Don’t look now folks but gold is up 50% YTD, 🤯.

The US government currently has roughly double the amount of debt outstanding than banks and other financial players: gold’s record rise through the $4000 barrier is reflective of, among other things, broad confidence deterioration in government management (and the attendant decline in the US dollar) and people are flooding into the precious metal (as well as its electronic equivalents – BTC, ETH, Solana and XRP have all ripped). This chart ⬇️ is bonkers:

And many believe there’s still room for gold to run (not trading advice, DYOR). Costco Wholesale Corp. ($COST) shoppers rejoice!

Of course, what trepidation is out there is countervailed by FOMO. Equities are in full-on bull mode (AI!) going into earnings season (next week!) and positioning is overweight: the S&P 500 Index is now up nearly 14.5% YTD and the Nasdaq Composite briefly eclipsed a record 23k (before dipping back down slightly). Hedge fund leverage is high, reflecting a risk-on environment. Options volume also reflects bullishness among retail traders. With Fed officials indicating that PCE increases are likely limited in duration and more rate cuts near, it stands to reason that bulls be bulling (as interest rates go ⬇️, interest in equities typically ⬆️).

The leveraged finance market is also firing on all cylinders: issuance is en fuego and spreads are uber tight. Nobody seems to give a sh*t about any of the noise you may be reading about on your morning commute. Authoritarianism? Nah. Government shutdown? Meh. Clash of the civilizations? Psshssht. Weakening labor markets? Yawn (even though chapter 7 filings surged 19% YOY in September). None of that shrinks the amount of green out there begging for deployment. Who cares if signs abound that stagflation may be near?

In our world, things are plodding along and Q3’25 ended with a pair of big filings — First Brands Group LLC and Anthology Inc. (see below) — capping a quarter kicked off by Del Monte Foods Corporation II Inc. and followed by other multi-billion cap stacks like Genesis Healthcare, Modivcare Inc., and Spirit Aviation Holdings Inc. But commercial chapter 11 bankruptcy filings are down YOY. Per Epiq:

“Commercial chapter 11 bankruptcies were the only category to record a decrease, as the 5,883 commercial chapter 11s filed during the first nine months of 2025 represented a 3 percent drop from the 6,078 filed during the same period in 2024.”

What this presages for Q4’25 is anybody’s guess. Note, though, that the market concentration of big deals among a small subset of large firms appears to have diminished somewhat. In that list 👆, there’s quite an array of firms helming these big cases (welcome back to the party Weil!). HSF Kramer?! We certainly didn’t have them on our bingo card.

What do you anticipate for Q4’25? Give us your take ….

⚡Update: ConvergeOne Holdings, Inc.⚡

Another piping hot L has been served up to the Southern District of Texas’ bankruptcy court.

