💥New Chapter 11 Bankruptcy Filing - Merit Street Media Inc.💥

Dr. Phil is no stranger to drama and he's got drama in spades with this one.

On July 2, 2025, Dr. Phil McGraw-affiliated Merit Street Media, Inc. (the “company”) filed a chapter 11 bankruptcy case in the Northern District of Texas (Judge Everett). Formed in January ‘23, the company was initially a 70/30-split joint venture (“JV”) between Christian-media outlet Trinity Broadcasting Network of Texas, Inc. (“TBN”)* and Dr. Phil’s production company, Peteski Productions, Inc. (“Peteski”). Under the arrangement, (i) TBN would provide the company — at no cost — all distribution and production services needed to launch and operate a new television network, as well as a license for all of its content and (ii) Peteski would deliver Dr. Phil and his famed programming, for which Peteski would be paid ~$50mm per year for ten years.

But pretty much immediately, TBN, according to the debtor “… reneged on its obligations and abused its position as the controlling shareholder of Merit Street to improperly and unilaterally burden Merit Street with unsustainable debt.”

Instead of providing free-to-the-company distribution to TV stations, “dozens” of which TBN and its affiliates owned (and cable and satellite providers), TBN caused the company to enter into its own broadcast arrangements at a ~$2.6mm monthly clip. And while TBN soaked up those costs “… for several months …,” it stopped thereafter, forcing the company to pay its own way.

TBN allegedly failed in numerous other ways. Production facilities promised were “… far from state of the art” and included “… nonfunctional screens, teleprompters, and control rooms as well as subpar or ineffective software,” and instead of being delivered at no cost, TBN again caused the company to sign a “… five-year, multi-million-dollar studio lease with TBN to produce Dr. Phil McGraw’s shows …” without so much as giving Peteski a heads-up. As a cherry on the sh*t sundae, TBN also apparently failed to deliver advertising sales infrastructure and didn’t even bother to create a sales team to monetize content created by Dr. Phil and his eclectic group of buds, Steve Harvey, Bear Grylls, and Nancy Grace, again forcing the company to come out of pocket.

Despite the shaky footing out of the gate, in November ‘23, TBN and Peteski publicly announced Texas-based MeritTV to “… provide a platform to embrace core American values of hard work, talent, and respect,” which debuted in April ‘24 to “… a record 100 million TV homes and connected devices.” A month later, in May ‘24, the company entered into a four-year deal with … ??? … Professional Bull Riders, LLC (“PBR”) to “… expand its viewership and revenue through PBR’s sports programming and [] broaden its advertising potential.”

Seriously. Who exactly is in this network’s target demo? Anyway, neither here nor there because, per CRO, independent director and first-day declarant Gary Broadbent, PBR took a page out of TBN’s book and also failed to perform. Though, PBR must disagree. It sent a notice of breach to the company in October ‘24 for failing to pay $3.5mm in monthly fees and, in November ‘24, terminated the deal and commenced arbitration.**

But by November ‘24, the company was already deeply in the sh*t. Backing up, in July ‘24, TBN skipped out on a $5mm JV payment owed, which led to an August ‘24 amendment that flipped ownership interests in favor of Peteski (now 70/30 the other way around)*** and the company’s exploration of “… various litigation and financial options to maximize the value of its existing assets.”

That exploration initially led to TBN and Peteski working to fix their broken relationship, and to bridge the gap while that was happening, the company issued a $25mm secured convertible note in September ‘24 to CrossSeed, Inc., an entity “… with whom TBN is closely connected[.]”****. Three months later, in December ‘24, the company, TBN, and Peteski inked proposed terms to squash beefs, largely by pushing costs back onto TBN where they always belonged.

It, lol, failed right out of the gate. While Peteski was drafting up definitive docs, “TBN abruptly stated that it would not honor …” the term sheet and proposed an “… entirely new …” deal that was “… unworkable and unacceptable …”

Still in December ‘24, the company issued another $5mm in convertibles to a trust, but that obviously wouldn’t last, and, in February ‘25, Peteski became the lender of last resort, purchasing ~$11.4mm in convertibles. Around the same time, the company sought out equity investments, but can you believe it, no one was interested in that …

… and in May ‘25, those efforts were abandoned. While that was going on, distributors noticed their bank accounts weren’t as flush as expected, breach notices came pouring in, and “… millions of households [lost] access to Merit Street’s programming, including Dr. Phil Primetime.”

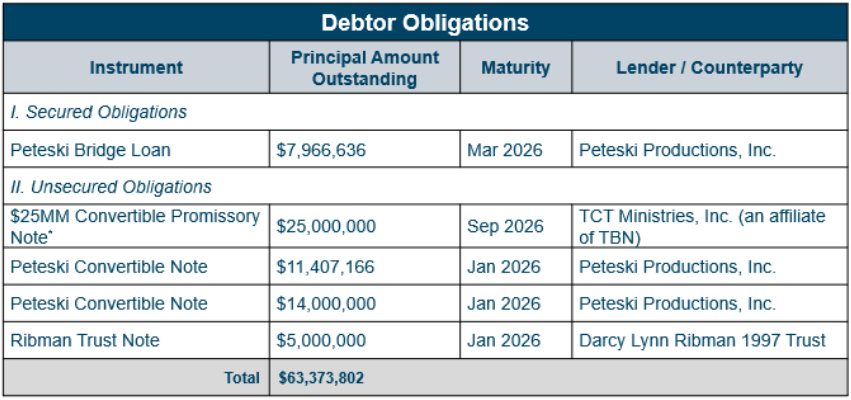

With liquidity running low, Peteski bought another $14mm in convertibles in early June ‘25 and, later that month, funded a ~$8mm secured bridge loan (the “bridge loan”), which gives us the full petition date debt stack:

That same month, the company brought on Mr. Broadbent, who is the sole member of the company’s special committee, and hired Sidley Austin LLP (“Sidley”) as legal counsel and Portage Point Partners-affiliates Triple P TRS, LLC and Triple P Securities, LLC as financial advisor and investment banker, respectively.*****

So now that it’s here, what’s the company plan on doing in chapter 11? For that, we go to Mr. Broadbent:

“Merit Street intends to maximize the value of its assets for stakeholders in this case by expeditiously transferring its assets, including the owned facilities and its intellectual property portfolio. The Debtor anticipates that in the coming days, more information will be shared regarding a potential pathway with respect to the process for monetizing such assets.

Merit Street has determined that an expeditious transition and marketing process and resolution of this Chapter 11 Case is necessary to preserve its limited liquidity and ensure the greatest possible recovery for its stakeholders.”

An amorphous sale. Super. Plus, TBN poked the bear.