🔥Beyond Bad (Meat)🔥

Updates all over the place: Nikola, RENT, SOND and TPIC.

When we first initiated on plant-based “meat” company, Beyond Meat Inc ($BYND) …

… we remarked:

“We’ll let you run the math but, clearly, a plant-based diet comes at a premium.

A premium that a lot of people aren’t willing to pay.”

That proved to be quite prophetic as the next few quarters saw massive drops in the volume of product that BYND was selling — we covered all that here:

We’re now back with a quarter worth of new results and …

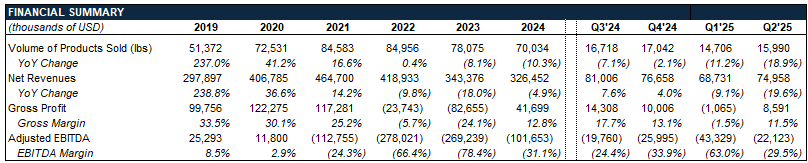

For 2Q’25, BYND reported net revenues of $75mm, a 19.6% decrease YoY, gross profit of $8.6mm, a 37.4% decrease YoY, and net loss of $29.2mm ($0.38/share). BYND also booked negative $22.1mm of adjusted EBITDA and burned through $33mm in operating cash flow.

This all translated into a deteriorating stock chart …

… and a rather morose August 6, 2025 2Q’25 earnings call that started off with this intro from CEO Ethan Brown:

“We are disappointed with our second quarter results, which reflect ongoing softness in the plant-based meat category, particularly in the U.S. retail channel and certain international foodservice segments.

Before diving into details on the quarter, this level of disruption to a recovery requires broader commentary. Though we saw a return to top line growth in the back half of 2024, the first 2 quarters of this year indicate the need for a fundamental reset for our brand and category.”

Disappointing is putting it lightly. Both US retail volumes and international foodservice volumes — the company’s two biggest segments by volume — cratered, falling by 24% YoY and 22% YoY, respectively. This translated into a US retail revenue decrease of 26.7% YoY and international foodservice revenue decrease of 25.8% YoY.*

Mr. Brown continued:

“We believe the factors that encumber our success today are transient. Just as we recognize that we are a higher-priced item in a period of economic uncertainty and stress, we know that on a material basis, our cost structure will change as we achieve scale.”

Okay and what are the other encumbering factors?

“And just as we acknowledge that our products are on the wrong side of a cultural moment, we know that the extreme nature of the current renaissance around animal protein will, as consumer trends do, moderate. This moderation may occur solely with time, new information, or new trends or may be spurred on by a set of related factors, including pricing pressure, droughts, and genetic disease outbreaks.”

Yeah somehow, vegetarianism/veganism — and in turn, BYND — have been caught up in the middle of the political culture war. If you think about it, what are the reasons for adhering to a vegetarian diet these days? Environmental reasons? Health reasons? Moral reasons?

The current administration has already made it pretty clear that climate change is not at the top of the priority list. Meanwhile, Secretary of Health and Human Services, Robert F. Kennedy Jr., has already voiced his opposition against any kind of “processed” food — and plant-based meats are as processed as they come. The backlash against plant-based meats has been so strong that BYND made an original short film in an attempt to “counter misinformation.”

Great uh … anything else other than a 9 minute direct-to-YouTube “film”.

Back to Mr. Brown:

“[W]e are welcoming John Boken of AlixPartners as interim Chief Transformation Officer to lead and support our enterprise-wide transformation activities with a focus on operating expense reduction, gross margin expansion, and broader operational efficiency.”

Yes, we’re sure employees are welcoming him too, since those expense reductions include culling ~44 of ‘em, or 6% of BYND’s total workforce. Note that John Boken isn’t a pure “performance improvement”/turnaround guy, he’s a veteran restructuring professional who has been at the helm as CRO for such cases like PG&E, Flying J, and TOUSA. Those cost cuts are supposed to get BYND to positive EBITDA by the second half of FY’26 … which is … optimistic. Here’s Barclays PLC ($BARC) analyst, Ben Theurer, during the 2Q’25 earnings call on how the math isn’t mathing:

“Just two questions I have for you, gentlemen. So number one, you talked about getting somewhat adjusted EBITDA positive in the back half of next year, if I understood this correctly.

