💥A Coin Flip?💥

Pine Gate Renewables LLC, iRobot Corporation ($IRBT), Norcold LLC, Office Properties Income Trust ($OPITS) & More.

Honestly? Johnny is SO over it.

It started with him running late to work, stopping by the local bodega, realizing that NYC-Mayor-Elect Zohran Mamdani’s “policies” haven’t kicked in yet, and paying $2 for a banana that used to cost him just $0.25.

From there he stopped by the coffee shop, ordered his standard cold brew with oat, only to be prompted by Square (Block Inc., $XYZ) — that godforsaken abomination of a company — for $9 before the guilt-inducing auto-prompt pillaged him for an additional 460% tip. F*ck you, Square. That jolt of caffeine, after tip, cost so much that Johnny no longer had lunch money left for his now-$10.99 Shackburger — a patty that as recently as ‘20 might have run him $6.50. Now he gets why so many of you biglaw f*cks are making Aaron Judge-type money:* how else can you live in this dreadful cesspool?!?

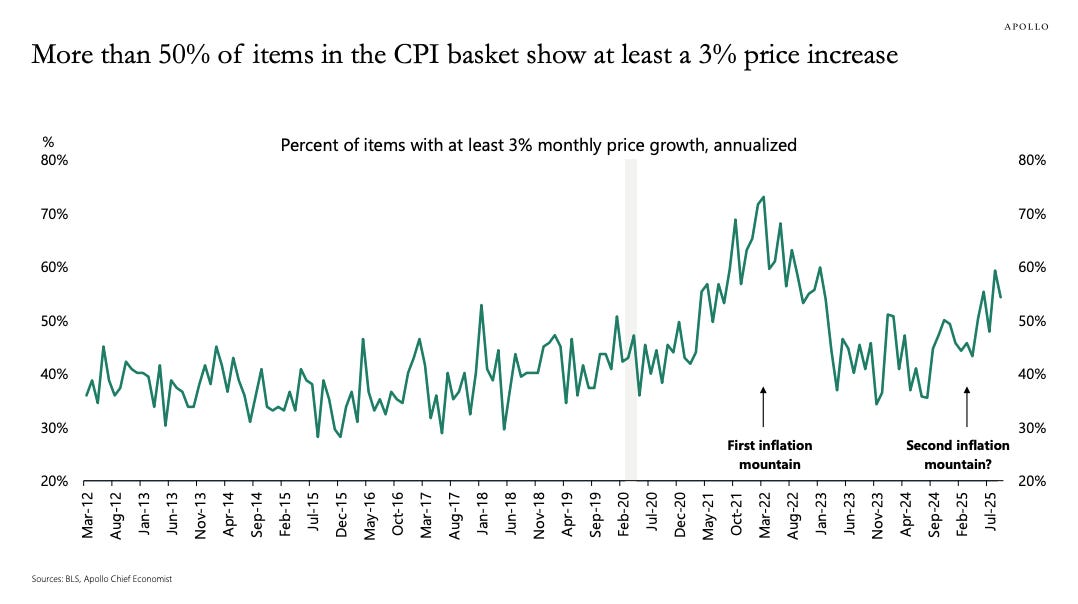

Anyway, it’s no wonder inflation remains elevated when this sh*t is happening👇…

… because bananas, coffee and beef are three of many CPI components that seem to be skyrocketing in price, 🚀.

President Trump can’t cut tariffs fast enough.

