💥Cue Cuts💥

Summer Jobs Totals Freak Markets, Prospect Health, Rent the Runway + More.

Surely you saw the jobs figures.

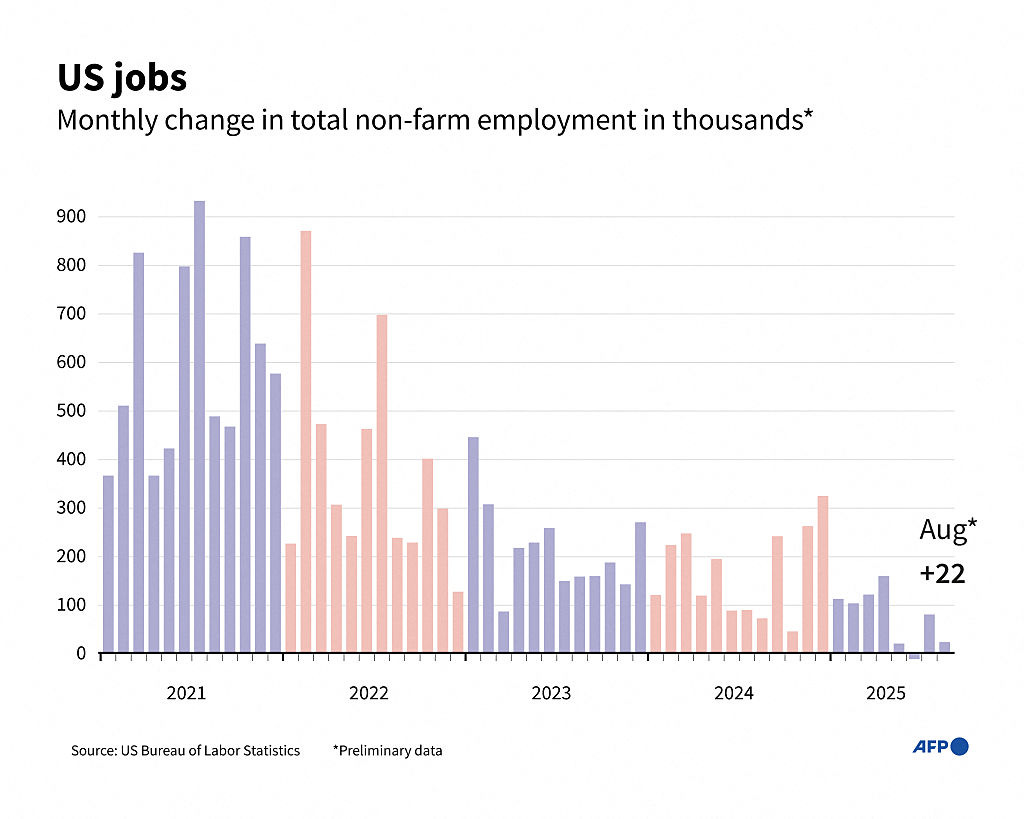

The economy added only 22k jobs in August, 😬, and if you ex-out healthcare, the economy actually went negative, 😱. That is, if you believe the numbers in the first place, which … truthfully … you probably shouldn’t given reporting weakness and a history of drastic revisions.*

Indeed, revisions abound and the latest report from The US Bureau of Labor Statistics (“BLS”) shows that the economy’s 53-month long streak of jobs growth actually ended back in May ‘25. Employers eliminated 13k jobs back in June, the first negative number since December of ‘20 — and y’all know what was confronting the economy back in December of ‘20, 😬.

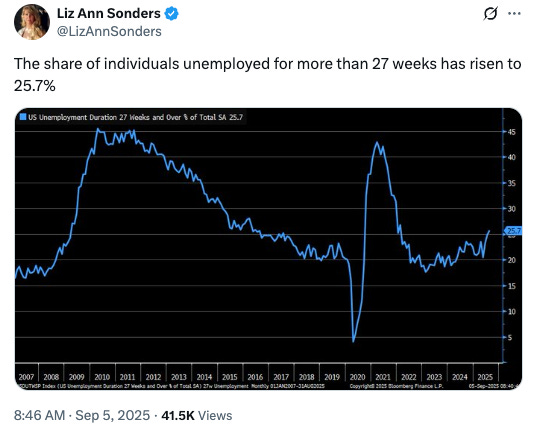

Some specific segments of the work force are bearing the brunt. Federal employees are getting sh*tcanned in droves, with another 15k jobs lost for a total of 97k since January.**

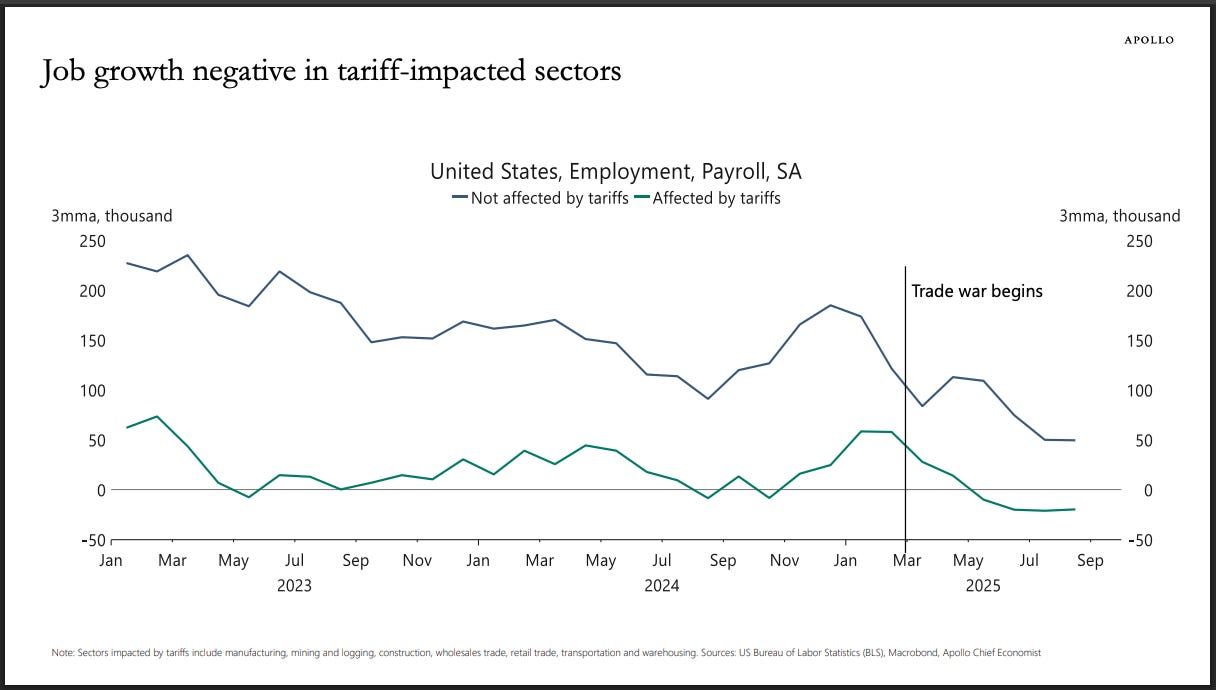

Similarly, manufacturing is contracting — a curious result considering one of the premises behind tariffs was the reshoring of manufacturing capacity. 12k jobs evaporated in August adding to the 66k that had disappeared already so far this year.

Apollo Global Management’s Torsten Sløk commented:

“Splitting employment growth into tariff-impacted sectors and sectors not directly impacted by tariffs shows that the slowdown in job growth is broad-based, and job growth in tariff-impacted sectors is now negative….”