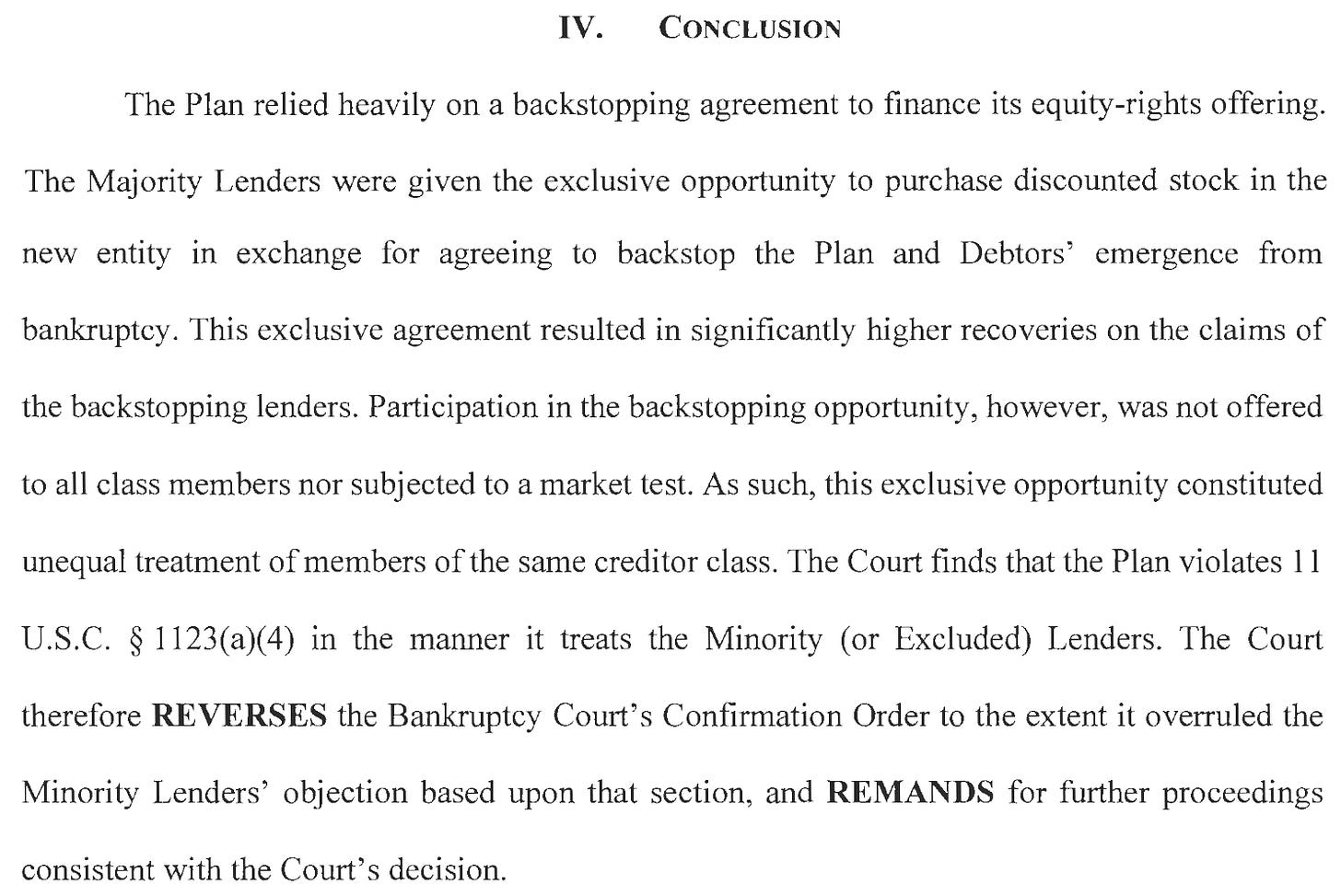

A little less than ten months after the Fifth Circuit took a 💩 all over (former) Judge Jones’ open-market-purchase “analysis” in Serta, on September 25, 2025, the district court (Judge Hanen) reversed Judge Lopez’s confirmation order in ConvergeOne Holdings, Inc. and sixteen affiliates’ (collectively, the “debtors”) prepackaged bankruptcy cases “… to the extent it overruled [the minority lenders’] objection based upon the ground that the Plan violated 11 U.S.C. § 1123(a)(4) …” aka the Bankruptcy Code’s “equal treatment” requirement.*

We covered the filing of the debtors’ filing back in April ‘24 …

… but no doubt a brief refresher is in order. In the lead-up to the filing, the debtors negotiated with their prepetition ABL secured parties, a first lien ad hoc group, a second lien ad hoc group, and equity-owner and CVC Capital Partners-affiliate PVKG Intermediate Holdings (“PVKG”) on the terms of a restructuring to address the debtors’ $1.8b in funded debt …

Those convos ultimately culminated in, per debtor i-banker Evercore, Inc. ($EVR)’s Roopesh Shah, the signing of a restructuring support agreement (the “RSA”) “… about probably five minutes before we filed this case …,” which garnered the support of ~81% of the first lien and second lien debt. Which based on our very rigorous calculations left roundabouts 19% of those folks, by value anyway, on the outside looking in.

The RSA itself didn’t break any new ground, so allow us to feed you baby birds the details on it …

… from that prior piece ⬆️:

“The plan as agreed to under the RSA contemplates a $159.25mm fully-backstopped equity rights offering (‘ERO’) and a $85.75mm direct investment commitment (‘DIC’) from the backstop parties.”

AKA certain “majority lenders” party to the RSA.

“As part of these transactions, 95.625% of the new equity interests will be distributed to holders of first lien claims and backstop parties. 65% of the 95.625% will go to the first lien claimants via the ERO (subject to a 10% put option premium owed to the backstop parties and dilution by the management incentive plan). The backstop parties will receive 35% of the 95.625% via the DIC (subject to the same conditions). Equity received from the ERO and the DIC is being offered at a 35% discount to plan.”

But dissent lingered among some within the roughly 19% minority.. Here’s counsel for an ad hoc group of excluded lenders, Proskauer Rose LLP’s David Hillman:

Johnny feels ya, Dave-o (despite over a decade of briefing y’all twice weekly, his dance card is as empty as ever 😞).