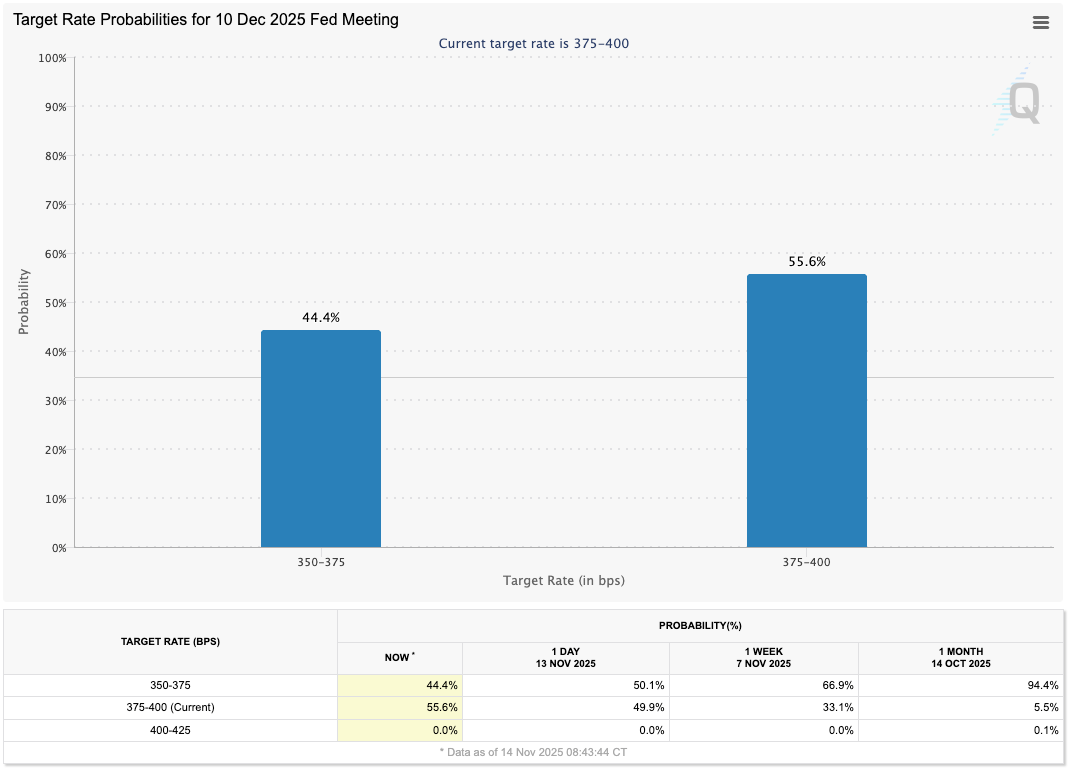

Speaking of cuts, it’s … uh … getting a bit harder for the Fed to justify a rate cut when inflation is rearing its ugly head. Good thing Jerome POW-ell left himself an escape hatch last month when he cast shade on a market-predicted December cut and said it was no “foregone conclusion.” We meeeeaaaaan … check this sh*t 👇:

LOL, the market priced in another 25 bps at 94% probability A MERE MONTH AGO. It was a 50-50 coin flip MIDDAY ON FRIDAY and now down to this 👆.

The hawks be lookin’ at markets and see some prey: Fed Reserve Presidents Mary Daly, Raphael Bostic, Alberto Musalem, Beth Hammack, Neel Kashkari, Susan Collins, Lorie Logan, Jeff Schmid all expressed concern about inflation this week. On the flip side, you can bet Michelle Bowman, Stephen Miran and Christopher Waller will do the President’s bidding and lobby for another 25 bps (if not 50, in Miran’s case).

The prospect of “higher for longer” had markets rattled and risk-on fervor abated. The S&P 500 Index fell 0.76%, the Nasdaq Composite fell nearly 2%, and BTC dropped nearly 7%.** US Treasury yields moved higher and IG and HY both retreated, with spreads widening.

November, however, has been quiet in RX circles — at least as far as filing activity is concerned. Anecdotally, however, Johnny is hearing in-between $9 coffees that things are picking up as we head into the final stretch of ‘25.

In that vein, a lot of people have their eye on private credit. Sure, on one hand those guys are saying all of the right things. Like, here is Ares Management ($ARES) CEO Michael Arougheti:

“Due to several high-profile bankruptcies or instances of fraud in the news, there have been many questions and concerns about what this could mean for a credit cycle and private credit players like Ares. Based upon the strength that we’re seeing in our portfolios and what we’re hearing from our peers and general credit trends, these events appear to be idiosyncratic and isolated and not the sign of a turn in the credit cycle. From our vantage point, our credit portfolios also remain healthy, and we’ve not seen any deterioration in credit fundamentals or changes in amendment activity that would indicate a turn in the cycle is coming.” (emphasis added)

And here is KKR & Co. Inc.’s ($KKR) CEO Scott Nuttall:

“We are talking both public and private have had low default rates for a long time. And we have seen defaults across both markets tick up somewhat. But from everything we are seeing, there’s nothing alarming going on, just the beginning of a return to a more normal default environment.” (emphasis added)

But, on the other hand, there’s this:

Hold up. Is that …

Someone break out the boric acid: Blackrock TCP Capital Corp. ($TCPC) had $150mm of exposure to Renovo Home Partners marked at par at the end of September only for it to collapse into chapter 7 bankruptcy literally TWO MONTHS LATER — L.O.F*CKING.L.

