💥New Chapter 11 Bankruptcy Filing - Impel Pharmaceuticals Inc.💥

Biopharma company seeks 363 sale to stalking horse bidder; purchase price blows.

On December 19, 2023, Impel Pharmaceuticals Inc. filed for chapter 11 in the Northern District of Texas (Judge Jernigan).

Impel is a commercial-stage biopharmaceutical company founded in 2008 with a focus on therapies for the central nervous system. One commercial stage product, Trudhesa, is a nasal spray for the treatment of migraines.

Whereas most nasal delivery systems largely target the lower nasal cavity, Impel’s delivery system targets the upper nasal cavity. This results in less nasal drip and better absorption.

How does the company do it? Through its proprietary delivery system, Precision Olfactory Delivery (“POD”).

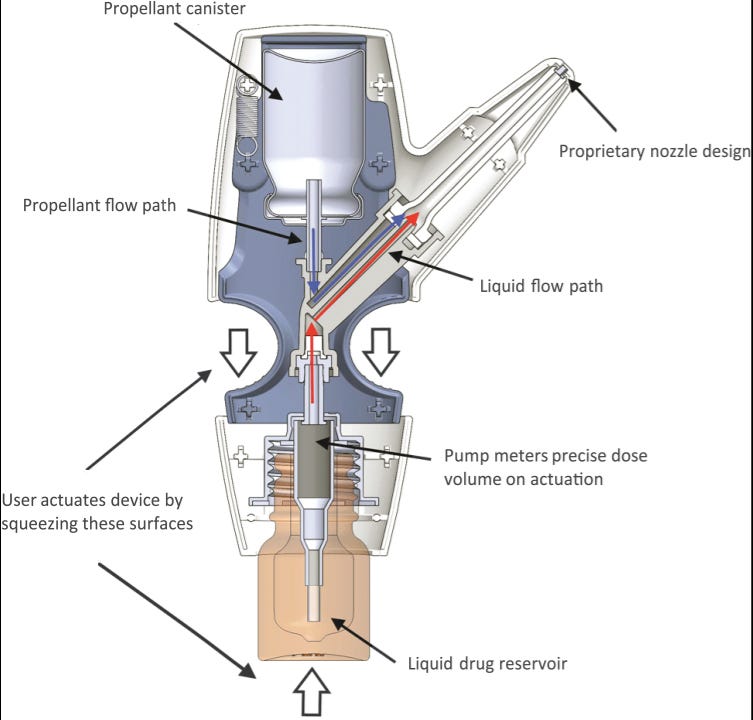

The device looks like this:

Unlike traditional nasal delivery systems that rely solely on mechanical pressure, POD uses hydrofluoroalkane (HFA), a propellant, to expel the drug from the device. Think an aerosol can, except smaller and propelling drugs straight up your nose.

Basically, the company’s entire shtick is the delivery mechanism. The medication being delivered under its only commercially available product, Trudhesa, is dihydroergotamine mesylate (DHE) and is also available through other bioequivalent and therapeutically equivalent drugs like Migranal (nasal spray) and other forms of delivery like IV DHE. Impel contends that Trudhesa is just as effective as IV DHE, more effective than Migranal, and reduces side effects associated with both.

The market doesn’t appear to be buying the debtors’ story. Despite the alleged benefits of Trudhesa, sales have been weak while the cash burn has been real. The debtors achieved just 55% of their corporate sales goal in ‘22 and the first half of ‘23. On top of that, cash burned from operations was $93.6mm, $66.4mm, and $39.2mm for FY’22, FY’21, and FY’20, respectively.

Keep reading with a 7-day free trial

Subscribe to PETITION to keep reading this post and get 7 days of free access to the full post archives.