💥New Chapter 11 Bankruptcy Filing - Eddie Bauer LLC💥

Eddie Bauer files bankruptcy. Again. Liquidation of brick and mortars to follow.

On February 9, 2026, Eddie Bauer, LLC and four affiliates (collectively, the “debtors”)* filed chapter 11 “sale” cases in counsel Kirkland & Ellis LLP’s préféré jurisdiction, the District of New Jersey (Judge Meisel).**

The debtors are the exclusive licensee of the Eddie Bauer brand for brick-and-mortar retail in the US and Canada, of which there’s 175 locations as of the petition date. That’s down from 224 as of January 31, 2026,*** but still much, much higher than where the cases will head:

And that’s because the debtors are owned by JCPenney’s (“JCP”) SPARC Group Holdings LLC (together with non-debtor affiliate Catalyst Brands LLC, “SPARC”), which, a little less than a year ago, kicked off Part I of its Adventures in Pretending to Sell a Broke-A$$ Brand.

We just re-read that F21 OpCo, LLC (“F21”) piece, and holy hell, the parallels. Here’s a list …

1️⃣ The reasons to be in bankruptcy are exactly the same:

The end of COVID ✔️

Inflation ✔️

A “shift” in consumer preferences ✔️

Contracting margins ✔️

The supply chain ✔️

The damage inflicted by the now-canceled “de minimis” exception ✔️

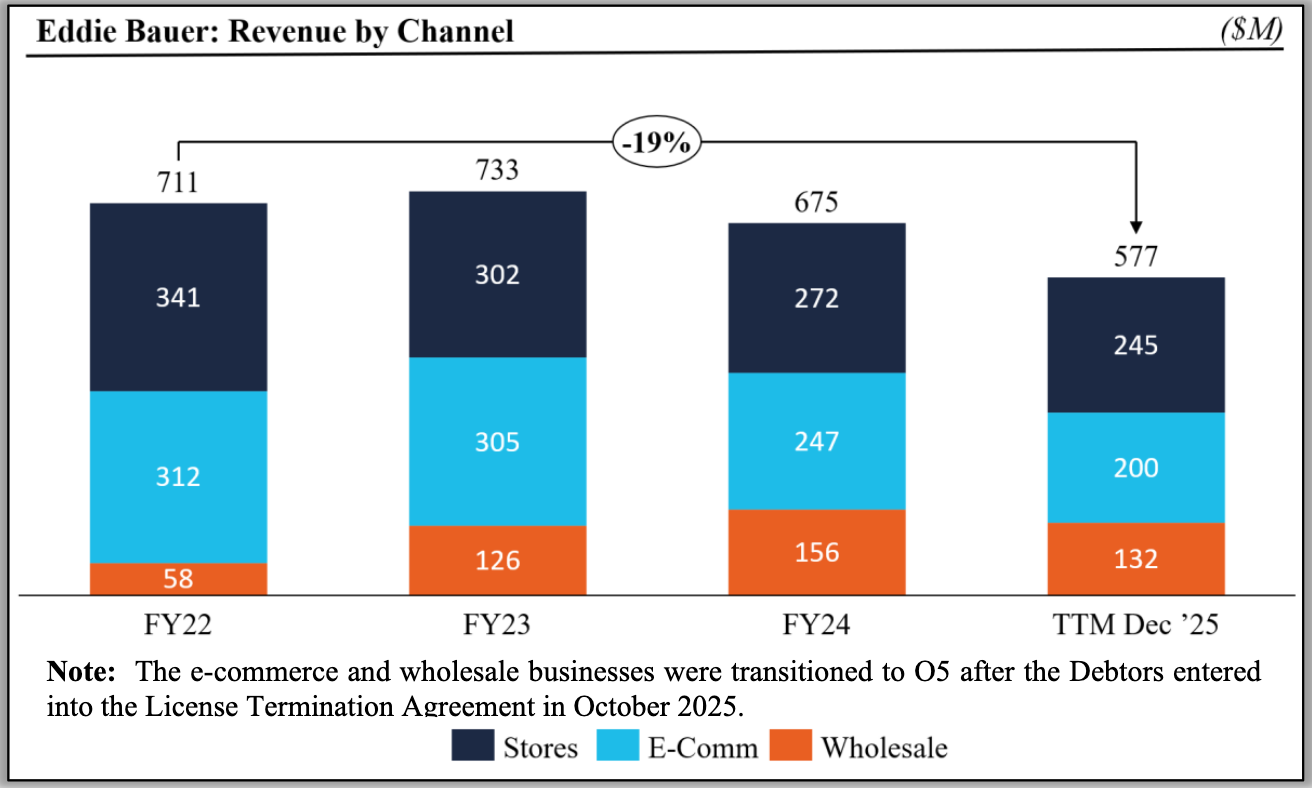

… all of which, in the debtors’ case, led to the shrinkage 👇.

… and “… negative earnings of approximately $2 million in 2022, $10 million in 2023, $82 million in 2024, and $80 million in 2025.”

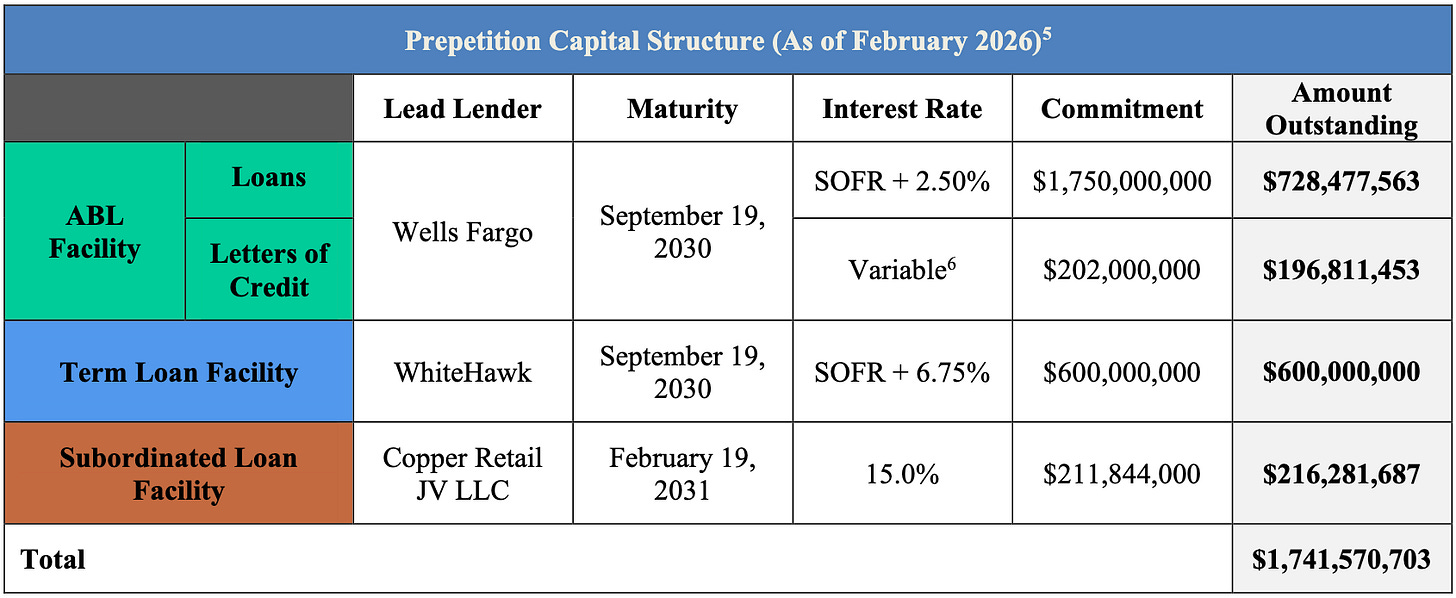

2️⃣ The debt’s more or less the same …

… except (i) the prior term and subordinated loans were refinanced and upsized in September ‘25 and (ii) as a result, the aggregate debt balance has grown ~$160mm (from ~$1.58b to $1.74b) since F21 filed. We understand why sub-lender Copper Retail JV LLC would do that — it’s an affiliate of SPARC — but what did (does?) Whitehawk Capital Partners LP see in SPARC and its brand “portfolio” of obligors, including JCP, Aéropostale, Brooks Brothers, Nautica, and Lucky Brands??

3️⃣ The general bankruptcy process is going to be exactly the same. Go through the motions of "marketing” the assets for sale, sans stalking horse, while Hilco Merchant Resources, LLC (“Hilco”) and SB360 Capital Partners, LLC actively burn down the brick-and-mortar biz, which, naturally, started prepetition on January 26. When it’s all said and done, all of the debtors’ stores will be liquidated.

4️⃣ The initial proposed GUC treatment is just as bad as F21’s. Under the debtors’ (i) restructuring support agreement with 100% of the lenders under the debt facilities above — attached as exhibit B to Berkeley Research Group, LLC’s Stephen Coulombe’s first day declaration, in his capacity as co-CRO (which, for the record, is the same role he had in F21 and, less relevant here though still interesting, has in American Signature LLC) — and (ii) contemplated-but-unfiled chapter 11 plan, GUCs, which are owed tens of millions at a minimum, will take their pro rata of ~$250k … if … cue the Admiral …

… they vote in favor of said plan. Obviously, the debtors’ and RSA parties’ advisors know that the official committee of unsecured creditors (the “UCC”), when appointed, will dig up things to gripe about, so, just like in F21, we expect the recovery to get juiced, after which the UCC will walk.