But here is Phil Tseng, Chairman/CEO/co-CIO of TCPC to explain this all away:

“I’d also like to share an update on our investment in Renovo, which, as you may recall, is a direct-to-consumer home remodeling business. Renovo was previously removed from non-accrual status following a comprehensive recapitalization in the second quarter. However, early in the fourth quarter, company-specific performance and liquidity issues led the Renovo board to determine that the best available path forward was a liquidation process, which started on November 3rd of 2025. The position in Renovo represented approximately 0.7% of our total investments at fair value as of September 30th. We do not expect to recover value on our investment in Renovo, and we expect to fully write down this position in the fourth quarter of 2025. Further, we expect this to impact fourth quarter NAV by approximately $0.15 per share on a pro forma basis. We view this outcome as the result of issues specific to the issuer rather than a reflection of broader sector weakness.” (emphasis added)

He added:

“Importantly, non-accruals improved to 3.5% of the portfolio at fair market value compared to 5.6% at the end of 2024. During the third quarter, we sold one non-accrual investment above our valuation estimate and placed two smaller previously restructured investments back on non-accrual.”

Lessons learned!***

Still, it’s hard not to question marks when investments go from 100 to … uh … 0 … in … sixty f*cking days, amirite?

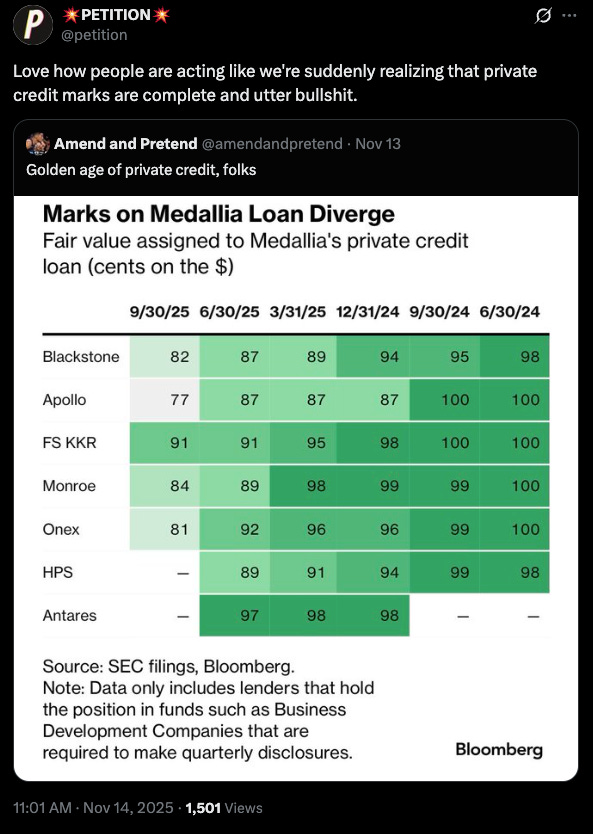

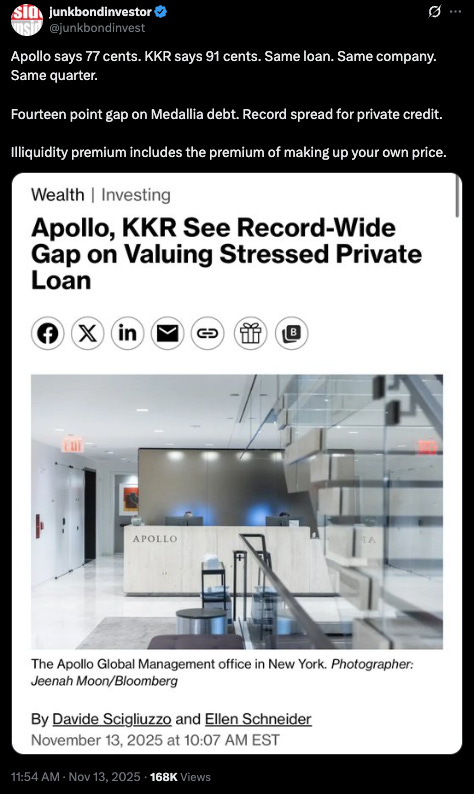

Or, like, when there’s massive dispersion on the same loan. Like with this 👇 … L.O.F*cking.L.2.0 … which might help explain Mr. Nuttall’s view 👆:

Who knows? Maybe a couple of surprises isn’t indicative of sh*t. Or maybe it is..., 🤷♀️?

Before we move on to today’s coverage we’ll leave you with this comment from CR3 Partners’ William Snyder in this past Wednesday’s a$$-kicking edition of PETITION (ICYMI):

“Right now, transportation, commercial real estate, some residential, agriculture, casual dining and importers are in trouble. Inflation bumped back up and long-term rates are not dropping. You also see cracks in private credit as many of the loans from 2021 and 2022 are coming due and there is no place for them to go. I believe there is a black-swan event coming that will involve a confluence of regulated entities funding non-regulated private credit, higher long-term interest rates and a general decline in consumer confidence.”

