**That said, the company’s Mexico-manufactured blades are USMCA-compliant and, therefore, presently tariff-exempt.

***In June ‘24, the company also chose to focus exclusively on the wind industry and divested itself of a wholly-owned subsidiary, TPI, Inc., which developed auto-industry products. The purchase price was not disclosed, but the company expected the move to “... improve monthly cash flow by about $1.7 million over the balance of 2024.”

****On May 2, 2025, the company received a deficiency letter from Nasdaq because its stock had traded below $1 per share for 30 consecutive business days. However, its share price has closed above that mark since May 13, 2025, so the company ought to be in the clear on that for now.

*****Oaktree owns ~9.7% of the company’s common stock too.

📚Resources📚

We have compiled a list of a$$-kicking resources on the topics of restructuring, tech, finance, investing, and disruption. 💥You can find it here💥.

📤 Notice📤

Coley Brown (Managing Director) joined Portage Point Partners from Huron Consulting Group.

Olivier Blechner (Managing Director) joined Portage Point Partners from Turicum Capital.

Rich Stieglitz (Partner & Co-Leader of Restructuring) joined Mayer Brown LLP from Cahill Gordon & Reindel LLP.

🍾Congratulations to…🍾

Dundon Advisers LLC (Joshua Nahas) for securing the financial advisor mandate on behalf of the official committee of unsecured creditors in the CTN Holdings Inc. chapter 11 bankruptcy cases.

McDermott Will & Emery LLP (Darren Azman, Steven Szanzer, Ethan Dover, Marcus Helt, Jack Haake, Michael Wombacher) for securing the legal mandate on behalf of the official committee of unsecured creditors in the Harvest Sherwood Food Distributors Inc. chapter 11 bankruptcy cases.

Province LLC (Paul Navid) for securing the financial advisor mandate on behalf of the official committee of unsecured creditors in the Global Clean Energy Holdings Inc. chapter 11 bankruptcy cases.