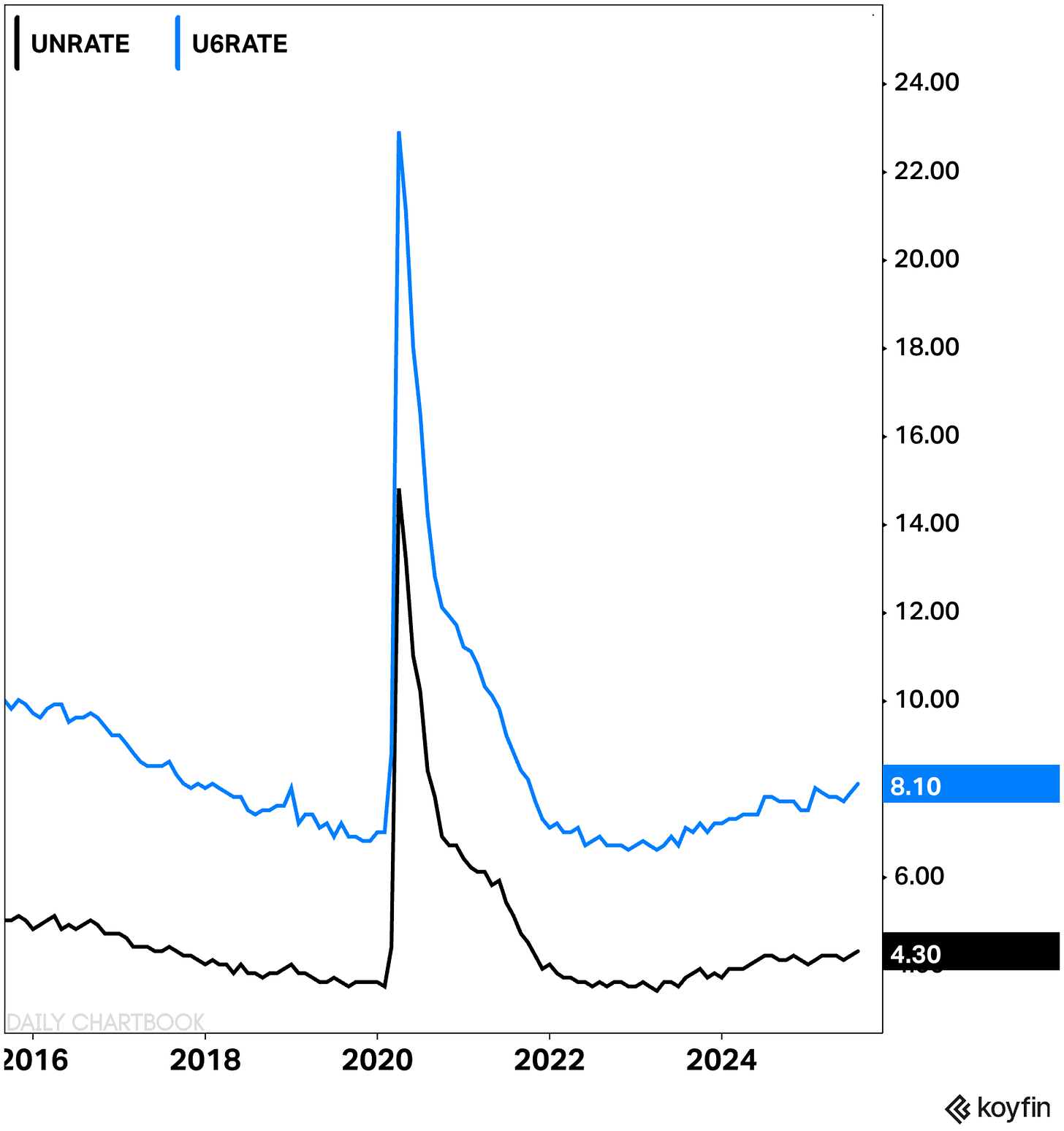

The unemployment rate went ⬆️.

Cue Jerome POW-ell and the Fed. Cue also the market — which clearly thinks Jerome POW-ell and the Fed are going to suddenly flip, despite rising PCE, and speed up Fed Funds Rate cuts going into year end. The market is baking in an 89% chance of a 25 bps rate cut for the 9/17/25 meeting, a 71% chance of an additional 25 bps cut at the 10/29/25 meeting, and a 65% chance of another 25 bps decrease at the 12/10/25 meeting, landing the target rate at 3.5-3.75%.*** 30-Year Treasuries receded on the report from nearly 5% to 4.7%.

There’ll be a lot of close watchers of macro data on Thursday when the CPI for August comes out. 🍿

*National Economic Council director Kevin Hassett insisted this week that the weak numbers are attributable to an incompetent and that we should expect an upward revision. Yeah, sure buddy.

**We can only imagine what the local economies of Maryland and Virginia look like these days.

***The market also suggests a 38% likelihood of an additional 25 bps cut at the January 28, 2026 meeting. JPMorgan Chase & Co. ($JPM) economists are on board with this notion with their forecast.

*****

Let’s turn our gaze to the RX world. Today’s edition features several updates — updates of troubled companies not yet in BK and updates for situations currently languishing in BK. Let’s dig in.