So if I just look at somewhat the run rate operating expense that you're having right now, a little over, call it, $40-ish million, I just assume you get this down to a run rate more like in the low 30s, so that would still be an annualized somewhere in like the 120s. So that's like kind of like your gross profit starting point, a little less on D&A adjusted.

But in order to get there, it really feels like we need higher top line, right? And I mean, you've given obviously outlook for the third quarter to be somewhat slightly down sequentially versus the second quarter if we just assume low 70s versus the $75 million.

So the question really is, aside from trying to get the gross margin back up to the 20s, close to 30s, you also need the revenues to be maybe closer to like $350, $400 on an annualized basis, which just with, call it, $70-ish million each quarter doesn't work out.

So what can you do to really scale up the top line while at the same time, taking all this hit and trying to serve a cut on the SG&A side. So the balance of here, that's what I would like to understand. What are the measures you're going to take to get one up and the other one down?”

Basically, even if management hits all their cost cutting goals, the top line has to grow considerably from here to reach positive EBITDA.

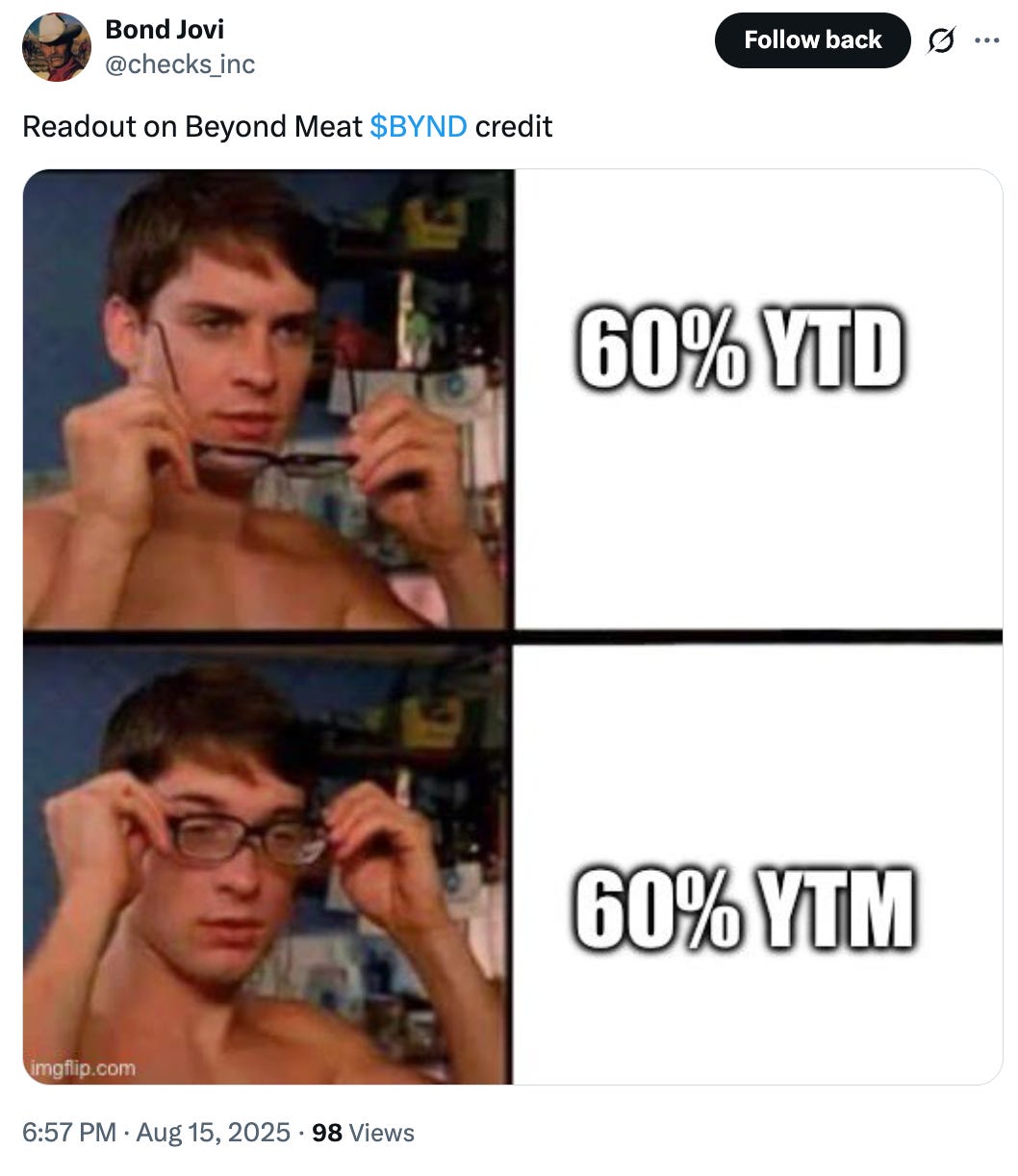

Debt-wise, BYND still has $1.15b outstanding of 0% converts due March 15, 2027. Pricing on the converts actually increased by ~60% since June to … drum roll please … 12c on the dollar (according to FINRA).