5️⃣ Meanwhile, holders of the ABL, the term loans, and the subordinated loans agreed to identical F21 treatment: whatever doesn’t go to GUCs, fund a wind-down plan, or pay profs will go to the ABL, and the other loans, which as alluded to above have non-debtor, SPARC-affiliated obligors, will take a 🍩 vis-a-vis the debtors.

6️⃣ The need for speed is approximately the same. The RSA gives 31 days for a sale hearing, 35 days for conditional disclosure statement approval, 70 days for a confirmation order, and 75 days for the effective date, taking us all the way out to April 25, 2026.

The court held a ~1.75-hour first day hearing on February 10, 2026 at which all requested relief was granted, and scheduled the second day for March 3, 2026 at 1pm ET. By then, we’ll have found out who’s buying the biz.

Nobody. Best of luck to the debtors’ ~2.2k employees.

The debtors are represented by Kirkland & Ellis LLP (Joshua Sussberg, Matthew Fagen, Oliver Paré, Nathan Felton, Matt Lazarski, Sarah Osborne) and Cole Schotz, P.C. (Michael Sirota, Warren Usatine, Felice Yudkin) as legal counsel, Berkeley Research Group, LLC (Stephen Coulombe, George Pantelis) as financial advisor and co-CROs, and SOLIC Capital Advisors, LLC (Reid Snellenbarger) as investment banker. Jeffrey Stein and Anthony Horton are the debtors’ independent directors. Wells Fargo Bank, N.A., as prepetition ABL agent, is represented by Otterbourg P.C. (Daniel Fiorillo, Matthew Stockl, Varinder Singh, Antonio Aguilera) and McCarter & English LLP (Joseph Lubertazzi Jr., Jeffrey Testa) as legal counsel. The “consenting term loan lenders” are represented by Ropes & Gray LLP (Gregg Galardi, Michael Wheat, Lauren Knight) and Sill Cummis & Gross P.C. (Andrew Sherman, Gregory Kopacz, Oleh Matviyishyn) as legal counsel. Copper Retail JV LLC, as prepetition subordinated agent, is represented by Choate, Hall & Stewart LLP (Michael Comerford, Alexandra Thomas) and Chiesa Shahinian & Giantomasi PC (Thomas Walsh, Sam Della Fera) as legal counsel. Hilco is represented by Riemer & Braunstein LLP (Steven Fox) and Mandelbaum Barrett PC (Vincent Roldan) as legal counsel.

*Two debtors are Canuck, and they intend to file ancillary proceedings under Canada’s Companies’ Creditors Arrangement Act with Eddie Bauer LLC acting as foreign rep.

**Many moons ago, in March ‘03, Eddie Bauer filed chapter 11 in the Southern District of New York, and among other outcomes that bankruptcy was the spinning out of the brand as a standalone enterprise. That lasted about six years. In June ‘09, our dear Eddie once again sought refuge in the District of Delaware and exited via a sale to Golden Gate Capital. So, you could say these cases are technically 33s, but kids born after the first set are now old enough to drink so whatever.

***That same day, the debtors lost their license to operate Eddie Bauer’s e-commerce and wholesale business. Apparently, e-commerce was only “… marginally …” profitable and wholesale not at all, so to save $220mm in fees over six years, the debtors brokered a deal with IP-owner Authentic Brands Group, LLC, which has also had recent bankrupt brand experience, to transfer those rights back. A good move for the company? Maybe, but it did f*ck all to prevent a liquidation. Per Mr. Coulombe, “[a]lthough the License Termination Agreement alleviated a substantial liability for the Company, the Debtors’ revised financial projections continued to indicate that the Debtors would generate negative cash flow.”

Company Professionals:

Legal: Kirkland & Ellis LLP (Joshua Sussberg, Matthew Fagen, Oliver Paré) and Cole Schotz, P.C. (Michael Sirota, Warren Usatine, Felice Yudkin)

Financial Advisor/Co-CROs: Berkeley Research Group, LLC (Stephen Coulombe, George Pantelis)

Investment Banker: SOLIC Capital Advisors, LLC (Reid Snellenbarger)

Independent Directors: Jeffrey Stein and Anthony Horton

Claims Agent: Stretto (Click here for free docket access)

Other Parties in Interest:

Prepetition ABL Agent: Wells Fargo Bank, N.A.

Legal: Otterbourg P.C. (Daniel Fiorillo, Matthew Stockl, Varinder Singh, Antonio Aguilera) and McCarter & English LLP (Joseph Lubertazzi Jr., Jeffrey Testa)

Consenting Term Loan Lenders

Legal: Ropes & Gray LLP (Gregg Galardi, Michael Wheat, Lauren Knight) and Sill Cummis & Gross P.C. (Andrew Sherman, Gregory Kopacz, Oleh Matviyishyn)

Prepetition Subordinated Agent: Copper Retail JV LLC

Legal: Choate, Hall & Stewart LLP (Michael Comerford, Alexandra Thomas) and Chiesa Shahinian & Giantomasi PC (Thomas Walsh, Sam Della Fera)