💥Genesis in Scumbaggery💥

Updates: Genesis Healthcare Inc. & Lugano Diamonds & Jewelry Inc. + Zynex, Inc. Filed.

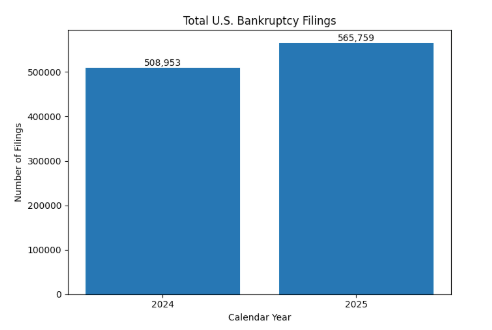

The numbers are in folks: bankruptcies were up in ‘25! Per Epiq AACER, “[t]otal bankruptcy filings in calendar year 2025 were 565,759, an 11 percent increase from the 508,953 registered during calendar year 2024.”

What’s beneath that headline number, though? “Commercial chapter 11 filings increased 1 percent in 2025 to 7,940 from 7,893 filings the previous year. Small business subchapter V elections within chapter 11 rose 11 percent in calendar year 2025 to 2,446 from the 2,202 recorded in 2024.” One percent, 🙄. F*cking LME. Yet:

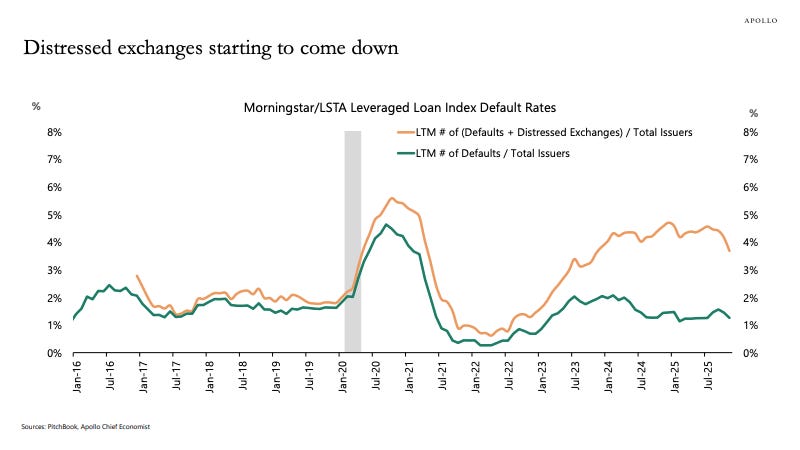

Indeed, per JPMorgan Chase & Co. ($JPM), default activity within the leveraged credit universe tempered as a 43% YOY drop in distressed exchanges/LMEs helped setoff a 32% jump in payment defaults. To put some numbers behind those percentages, JPM counted 60 defaults/LMEs totaling $67.8b in ‘25, a dramatic drop from the $83.6b in ‘24 and $85.9b in ‘23. Notably, a lot of the action in ‘25 was in the leveraged loan space and not the high yield market (though Saks Global’s December payment default surged HY back to relevance). Technology led the way, followed by retail and food/beverage.

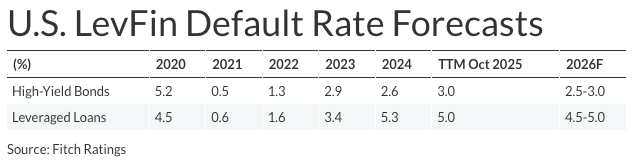

What did this all translate to in terms of default rates? JPM pegs the HY bond default rate at 1.88% and the leveraged loan default rate at 2.87% (inclusive of distressed exchanges); it forecasts a drop in the former (to 1.75%) and a mild increase in the latter (to 3%).

Fitch Ratings is taking the “over.” “Fitch forecasts that the U.S. leveraged loan default rate will close 2026 in a range of 4.5%-5.0%, while the U.S. high yield default rate will be between 2.5%-3.0%. These rates are roughly in line with the TTM rates in the U.S. for the past several months, while also indicating a downward trajectory.”

But … also expecting less overall default drama than ‘25, 🤔.

And now, as we await the imminent Saks chapter 11 filing, let’s dig in to this week’s a$$-kicking commentary….

⚡Update: Genesis Healthcare, Inc.⚡

Sorry, y’all, we’ve been remiss in our coverage of the chapter 11 dumpster fire cases of Genesis Healthcare, Inc. (“Genesis”) and its 298 affiliates (collectively, together with Genesis, the “debtors”). The healthcare cases filed in July ‘25 in the Northern District of Texas with Judge Jernigan, but because the sh*tshow that is Prospect Medical Holdings, Inc. (“Prospect”) beat these guys to the punch and almost instantly sucked the life out of Johnny, nobody here at PETITION could muster the fortitude to focus on this particular brand of f*ckery.

Until now.

That’s right: Prospect confirmed,* so we’re back. In case you need a refresher, our initial coverage of these debtors can be found 👇 …

… but we’ll quickly recap:

📍The debtors filed with ~$2.3b in obligations, inclusive of funded debt, A/P, litigation claim exposure, workers’ comp., etc., of which, on the funded debt side, some $414.3mm was owing, in the aggregate, to entities affiliated with Welltower, Inc. ($WELL) (“Welltower”), Joel Landau’s ReGen Healthcare, LLC (“ReGen”), the former of which also owns a majority stake in the debtors, and Omega Healthcare Investors, Inc. (“Omega,” and collectively with Welltower and ReGen, the “prepetition lenders”).

📍The prepetition lenders agreed to fund a $30mm, junior DIP TL ($12mm interim) …

📍… to be used to fund a section 363 sale process, under which ReGen-affiliate CPE 88988 LLC (“CPE”) served up a competition-free stalking-horse bid comprised of (i) a $14mm DIP credit bid, (ii) the assumption of the DIP balance and ~$317.7mm in prepetition term loans (i.e., the full amount), (iii) the payment of $15mm in cash, and (iv) more cash to purchase facilities under two of the debtors’ JV arrangements and included, in the assets to be acquired, estate claims against ReGen, Mr. Landau, and related parties …

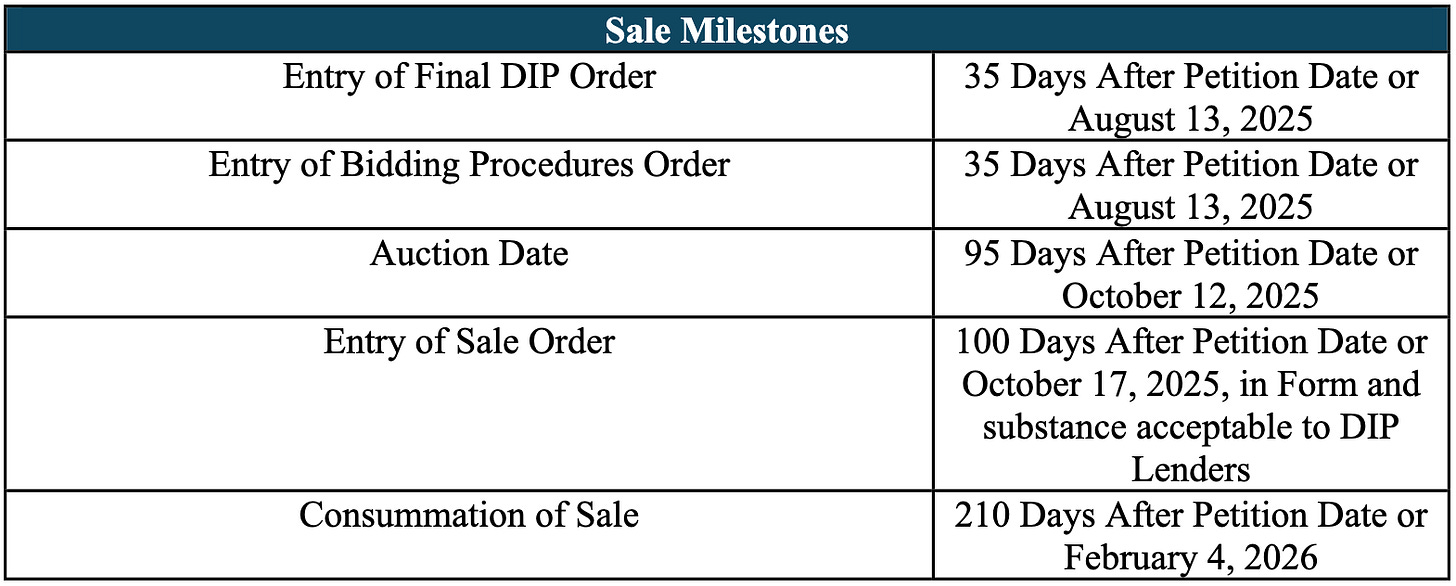

📍… on the following timeline:

Insider-y as f*ck.

So. How’s it going?

Keep reading with a 7-day free trial

Subscribe to PETITION to keep reading this post and get 7 days of free access to the full post archives.