But we digress. After asking for a seat at the table and being told to f*ck off, on May 7, 2024, the excluded lenders fought back by filing a confirmation objection on account of the plan’s doling out “… vastly different recoveries for Majority Lenders as compared to the Excluded Lenders,” despite being dumped into the same class, and, therefore, running afoul of the equal treatment requirement.**

And the excluded lenders didn’t just create problems; they provided a solution too. Specifically, an alternative proposal that would equitize the 1Ls across the board and raise capital through a term loan that (i) preserved the debtors’ intended post-exit leverage — no harm, no foul to the reorg biz — and (ii) gave each 1L lender an opportunity to backstop.

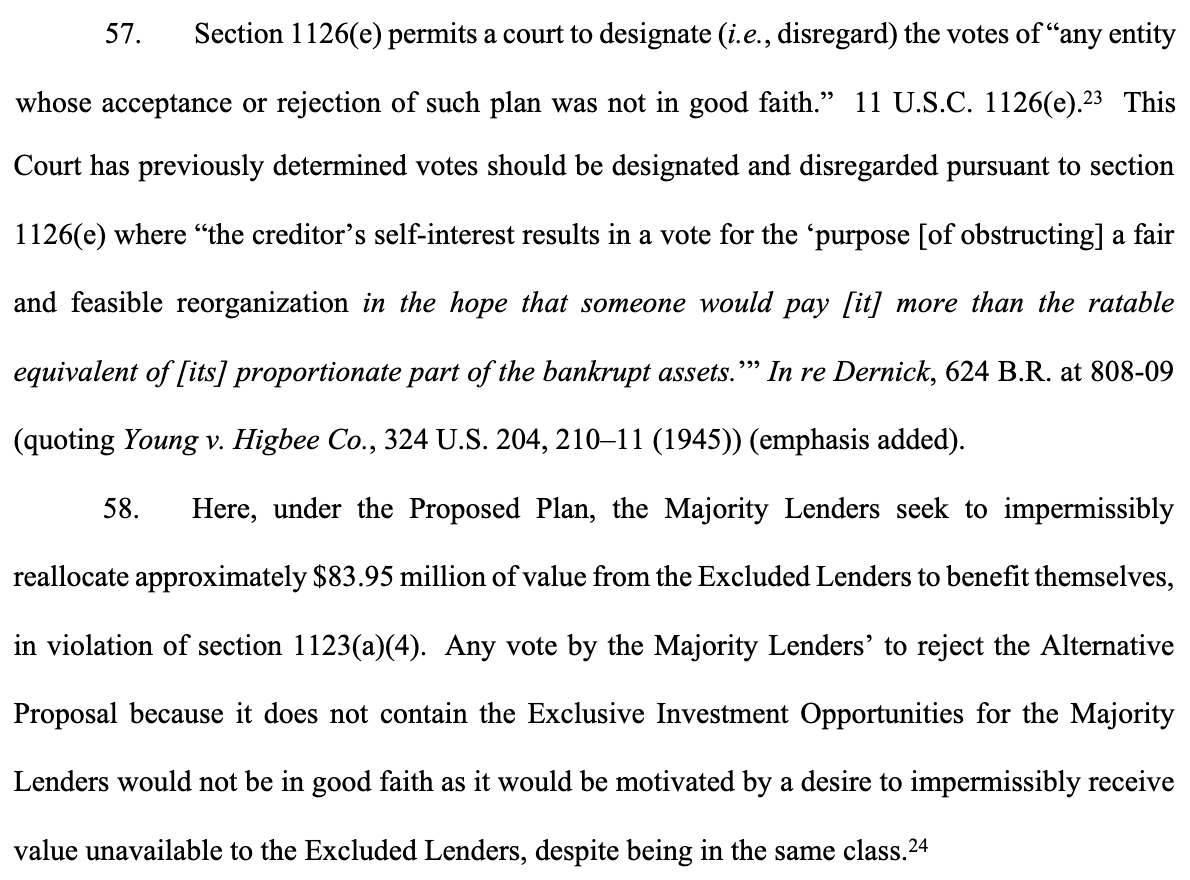

But, on account of self-evident financial considerations, i.e., being able to pick the pockets of the excluded lenders, the majority lenders didn’t bite, so neither did the debtors, and, not one to discourage future Texas filings of non-Texas enterprises,*** Judge Lopez overruled the excluded lenders’ objection and entered the confirmation order on May 23, 2024, a wicked quick … *breaks out calendar* … 49 days post-filing.

