💥New Chapter 11 Bankruptcy Filing - FLOAT Alaska LLC💥

Airline with no revenue-generating operations files to sell planes and licenses in BK.

On January 26, 2026, Anchorage-based FLOAT Alaska LLC and six affiliates (collectively, the “debtors” or the “company”) filed chapter 11 bankruptcy cases in the District of Delaware (Judge Goldblatt) — nearly six years after CEO and First Day Declarant Thomas Hsieh founded his “new urban mobility service” in SoCal meant to “FLy Over All Traffic” — get it, 🙄? — and take people to their destinations in 15 minutes rather than three hours on California’s dreaded highways.

But do some quick math … six years drops our poor debtors into action RIGHT BEFORE THE PANDEMIC HIT, ushered in WFH and crushed commutes entirely.

But one man’s bad timing is another’s opportunity. The pandemic, after all, crushed other airlines too, and the opportunistic principals behind our now-debtors seized the moment and purchased several aircraft and an FAA 121 certificate out of the ‘20-vintage Ravn Air Group bankruptcy. Reinvigorated, the debtors relaunched as now-lead debtor, FLOAT Alaska LLC.

The debtors’ grand plan was to do for Alaska and the northern Pacific region what Icelandair had done for Iceland and the north Atlantic. Anchorage is one of the busiest cargo hubs in the world because of its strategic position between major Asian and North American cities. The company aimed to use that strategic positioning to offer cheaper transpacific passenger flights on narrow-body jets and simultaneously encourage travel to more remote parts of Alaska on its regional network. The company purchased its first Boeing 757 aircraft for this plan in October ’21 — dumping it into debtor sub New Pacific Airlines Inc. — and invested $6mm into remodeling the Anchorage airport.

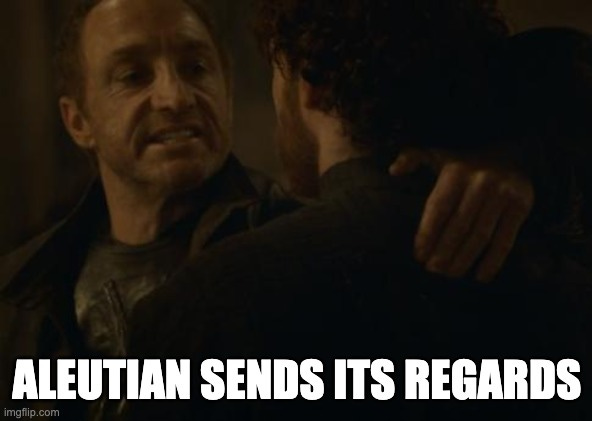

A few months later, in February ’22 … well … this guy👇 … did stuff.

And by “stuff” we mean invaded another sovereign nation, hurtling the region into a war that persists to this day. That’s right, after Russia invaded Ukraine, Russian airspace was closed to U.S. commercial flights. Without access to Russian airspace, the debtors could not conduct Pacific flights because it lacked the proper certifications, certifications that take a minimum of two years to obtain.

Man, ’22 started off bad and just kept getting worse.

Upstart Aleutian Airways (“Aleutian”) began to encroach on the debtors’ most profitable Alaskan route. Then, the company lost 80% of its pilots, who were poached by major airlines offering way more money. The shortage of pilots forced the company to reduce and then shut down its busiest route and fire over 100 people.

In addition to their airline operations, the company attempted to capitalize on the crypto hype — because, 🤷♀️ — by launching “FlyCoin,” a blockchain-based airline loyalty program.* This scheme also collapsed in ’22, after every airline exploring a deal with FlyCoin dropped them in the wake of multiple crypto company scandals and failures.

The company pivoted again in ’23, establishing new routes from Ontario, CA (40 miles from Downtown LA) to Vegas, Reno, and Nashville. Far from turning things around, this new plan cost the company approximately $5mm cash each month.

It also attempted to salvage the last of its Alaska business by applying for Department of Transportation (DOT) subsidies and as a back-up, by negotiating a possible sale of the Alaska business to Aleutian. Aleutian savagely torpedoed the possibility of help from the DOT by informing the DOT that it would fly one of the routes without any subsidies. The company then entered into an agreement with Aleutian to transfer several leased prop planes, routes, and certificates in exchange for equity in Aleutian. However, this deal was never consummated. That same month, in fact, Aleutian retracted its no-subsidy letter to the DOT and later secured DOT subsidies to fly three of the four routes that the company had serviced.