🤔. What is Renovo, after all? Oh, right: a private credit-backed PE rollup of home (“residential”) improvement companies.

*Despite lacking Judge-like business-generation stats.

**As of November 15, 2025.

***Those companies back on non-accrual? Fishbowl Solutions and Brook & Whittle.

☀️New Chapter 11 Bankruptcy Filing - Pine Gate Renewables, LLC☀️

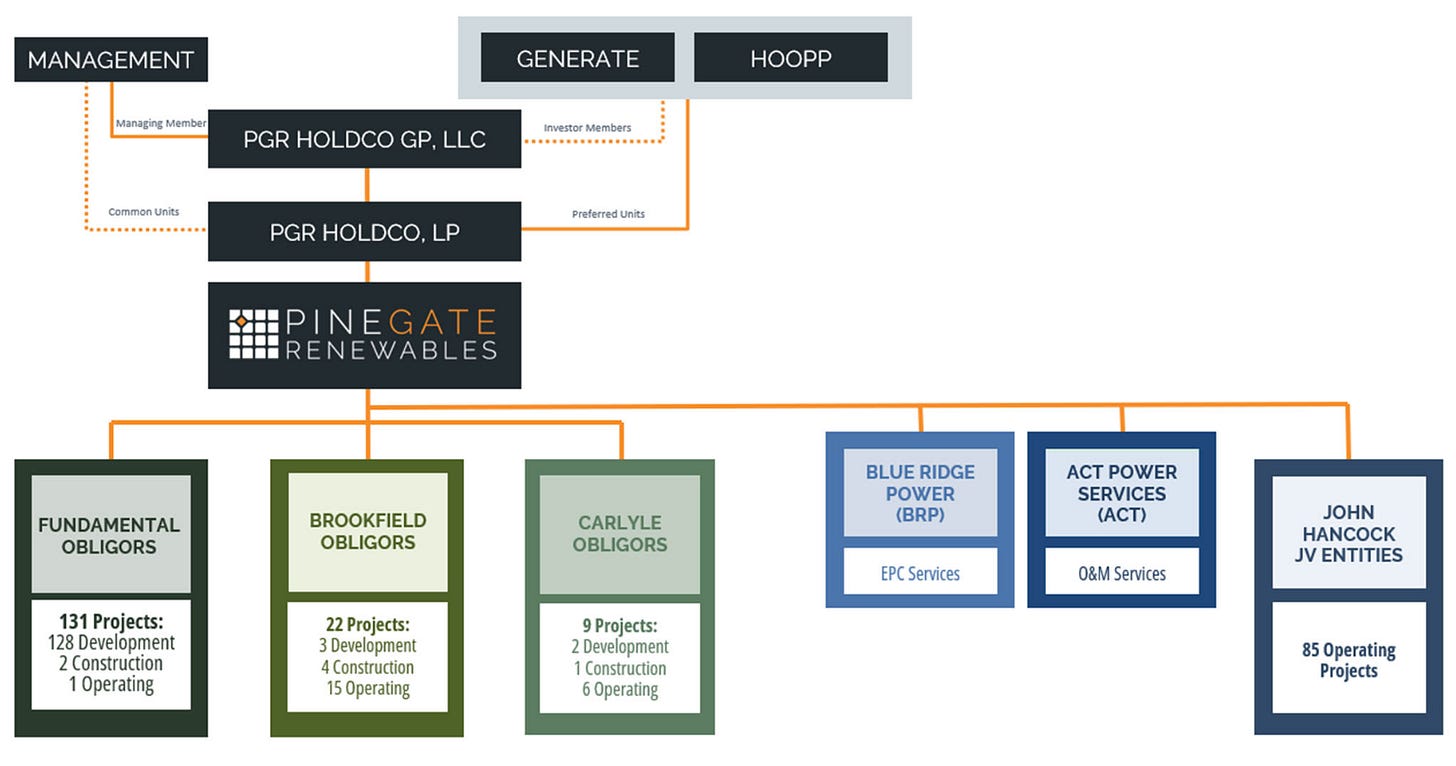

On November 6, 2025, Asheville-based Pine Gate Renewables, LLC (“PGR”) and 118 affiliates (collectively, together with PGR, the “debtors” and together with 761 — no, that’s not a typo— non-debtor affiliates, the “company”) filed chapter 11 sale cases in the only venue Ray Schrock seems to know these days: the Southern District of Texas (Judge Lopez). The company is a developer and owner-operator of “utility-scale” solar power facilities throughout the US and, through debtor Blue Ridge Power, LLC and non-debtor Affiliate ACT Power, also dabbles in engineering, procurement, and construction services and operations and maintenance for third parties and itself.*

Good lord are we tired of failed solar companies. There’s nothing original or interesting about the slew of excuses — “… increased interest rates, changes in the regulatory environment, and inflationary pressures …” Without getting into whether “changes in the regulatory environment” are good or bad, we all know what it is code for.

