💥New Chapter 11 Bankruptcy Filing - Carbon Health Technologies, Inc.💥

Healthcare tech. co. files chapter 11 to effectuate a prearranged debt-for-equity swap

On February 2, 2026, Sunnyvale, CA-based Carbon Health Technologies, Inc. (“CHTI”) and twenty-eight affiliates (collectively, together with CHTI, the “debtors” and together with their non-debtor affiliates, the “company”) filed prearranged chapter 11 cases in the Southern District of Texas (Judge Lopez) – a dramatic fall from grace for a venture capital darling once valued at over $3b and featuring Blackstone Group, Dragoneer Investment Group, and CVS Health Ventures on the cap table.

Founded in ‘15, CHTI is a health tech and management services organization (“MSO”) that serves up non-clinical support to urgent and primary care providers, while, beginning in ‘17, the other debtors deliver the actual healthcare,* today operating 93 locations across eight states and seeing 800k+ patients per year.

At the center of it all is CHTI’s proprietary CarbyOS, which per its website, is an “AI-powered operating system for care delivery” that provides “[s]eamless integration of EHR, practice management, billing, and patient engagement—so you can focus on patient care.”

Such a heartwarming pitch for a notetaking, scheduling, and billing platform for physicians.

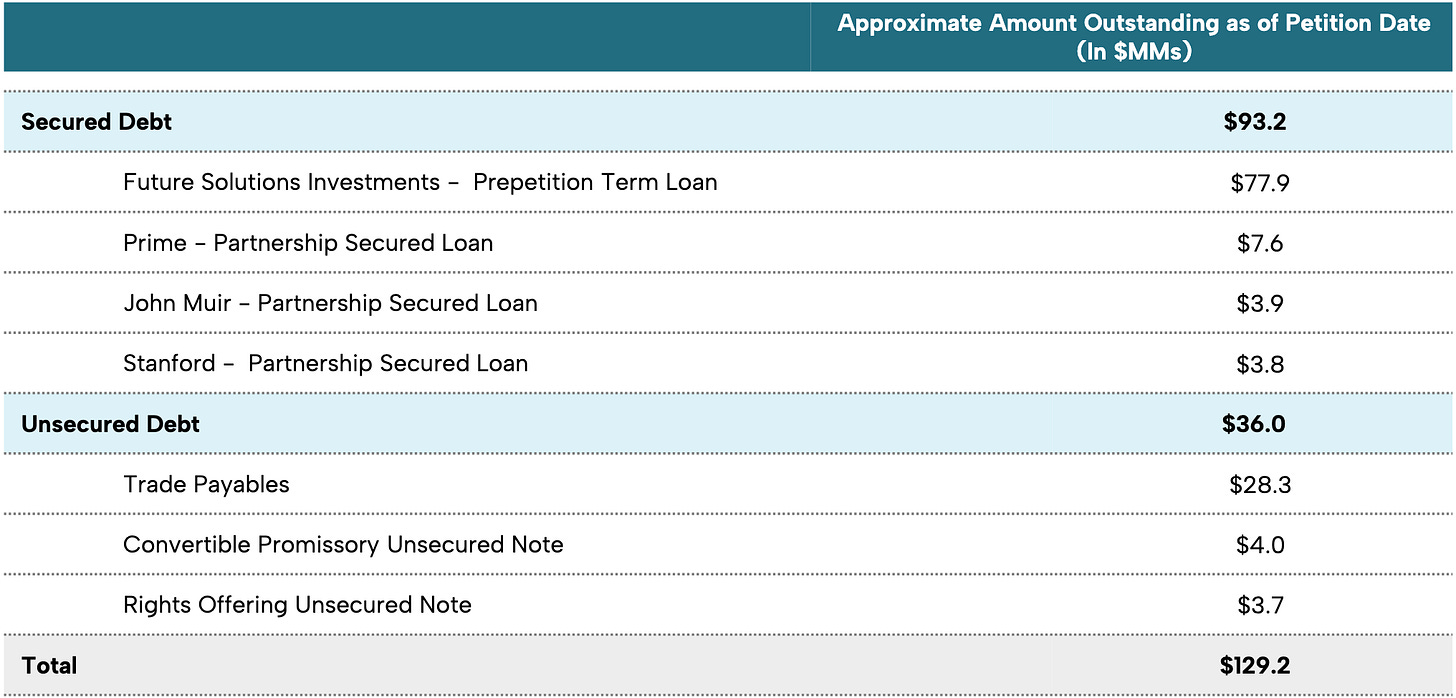

Jokes aside, it must be damn good because, along with CHTI’s MSO contracts, Future Solution Investments LLC (“FSI”) apparently wants to own it. Check the prepetition debt stack ⬇️ …**

… and consider that FSI’s debt came into existence in November ‘25 … which *checks calendar* … was only three months ago and which the debtors used to pay off a ~$61.9mm loan agented by Fearless Capital Management, LLC.***

The path to bankruptcy here is nothing new. CEO, COO, CMO and first day declarant Kerem Ozkay knocked it out in seven sentences:

“During 2020 and 2021, the Debtors expanded their operations in response to increased demand for accessible healthcare services in the communities they serve. This expansion included investments in technology, clinical footprint, and personnel to support efficient delivery of care, including—but not limited to—Covid-related testing and vaccinations. These efforts were undertaken to meet community needs and to validate and scale the Debtors’ broader care delivery model.

Beginning in 2022, as pandemic-related demand subsided and capital markets tightened significantly for healthcare growth companies, the Debtors experienced a material decline in revenue and access to external financing. In response, the Debtors implemented cost-reduction initiatives, including workforce reductions, clinic closures, and the discontinuation of certain service lines. Despite these measures, the Debtors continued to face liquidity constraints as the scale of the business no longer aligned with available capital. Ongoing operating losses and limited financing alternatives ultimately led to the present liquidity challenge.”

Despite the challenges, the debtors still produce respectable revenue: ~$166mm in ‘24 and ~$154mm TTM for the period ending November 30, 2025, with the drop driven by those cost reduction initiatives above.

In bankruptcy,**** the debtors intend to effectuate their deal with FSI: a debt-for-equity swap bolstered by a concurrent marketing and sale process on the following timeline: