💥New Chapter 11 Bankruptcy Filing - AFH Air Pros LLC💥

On March 16, 2025, FL-based Air Pros Solutions LLC (“Air Pros” or the “company”) and 19 subsidiary affiliates (collectively with Air Pros, the “debtors”) filed chapter 11 bankruptcy cases in the suddenly sizzling 🔥 Northern District of Georgia (Judge Baisier).* The company is “…a professional home services provider offering a wide range of solutions for residential and commercial clients, specializing in HVAC (heating, ventilation, and air conditioning) installation, repair, maintenance, and air quality solutions…” operating in eight states after a string of footprint-expanding acquisitions over the past eight years.** Now, if you read that last sentence and caught yourself performing an epic eyeroll while lipping to yourself “another f*cking roll-up,” give yourself a cookie because that’s exactly what we’re dealing with here.

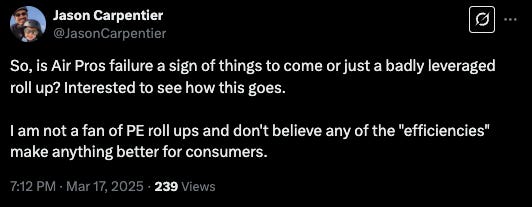

So synergies right? Isn’t that the basic premise behind roll-ups?

Oh. Our bad. We mean “efficiencies.” Anyway, generally, yes, whether its synergies or efficiencies, these pros failed to realize either. Per the first day declaration of Accordion Partners LLC’s (“Accordion”) Head of Turnaround & Restructuring and Senior Managing Director Andrew Hede:

“Since completing multiple acquisitions, the business has experienced a series of ongoing operational and integration challenges that have negatively impacted operations and financial performance. After acquiring several new business units in an approximately 15-month period, the Debtors have not been able to fully integrate its [sic] various business units. Many of the operating practices of the legacy Air Pros business have not been applied to acquired business units. Combined with other challenges, the businesses have underperformed. For example, each business unit has an individualized operating model, which leads to lack of controls, different operating philosophies and margins, and a lack of economies of scale.”

And of course there is the debt. Specifically there’s $250.4mm of pre-petition secured debt comprised of (i) a ~$196.9mm term loan, (ii) an initial ~$23.5mm revolving facility (which was subsequently upsized in November ‘24 by another $11mm) and (iii) an additional $2.5mm bridge loan funded the week before filing. Below that the debtors also owe general unsecured creditors ~$45mm (inclusive of $17.1mm in aggregate amount of contingent, unliquidated, and disputed obligations emanating out of the debtors’ various acquisitions). Mr. Hede wasn’t kind enough to provide us with pre-petition operational metrics but he does say that the debt was crushing — so much so that the debtors were unable to satisfy their obligations under the ‘22-placed credit facility and ultimately defaulted, leading to acceleration.

Before we talk some more about the debt and that ominous default, we wouldn’t want to leave you with the impression that all of this trouble struck suddenly, like lightening (⚡️). Nope, Jefferies LLC (“Jefferies”) started shopping this thing around to potential strategic buyers and sponsors in the summer of ‘23. That’s right, ‘23. Things merely got worse from there.

Which gets us back to that debt. On January 31, 2024, Alter Domus US LLC (“Alter Domus”), acting as pre-petition agent on behalf of the pre-petition lenders, (i) delivered a notice of default, (ii) exercised proxy rights under the credit agreement, (iii) sh*tcanned the company’s founder and CEO Anthony Perera,*** and (iv) installed bankruptcy (and board flip) veteran Lawrence Hirsh as independent manager.**** Accordion has been in there since March of ‘24 and Mr. Hede has been CRO since September ‘24.***** Jefferies got invited back to the party for a second bite at the apple in October ‘24. With a full roster of RX professionals,****** the debtors were ready to rock and roll and get things back on track.

So what track is that, exactly? More sale stuff! Here’s the mic Mr. Hede:

“After evaluating the alternatives, the Debtors concluded that the best path forward to maximize the value of the Debtors’ assets was a break-up sale of the businesses.”

Multiple sale stuff, actually!! Mr. Hede added:

“Through this most recent and ongoing process, the Debtors have received several formal offers that will serve as baseline, stalking horse bids for the Debtors’ assets, subject to higher and better bids pursuant to court-approved bidding procedures. The Debtors intend to file a motion seeking approval of proposed bidding and auction procedures within the first several days of these Chapter 11 Cases, which will, among other things, identify the stalking horse bidders and set forth the material terms of the stalking horse bids, including the specific assets being acquired.”

