💥March Madness: Filings Pile Up💥

Everde, OTB, Azzur, Cutera Inc. and Dynamic Aerostructures LLC File

Hot damn, what got into y’all?

We weren’t even caught up on some late February filings when all of the sudden — 💥BAM💥 — dockets in Delaware and Georgia(!) and Texas starting filling up. Let’s all pour one out, 🥃, for Judge Alfredo Perez in Texas, y’all.

Only two more and Judge Perez will have the blessing of Elon Musk! 😜

Hopefully the great state of New Jersey isn’t on DOGE’s radar because otherwise Musk might just have one of his Starlink satellites “Death Star” the bankruptcy court out of existence:

New Jersey lasted just a hair longer than President Trump’s most recently announced round of tariffs.

Speaking of which, we won’t bore you with an in-depth macro rundown today because (a) we have a lot to cover below and (b) you likely saw what we saw which is a continuation of the alluded to policy-WTF*ckery out of DC (that’s an objective statement, folks — clearly even President Trump doesn’t know what he’s going to do from one day to the next).

In a speech on Friday March 7, 2025 at the University of Chicago Booth School of Business 2025 U.S. Monetary Policy Forum, Jerome POW-ell took a measured tone lest he somehow get Musk’d:

“Inflation has come down a long way from its mid-2022 peak above 7 percent without a sharp increase in unemployment—a historically unusual and most welcome outcome. While progress in reducing inflation has been broad based, recent readings remain somewhat above our 2 percent objective. The path to sustainably returning inflation to our target has been bumpy, and we expect that to continue. We see ongoing progress in categories that remain elevated, such as housing services and the market-based components of non-housing services. Inflation can be volatile month-to-month, and we do not overreact to one or two readings that are higher or lower than anticipated. Data released last week showed that total PCE prices rose 2.5 percent over the 12 months ending in January and that, excluding the volatile food and energy categories, core PCE prices rose 2.6 percent. We pay close attention to a broad range of measures of inflation expectations, and some near-term measures have recently moved up. We see this in both market- and survey-based measures, and survey respondents, both consumers and businesses, are mentioning tariffs as a driving factor. Beyond the next year or so, however, most measures of longer-term expectations remain stable and consistent with our 2 percent inflation goal.”He continued:

“Looking ahead, the new Administration is in the process of implementing significant policy changes in four distinct areas: trade, immigration, fiscal policy, and regulation. It is the net effect of these policy changes that will matter for the economy and for the path of monetary policy. While there have been recent developments in some of these areas, especially trade policy, uncertainty around the changes and their likely effects remains high. As we parse the incoming information, we are focused on separating the signal from the noise as the outlook evolves. We do not need to be in a hurry, and are well positioned to wait for greater clarity.

Policy is not on a preset course. If the economy remains strong but inflation does not continue to move sustainably toward 2 percent, we can maintain policy restraint for longer. If the labor market were to weaken unexpectedly or inflation were to fall more quickly than anticipated, we can ease policy accordingly. Our current policy stance is well positioned to deal with the risks and uncertainties that we face in pursuing both sides of our dual mandate.”We meeaaan … what, realistically, was he gonna say? Something like this👇?

Or THIS 👇?!?

Lol, no, but still, something tells us he’s a wee bit more concerned than he’s showing. After all, this sure escalated quickly:

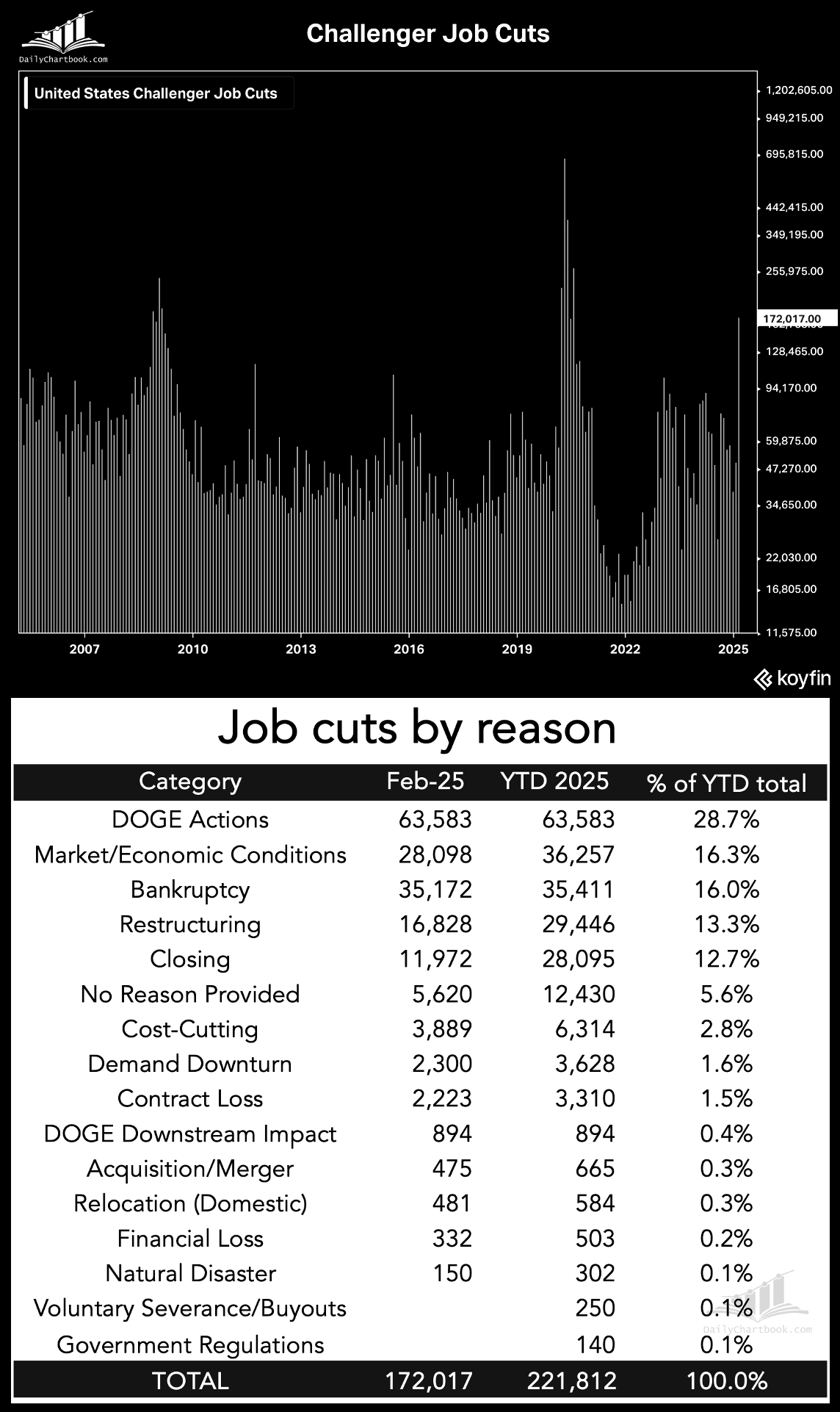

Speaking of Musk, take a look at how busy DOGE has been:

Notice anything else? Yup, pretty rough seeing bankruptcy feature so prominently on that list, 😔. Though, not as rough as this looks like it’s gonna be:

Yup, 60 Minutes literally scrolls through a monthly operating report, LOL. Hold on to your butts y’all.

Just kidding.

Nothing will happen.

How many times have we seen this “bankruptcy fees are out of control” tearjerker of a movie before? 😢

In the event the masses do come out with their pitchforks and shovels, just know that you can always make a run for the border …

💥New Chapter 11 Bankruptcy Filing - OTB Holding LLC💥

On March 4, 2025, Atlanta-based OTB Holdings LLC (“OTB”) and six affiliates (collectively, the “debtors”) filed chapter 11 bankruptcy cases in the Northern District of Georgia (Judge Sigler) because nothing will lube up the bankruptcy system for the inevitable Hooters monstrosity like an “award-winning margarita” at your favorite local casual Tex-Mex food concept, On The Border Mexican Grill & Cantina — the “OTB” in this equation, if you’re too hungover from “award-winning” margaritas to figure that out on your own.

Frankly, we wish we were drinking right now: first, because that would justify the preceding run-on sentence and, second, because the history of this company is a neck-snapping rollercoaster. In short, it was founded in 1982; it sold 12 years later to Brinker International Inc. ($EAT). Sixteen years later EAT sold OTB — which at that point had grown to 160 “cantinas” — to Golden Gate Capital, which, four years later, flipped this hot enchilada to Argonne Capital Group (“Argonne”). Argonne has owned this thing ever since; it probably wishes it didn’t. We love this bit because it’s such a *chef’s kiss* sequence of sentences:

“On The Border leverages its unique, authentic brand to differentiate itself from others in the casual dining sector. As of the Petition Date, the Debtors continue to operate sixty (60) restaurant locations across eighteen (18) states.”C’mon, y’all. This has to be some sort of violation. You can’t be bragging about your restaurant chain’s uniqueness and authenticity only to immediately follow that up with “as of the petition date” and casually slip in that the enterprise shrank by ~100 locations, LOLOL. You know what’s not unique? A slimmed-down casual restaurant chain in bankruptcy court. That’s right: there’s … literally … nothing … unique … about … that. Just ask those who invested in Red Lobster and TGI Friday’s.

As if this story wasn’t droll enough, the reasons for the debtors’ bankruptcy are also very … well … whatever the opposite is of the word “unique.” Unoriginal? Yeah, sure, we’ll go with that: unoriginal. Inflation — particularly in the form of labor costs — impacted menu prices, which outpaced the rising cost of groceries and so people stayed the eff home. Or at least they sure as sh*t didn’t go to OTB. The rising minimum wage rate in several of the states within which the debtors operate also impacted the debtors, compressing margins and affecting the debtors’ ability to recruit and maintain their workforce. Damn you Bernie Sanders!

With the wage inflation box checked, what other wholly hackneyed elements are at play here? Well, pretend this is The Family Feud and if you hit that buzzer and scream out “burdensome leases,” congratulations, the “survey says” you’re dead on and you just earned yourself an epically gratuitous a$$-groping and herpes infusion courtesy of Richard Dawson (may he RIP). Seriously, folks, what the f*ck was this sh*t ⬇️?

Hot damn the 80s were horny AF. How many margaritas was that guy 👆 pounding each night. OTB founded in 1982. Dawson terrorizing an allegedly family friendly show throughout the first half of the decade. Causation or correlation? Inquiring minds want to know.