In addition, BYND also took out $40mm during 2Q’25 on the recently announced $100mm delayed draw term loan that carries a 12% PIK interest rate and matures in February ‘30.

On the other side of the balance sheet, BYND ended 2Q’25 with $103.5mm in unrestricted cash and $13.8mm in restricted cash, there’s also $60mm of remaining availability under the delayed draw term loan. That’s roughly enough liquidity to cover a little over a year’s worth of operating cash burn. If BYND somehow lasts longer than that, then there’s the ‘27 maturity to contend with — but something tells us the company will contend with it long before then (keep reading).

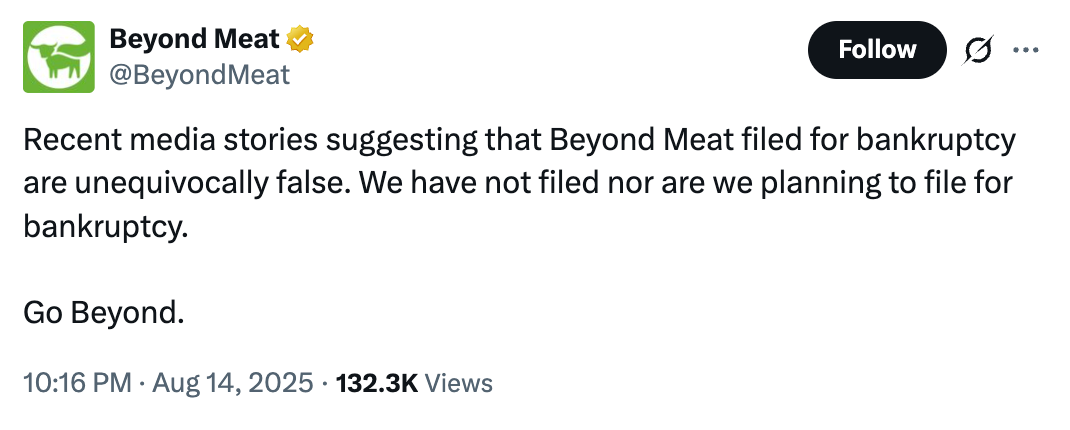

All of which makes the “Beyond Meat has filed for bankruptcy” chatter on X and in C-list media earlier this week extra wrong amusing (hence Mr. Bushnell’s “nice weekend” comment 👆). Here 👇, as just one example, is an X user with the handle samsolid57 with the not-so-solid fake news blasted to his 17.5k followers:

The rumor was spreading so fast that the company itself felt compelled to respond:

Of course it hasn’t filed. We’d all have seen that actually hit a docket.

And of course it’s not planning to file. There’s still a liability management exercise (“LME”) to do first.

Keep reading with a 7-day free trial

Subscribe to PETITION to keep reading this post and get 7 days of free access to the full post archives.