Anyway, that’s all in the past. Because the excluded lenders appealed and their argument carried weight with Judge Hanen, who, as a district court judge, would probably be every bit as happy — or more — if he never saw another BK appeal.

We’ll save the suspense and cut to the chase:

We don’t hate it and suspect folks who have gotten shafted on account of these “value maximizing” deals don’t either. Because for years now, 66.7%+ groups have been juicing their plan recoveries to the detriment of peers by threatening to doom any other option by voting against the plan.

Which, if you’re curious, Mr. Hillman has a fix for too. Take it away, sir:

Although, with nigh certainty, that won’t be necessary here since the district court ruled earlier — at the unavoidable “equitable mootness” stage — that it could fashion a remedy and make things straight by, e.g., forcing the majority lenders to sell a portion of the now-ill-gotten reorg equity to the would-be bagholdin’ lenders.

Obviously this won’t be the end of the still-evolving story. As a general matter, bankruptcy courts don’t consider themselves bound by district court decisions except in that specific case, and naturally, the debtors and majority lenders could appeal up to the Fifth Circuit … although query whether either wants to open that door and risk binding, circuit-wide precedent.

But we’ve heard the debtors and the majority lenders are crunching the numbers:

Before we roll out though, we noticed that certain folks in the community expressed uncertainty regarding how the decision would be put to use on the ground. Frankly, we didn’t think it was all that complicated: either open up the goody box to everyone or separate the plan’s actual claim recovery from its funding needs and then pit separate groups vying to provide the latter, in whatever form, against each other to give the reorg debtors and all stakeholders the best outcome (based on pricing, dilution, etc.).

And if a group holding a blocking position threatens to vote against the plan because the debtors went down a different financing path … well, go read that fix ☝️ again.

*The applicable confirmation requirement lives under 11 U.S.C. § 1123(a)(4), which mandates that “… a plan shall provide the same treatment for each claim or interest of a particular class, unless the holder of a particular claim or interest agrees to a less favorable treatment of such particular claim or interest.”

**Not that it was necessary for the legal argument, we thought it was interesting that, per the excluded lenders, the ~$37.7mm cost of the “put option premium” exceeded the quantum of equity not already reserved for or committed to by the majority lenders (~$30.7mm).

***These debtors were headquartered near Minny, over 1k miles from Judge Lopez’s chambers.

💥New Chapter 11 Bankruptcy Filing - Anthology Inc.💥

Sharpen your pencils, boys and girls, because, on September 29, 2025, the Boca Raton, Florida-based education technology aka “edtech” company Anthology Inc. and 26 affiliates (collectively, the “debtors” and, together with their non-debtor affiliates, the “company”) filed chapter 11 bankruptcy cases in the Southern District of Texas (Judge Perez).

If you were in school at any point over the past two-odd decades, you should be familiar with the company’s flagship product, Blackboard Learn (“Blackboard”) …

… which “… facilitates course delivery and management … with tools for course design, assessments, grading, performance analysis and improvement, and cross-product integration (including academic integrity and plagiarism tools).” Lotta words for, 🙄, “education-focused CMS.”

And folks really love the platform too. Why, here’s just one glowing review courtesy of X.