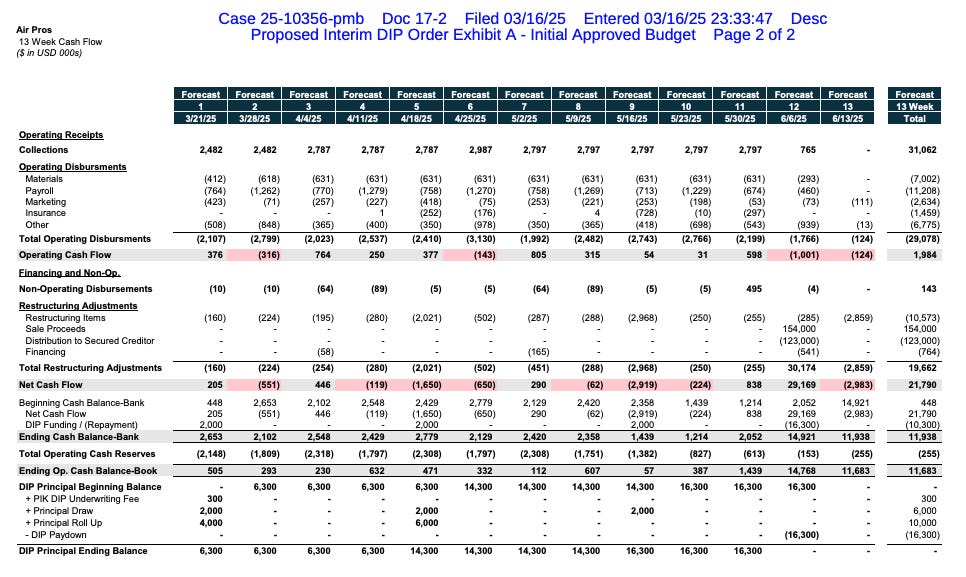

A sale process, of course, requires money and so, of course, there’s a proposed DIP and motion to seek the use of cash collateral. The headline number of the DIP is $20mm but only $10mm is new money ($4mm interim, roll-up dollar-for-dollar, multiple delayed draw term loan). The DIP carries a SOFR+11.5% interest rate and a 3% closing fee against the new money (PIK). The DIP terms include liens on avoidance actions (at final order stage) and other now-typical waivers that may benefit the secured lenders to the benefit of unsecured creditors. Moreover, the prepetition lenders preserved their right to credit bid. We’d previously mentioned that Mr. Hede wasn’t kind enough to regale us with pre-petition operating results but, naturally, we can see from the DIP budget where this company stands:

Yeah, sans a DIP stat, you can see how there’d be “immediate and irreparable harm.”

As for timing, this budget subsumes the entirety of the process. The debtors intend to have one or more auctions for the sale of all or substantially all of their assets by May 12, 2025, with a sale hearing to be held on May 19, 2025; they hope to have an order confirming a plan of liquidation by June 24, 2025. In other words, the events will, subject to an obstreperous official committee of unsecured creditors, transpire “suddenly, like lightening” (⚡️).

In addition to other relief, Judge Baisier entered an interim order authorizing the DIP and cash collateral use on an interim basis on March 18, 2025.

The debtors are represented by Greenberg Traurig LLP (David Kurzweil, Matthew Petrie) as legal counsel and the aforementioned Accordion and Jefferies (Jeffrey Finger) as restructuring advisor and investment banker, respectively. Alter Domus is represented by Seward & Kissell LLP (Gregg Bateman, John Ashmead) while lender, OC III LVS LXI LP, is represented by Latham & Watkins LLP (James Ktsanes, Ebba Gebisa, Nikhil Gulati) and Scoggins Williamson & Ray PC (J. Robert Williamson, Matthew Levin).

*Ok, fine, maybe this is a bit of hyperbole but, still, this is the second relatively sizable chapter 11 bankruptcy filing to occur in this district in ‘25, which, *checks notes*, is more than we can say about either New York or New Jersey. Yes, folks, this is the deal flow today.

**Florida, Georgia, Alabama, Mississippi, Louisiana, Texas, Colorado, and Washington. The debtors are, lol, the official AC Company of the Miami Dolphins and Florida Gators.

***This is an astonishing turn of events, really, given that Mr. Perera led the debtors to the prestigious number 868 slot on Inc. Magazine’s annual Inc. 5000 2024 list — ahead of Kim Kardashian’s Skims.

Inc. Magazine cites 576% three-year growth which is, obviously, fake AF. “It is an honor to have earned our place in the top 1000 of the Inc. 5000 list,” Mr. Perera said to PHCP Pros, LOL, mere months before he got sh*tcanned … we mean … “stepped down.” For what it’s worth, Johnny is now feverishly scrubbing the list from number 869 on down to see what other future bankruptcy candidates may be waiting in the wings.

Mr. Perera initially remained as manager of the holdco entity, Air Pros Solutions Holdings, LLC (“Holdings”) but that status ceased in October ‘24. Afterwards, Mr. Perera remained on with the debtors as a consultant to help prepare these cases and aid the sale/marketing process but that, too, has since ceased, leaving Mr. Hirsh as the sole manager of Holdings and the next entity down, Air Pros Solutions, LLC, which, in turn, owns 100% of the membership interests in all but one of the remaining debtors.

****PETITION readers will remember Alvarez & Marsal LLC (“A&M”) alum Mr. Hirsh from his stints on the boards of Coach USA Inc. and Red Lobster Management LLC.

*****For those of you enamored with relationship science, Mr. Hede worked at A&M from March ‘03 through February ‘17. Mr. Hirsh was duly employed by A&M from June ‘02 through November ‘20. Overlap!

Mr. Hirsh is still listed as a “senior advisor” to A&M on his LinkedIn profile so the retention of Mr. Hede must be super well-received.

******It’s unclear when debtors’ counsel, Greenberg Traurig LLP — which didn’t even warrant a mention by Mr. Hede — hopped aboard.

💥23andMeh. Part II.💥

When we last left you on 23andMe Holding Co. ($ME) (the “company”), CEO Anne Wojcicki, who holds 49% of the voting power in the company, and New Mountain Capital (“New Mountain”) had just delivered a non-binding take-private proposal to the company’s special committee of Andre Fernandez, Jim Frankola, and Mark Jensen, which offered to buy out (or let rollover) all shareholders not named Anne Wojcicki for $2.53 per share, representing an equity value of $74.7mm.*

That offer was a small premium over the-then current $65mm market cap. But whoops, a mere three days after we published that piece, on February 28, 2025, New Mountain backed out of the deal entirely. We can only imagine how Ms. Wojcicki felt about that.

But Ms. Wojcicki hasn’t had the success she’s had by lacking persistence. On March 2, 2025, she embarked on a new, self-financed path and delivered a non-binding proposal of her own. Just one catch — the price. That $2.53 per share? Yeaaaahhhhhh, this time it was 41¢ a pop, which pegged the company’s value at roundabouts $12.1mm or 0.2% of its once $6b market cap (😬). What was it that Sir Richard Branson said about the company when his SPAC took the company public? Oh, yeah, “huge growth opportunities ahead,” LOL. If you’re curious how that proposal compares to the company’s current market cap, here you go:

Of course, this ⬆️ price action is after the stock experienced a 26.5% bump since March 10, 2025 (adding ~$10mm in market cap). But even at the time she made her generous 41¢ overture, the stock was nearly 4x higher than her proposal. So, of course, it went absolutely nowhere. Like, what was she expecting?

But she wasn’t done. On March 6, 2025, she tossed in another proposal at 41¢ cash plus three contingent value rights (“CVRs”), representing the potential to receive an additional $2.53 per share. The payment of the CVRs is tied to future revenue milestones, and if they all hit, that’d be a premium over the stock price. But, as the old saying goes, the devil’s always in the details. Here’s what the CVRs require:

To earn another 67¢ per share, revenue in FY26 (ending March 31, 2026) has to exceed $224 million;

For another 84¢ per share, revenue in FY27 (ending March 31, 2027) has to exceed $295 million; and

And finally, for another $1.01 per share, revenue in FY28 (ending March 31, 2028) has to exceed $367 million.

These are lofty-a$$ goals. For the 9 months ended December 31, 2024, the company’s revenue was down 5% YoY, from $134mm to $128mm, and FY24 (ending March 31, 2024) had a total revenue of $219.6mm. If that same pattern holds, FY25 should end up landing around $208.6mm. Both would be a far cry from prior years, which landed at $299.5mm in FY23, $271.9mm in FY22, and $243.9mm in FY21.

Even if that first payment is obtainable — it’s at least not ridiculous — the company needs to achieve revenues it’s only beaten once to get that 84¢, and the last $1.01 requires a figure 22.5% higher than the highest revenue year the company’s ever had.

We wouldn’t blame stockholders if they didn’t put a lot of value on those CVRs. We certainly wouldn’t, but we’re somehow still not done.

At the request of the special committee, she took yet another turn at the proposal and, on March 10, 2025, added her willingness to lend $20mm at 7% to fund operations, to be offset dollar-for-dollar by any future financing she is able to raise. It was otherwise identical to the prior offer. Maybe that tweak means something to the special committee, but why would shareholders care? They’re getting bought out, and loans aren’t revenue (duh).