Just say it, wimps.

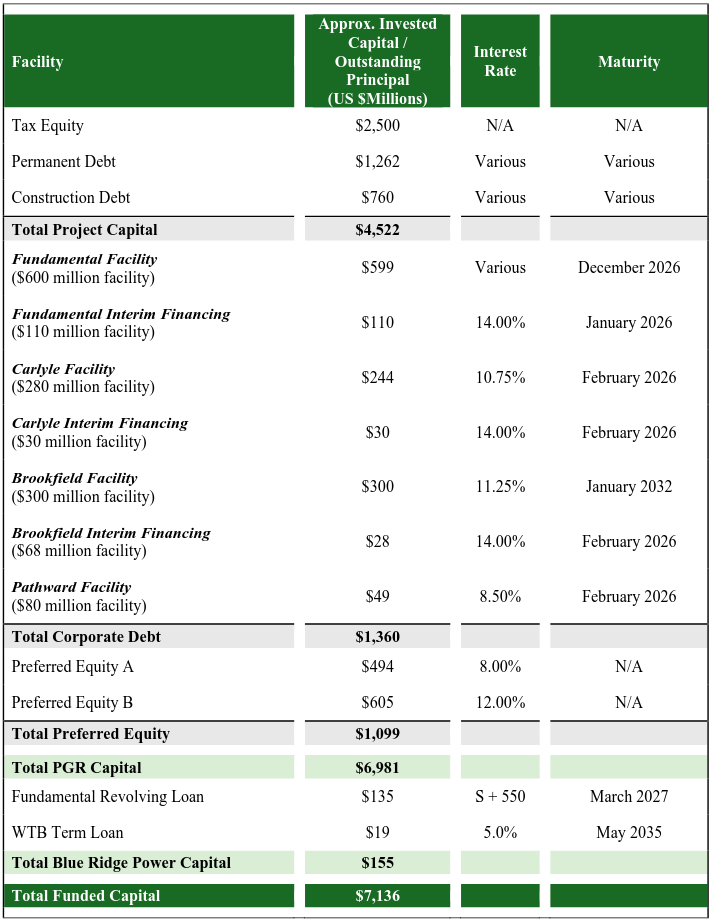

Ugh, at least the history here is more entertaining than most. After failing to find a buyer in ‘24 and the pre-bankruptcy part of ‘25, the company’s banker, Lazard Frères & Co. LLC ($LAZ) reached out broadly for a DIP, including, obvi, the company’s “corporate-level” secured lenders — Brookfield Asset Management ($BAM), The Carlyle Group ($CG), and Fundamental Renewables (“Fundamental” and together with BAM and CG, the “bridge/DIP lenders”), each of which had funded its respective silo in the org chart above. Specifically, as of the petition date, BAM had supplied $300mm, GC tossed in $244mm, and Fundamental was good for $599mm.

Third parties were, for once, interested: the company received two offers from lenders outside the cap stack, but allegedly neither was enough to fund a “full” chapter 11 case. More importantly, the bridge/DIP lenders apparently had more cash to burn. They responded to LAZ with a one-two punch combination out-of-court and in-court financing (the “combo funding”), contingent on each other, which resulted in three new financings that closed on October 6, 2025. A whole month before the bankruptcy.

The new injections gave the company, which previously had $8.5mm to its name, another $412mm to play with, composed of, at the time, up to ~$208mm in out-of-court, “interim” financing (the “pre-DIP DIP”) and the balance (plus any undrawn amounts from the out-of-court cash) as an honest-to-g-d postpetition DIP.

By the time the petitions landed, the debt stack looked like this:

Well, if you ignore $63mm in fees under the out-of-court loans, which just so happened to have not made their way to the chart. Holy hell, ~38.1% in fees for one month. Directors oughta get sued.

Keep reading with a 7-day free trial

Subscribe to PETITION to keep reading this post and get 7 days of free access to the full post archives.