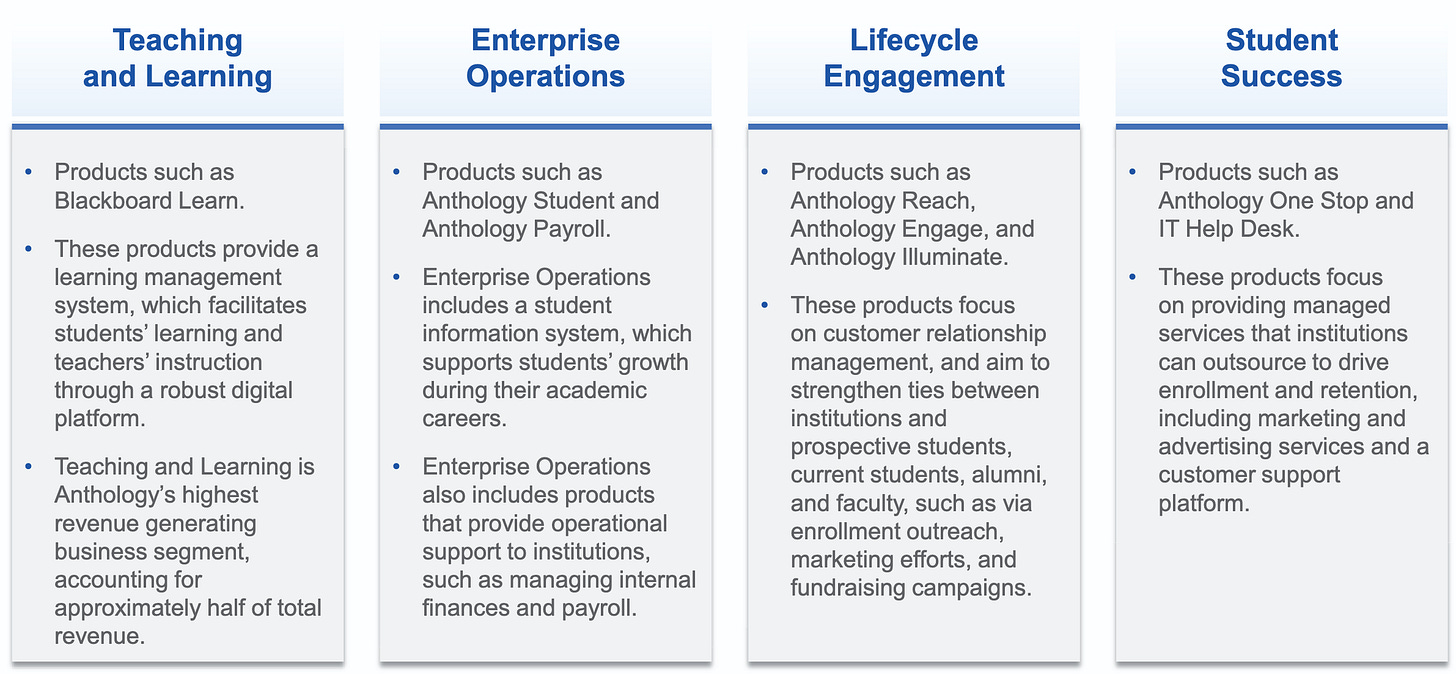

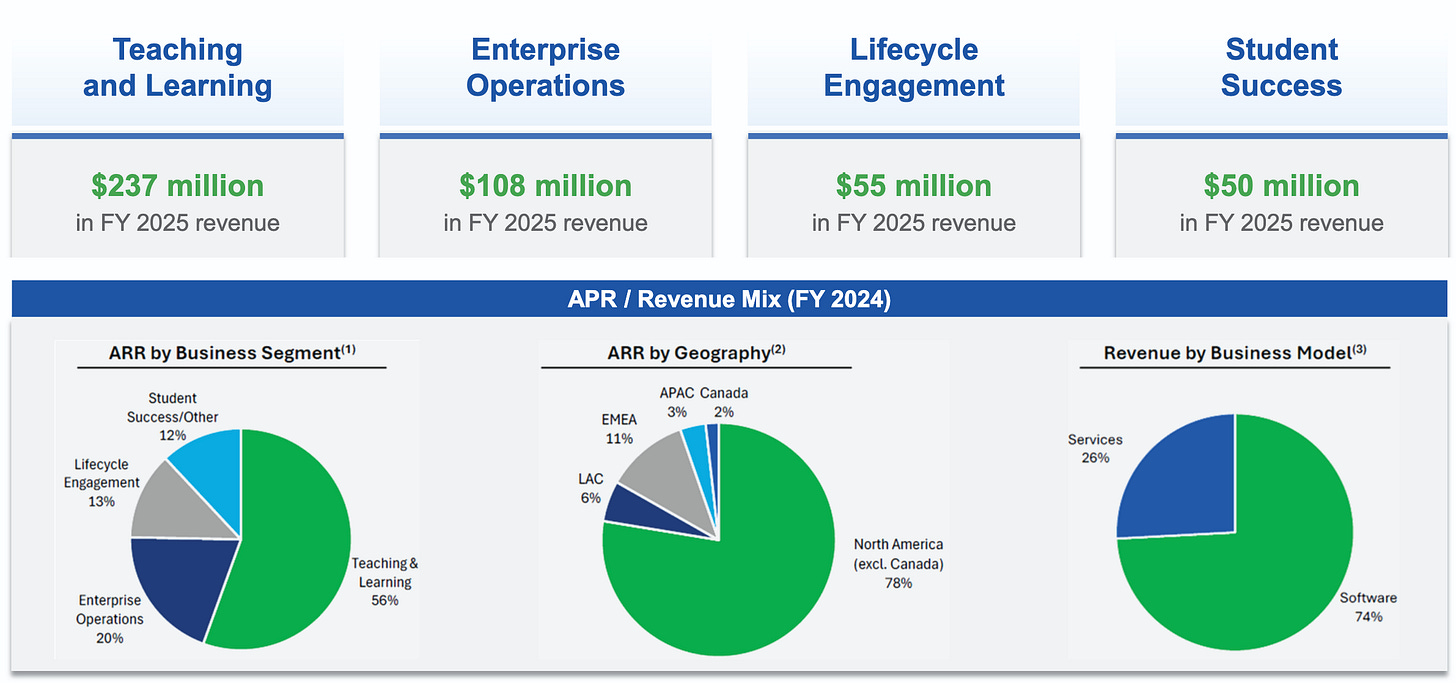

Anyway, in FY25, Blackboard generated ~$240mm in revenue and lives in the debtors’ Teaching & Learning (“T&L”) business segment, but there are three other complementary segments: (i) Enterprise Operations (“EO”), (ii) Lifecycle Engagement (“LE”), and (iii) Student Success (“SS”) …

… which generate the balance of the debtors’ $450mm revenue total.

However, after taking costs and expenses into account, the company only banked ~$33mm in EBITDA in FY23, which didn’t even come close to serving its then ~$1.5b debt stack, consisting of a revolver and 1L and 2L term loans, which the company had taken on to fuel expansion and M&A activity over the prior years.

So, in April and May ‘24, the company bought time by LME’ing into a superpriority credit facility with the support of 100% of its revolving lenders,* 99% of its 1L lenders, and “certain” of its 2L lenders.

But the business, of course, still sucked a$$. Per the CRO and first day declarant, FTI Consulting, Inc. ($FCN)’s Heath Gray, “[o]ver the last two years, the Company’s annual revenue has declined by nearly $80 million,”** EBITDA fell ~88% to $4mm in FY25, and the debtors merrily skipped …

… on by interest payments in December ‘24 (and then again in March ‘25), leading to standstills and yet further negotiations.

So the LME really only resulted in this unwieldy, petition-date debt stack:

But hey, what a “success” — the company and its lenders coalesced around the former’s “Power of Together” slogan, leaving only $1.5mm of the pre-LME facility outstanding, 💪.

While we’re on the topic of togetherness though, we should talk about the debtors’ bankruptcy strategy: there are very few “together” vibes as the debtors intend to cash off the non-L&T segments. Perhaps it’s, lol, time for a new motto; feel free to test this one out:

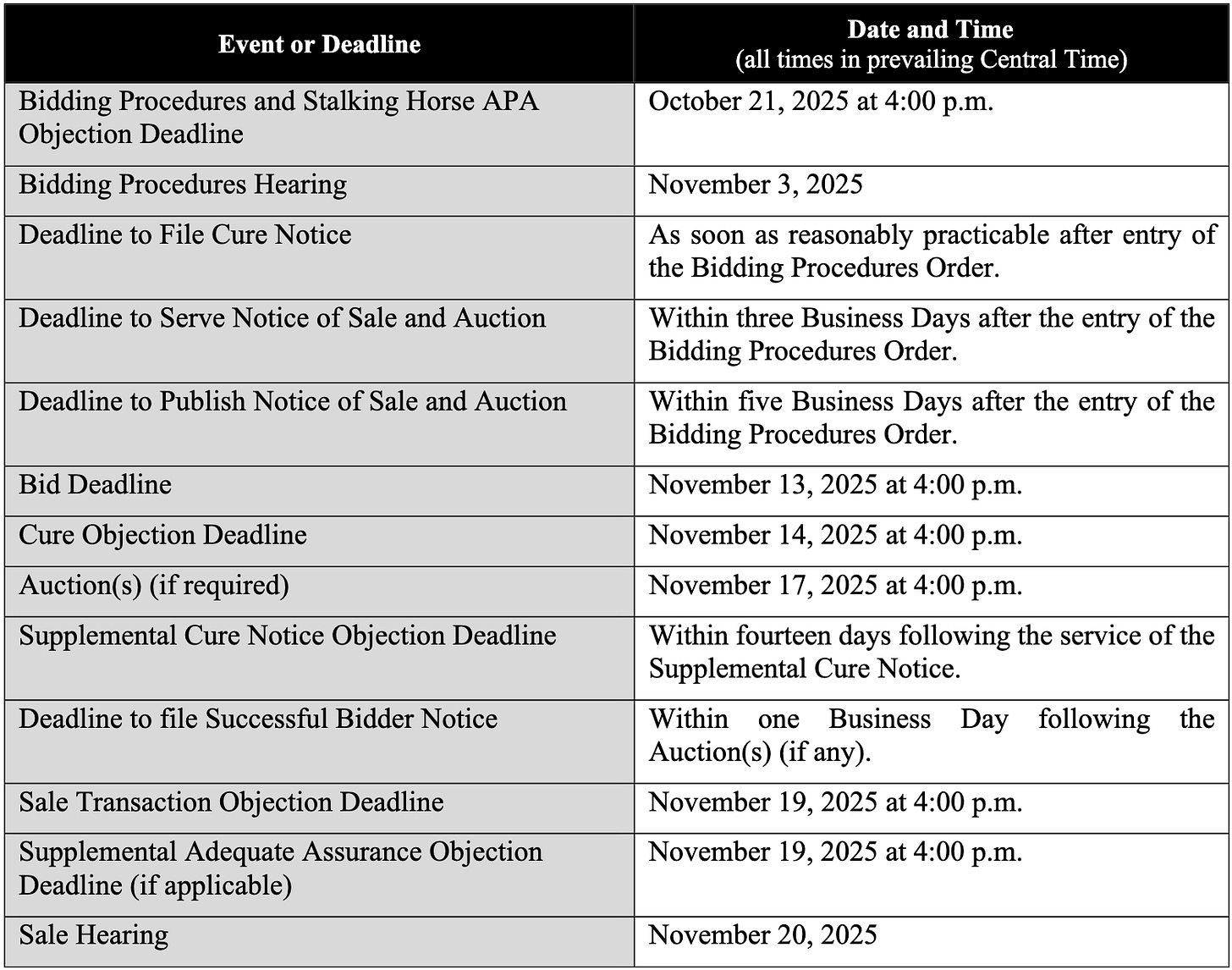

The debtors intend to dispose of EO to Ellucian Company LLC (“Ellucian”), which submitted a $70mm cash stalking horse bid, and LE and SS to Encoura, LLC (“Encoura”), which submitted a $50mm cash stalking horse bid. Here’s the proposed timeline:

But, backed by an ad hoc group holding ~87% and 68% of the tranche A and B superpriority loans (the “ad hoc group”), including the ever-busy Oaktree Capital Management, L.P. and Nexus Capital Management LP (“Nexus”), and a restructuring support agreement (the “RSA”) signed by the ad hoc group and sponsor Veritas Capital Fund Management LLC, the T&L segment will be “staying in the family.” Well sort-of. There’ll be a chapter 11 plan that equitizes the tranche A and B loans (to receive 99% and 1% of the reorg equity, respectively), raises at least $50mm in new capital through the issuance of pref equity, and, most likely, serves up a 🍩 to everyone else. All set to happen by December 23, 2025, the confirmation milestone under the RSA. Merry Christmas “everyone else”!

To fund the cases through then, the ad hoc group is providing a backstopped, headline $100mm DIP term loan, composed of (i) $50mm in new money ($10mm interim) and (ii) a 1:1 roll-up of the prepetition superpriority tranche A term loans. Participation in the DIP will be available to all 1L lenders who sign the RSA and “… have not breached their obligations under the Prepetition Superpriority First Lien Credit Agreement,” which we suppose rules out Vector Capital Credit Opportunity Master Fund LP and Vector Investment Partners I LLC. Those yokels didn’t fund $18.5mm when the debtors drew down on the revolver back in March ‘25 and bought themselves a happy little lawsuit.**** Womp womp. Anyway, the DIP carries interest at 8.75% and features a 9.5% PIK backstop fee on interim order.

The court held a one-hour first-day hearing on September 30, 2025, at which 19th century tech (☎️) defeated pretty much every participant and Kirkland & Ellis LLP’s Chad Husnick dryly showed everyone why his partner Josh Sussberg is the schtick reigning world champ …

Judge Perez: “… we were wondering collectively whether you would pierce your ears?”

Mr. Husnick: “Your Honor, no, but I’ll take some college courses.”

That weak sh*t ain’t getting in People magazine.

All relief was granted otherwise unceremoniously, and the court scheduled the second-day and bidding procedures hearings for November 3, 2025 at 9am CT.

The debtors are represented by Kirkland & Ellis LLP (Chad Husnick, Charles Sterrett, Melissa Mertz, Anna Alieksieieva, David Hackel, Jeffrey Goldfine, Joshua Greenblatt, Karra Puccia) and Haynes and Boone LLP (Charles Beckham Jr., Arsalan Muhammad, Kourtney Lyda, Re’Necia Sherald, Charles Jones II) as legal counsel, FTI Consulting Inc. ($FCN) (Heath Gray, Tom Sledjeski, Gunnar Wolfe, James Goodyear) as financial advisor, and PJT Partners LP ($PJT) (Brett Herlihy, Jitesh Jeswani, Meera Satiani, Jamal Davis) as investment banker. Their special committee is composed of Neal Goldman and Alan Carr. The ad hoc group is represented by Davis Polk & Wardwell LLP (Damian Schaible, David Schiff, Joshua Sturm, Amber Leary) and Porter Hedges LLP (John Higgins, M. Shane Johnson, Megan Young-John, Jordan Stevens) as legal counsel, Alvarez and Marsal LLC as financial advisor, and Lazard Frères & Co. LLC ($LAZ) as investment banker. Ad hoc group member Nexus is represented by Milbank LLP (Evan Fleck, Michael Price) as legal counsel. The debtors’ equity sponsor Veritas Capital Fund Management LLC is represented by Gibson, Dunn & Crutcher LLP (Jason Goldstein, Jonathan Dunworth) as legal counsel. Ellucian, as EO stalking horse bidder, is represented by Simpson Thacher & Bartlett LLP (David Zylberberg, Ian Kitts) and Fishel Law Group (Michael Fishel) as legal counsel. Encoura, as LE and SS stalking horse bidder, is represented by Milbank LLP too (Rick Presutti, Lowell Dyer) as legal counsel. JPMorgan Chase Bank, N.A. ($JPM), as prepetition superpriority and 1L agent, is represented by O’Melveny & Myers, LLP (Ana Alfonso, Jennifer Taylor, Laura Smith) as legal counsel.

*The revolver was refi’d entirely, so naturally 100% support ain’t surprising.

**Driven by customer attrition due to “… an aging product portfolio that had fallen behind competitive offerings and the Company’s declining reputation in the marketplace.”

***The ad hoc group’s members include BlackRock Financial Management, Inc. ($BLK), Morgan Stanley Investment Management Inc. ($MS), Nexus Asset Management LP, UBS Asset Management (Americas) LLC and Oaktree Capital Management, L.P.

****The debtors filed a lawsuit in April ‘25, but it wasn’t resolved ahead of the petition date.

📚Resources📚

We have compiled a list of a$$-kicking resources on the topics of restructuring, tech, finance, investing, and disruption. 💥You can find it here💥.

We’re nerds so we’re actually a bit excited about Andrew Ross Sorkin’s newest title, “1929: Inside the Greatest Crash in Wall Street History and How It Shattered a Nation,” which comes out on October 14, 2025. You can preorder it now.

Another one that is getting a lot of attention that we want to dig in to is “If Anyone Builds it, Everyone Dies: Why Superhuman AI Would Kill Us All” by Eliezer Yudkowsky and Nate Soares. It’s available now.

📤 Notice📤

Ben Schrag (Chief Strategy Officer) joined C Street Advisory Group from Fried Frank.

🍾Congratulations to…🍾

Aaron Metviner on his promotion to Partner at Kirkland & Ellis LLP.

Charlie Sterrett on his promotion to Partner at Kirkland & Ellis LLP.

Elizabeth Jones on her promotion to Partner at Kirkland & Ellis LLP.

Evan Swager on his promotion to Partner at Kirkland & Ellis LLP.

Lynette Janssen on her promotion to Partner at Kirkland & Ellis LLP.

Margaret Reiney on her promotion to Partner at Kirkland & Ellis LLP.

Matthew Koch on his promotion to Partner at Proskauer Rose LLP.

Dykema Gossett PLLC (William Hotze, Nicholas Zugaro) and Billstein, Monson & Small PLLC (Shane Coleman, Emily Cross, Daniel Beierwaltes) for securing the legal mandate on behalf of the official committee of unsecured creditors in the Elite Equipment Leasing LLC chapter 11 bankruptcy cases.

GlassRatner Advisory & Capital Group, LLC (Mark Shapiro) for securing the financial advisor mandate on behalf of the official committee of unsecured creditors in the Partners Pharmacy Services, LLC chapter 11 bankruptcy cases.

Pachulski Stang Ziehl & Jones LLP (Robert Feinstein, Bradford Sandler, Theodore Heckel) for securing the legal mandate on behalf of the official committee of unsecured creditors in the Worldwide Machinery Group, Inc. chapter 11 bankruptcy cases.

Province, LLC for securing the financial advisor mandate on behalf of the official committee of unsecured creditors in the US Magnesium LLC chapter 11 bankruptcy cases.