If history is any indication, we could easily be blessed with more rounds of this back and forth — or maybe the special committee’s directors take a page from their predecessors and resign too. Neither would be surprising. However, a 41¢ cash payment, with the somewhat realistic potential to get another 67¢ a year into the future, doesn’t seem particularly enticing compared to cashing out for $1.92 today.

As Bloomberg’s Matt Levine recently noted, “it will be hard to find another buyer when Wojcicki controls the company,” so maybe it’s just time for an old-fashioned chapter 11 sale process that’ll put those control rights in their place and other bidders can have an opportunity to drive value in the right direction. Unless the offer gets materially better, that outcome seems inevitable anyway.

⚡️Update: Prospect Medical Holdings, Inc. ⚡️

Regular readers of PETITION will recall that Prospect Medical Holdings, Inc. (“PMH”) and 66 of its direct and indirect subsidiaries (collectively and together with PMH, the “debtors” and together with their non-debtor affiliates, the “company”) filed chapter 11 bankruptcy cases in the Northern District of Texas (Judge Jernigan) back on January 11, 2025. You can revisit that coverage here:

In that edition, we said it’s “a contender for the sloppiest bankruptcy of the year.” Well, we’re happy to report that … absolutely nothing has changed. In the two-odd months the debtors have been in bankruptcy, the docket has been blasted with over 1,150 entries, and the story continues to be more of the same: the company is a bottomless cash pit with no clear way out of bankruptcy and so we’re at a point where professionals are throwing sh*t at the wall to see what sticks.

Since we last saw y’all on this name, a lot’s unfolded, but let’s start with the real easy stuff. The debtors got themselves a patient care ombudsman — Suzanne Koenig* — and the US trustee appointed an official committee of unsecured creditors.** The latter retained Paul Hastings LLP (Kristopher Hansen, Erez Gilad, Gabriel Sasson, Emily Kuznick, John Iaffaldano, Charles Persons) as legal counsel, Jefferies LLC (Leon Szlezinger) as investment banker, and Province, LLC (Paul Navid), as financial advisor. You’ve really gotta love bankruptcy: even when there’s a disastrous burning building, pros will run in headfirst so long as there’s the prospect of uncovering a treasure trove down the hallway.

Turning to harder items, we’ll begin at the DIP.

At the first day hearing, the debtors surprised their landlord and secured creditor Medical Properties Trust, Inc. ($MPW) (“MPT”) with a $100mm, priming facility provided by then-newcomer-to-the-cap-stack JMB Capital Partners Lending, LLC (“JMB”), which the court approved over MPT’s objection because the debtors intended to challenge MPT’s leases as unsecured disguised financings. Well, what do you know, peace has broken out through a “global” settlement. Under it, MPT is consenting to JMB’s DIP and kicking in its own junior DIP, consisting of an up-to $25mm new money term loan (at 16%), plus a roll-up of MPT’s $75mm in prepetition term loans (at 11.5%), plus the monthly accrual of $5mm to MPT in lieu of current interest and rent, plus amounts owed to MPT’s professionals. The new money’s got a 4% PIK financing fee and a 6% PIK exit fee, earned upon entry of an order approving the settlement. That settlement also creates a single recovery waterfall across all debtors (under which MPT is only behind the other DIPs) and gives MPT rights with respect to the debtors’ multitude of sale processes (discussed below), like being able to flat-out reject any bid that involves one of its leases and on which it doesn’t give a thumbs-up.

But notice how we put “global” in quotations ☝️. Typically the term implies that everyone’s signed off on it, but you know who's not thrilled about all that sh*t? The UCC, which tossed in an objection that the settlement is “a plan of reorganization premised on substantive consolidation and allows MPT to recover on its disputed — and significantly inflated — claims with proceeds of asset sales outside of a chapter 11 plan.” Global or not, it’ll all come to a head later today, where the court will consider the junior DIP, the “global” settlement, and a bid procedures motion (discussed below).

We mentioned a “multitude of sale processes,” so sure, let’s turn to the debtors’ ongoing efforts to shove their money-hemorrhaging hospitals onto someone else. Going chronologically, the first was their late January ‘25 motion to privately sell their Pennsylvania assets to “a non-profit entity formed to serve the health care needs of Delaware Country [sic] for this purpose.” Seem a bit vague? Yeah, the debtors’ sublandlord, the non-profit Foundation of Delaware County (PA) (the “Foundation”),*** thought so too and filed an objection over failure to include small details like (i) the identity of the purchaser, (ii) its capitalization, (iii) a list of contracts to be assumed and assigned, (iv) a proposed asset purchase agreement, (v) a form of order, and (vi) the terms of a settlement to be baked into the sale.

That sale’s still technically pending, but true to form, the debtors were experiencing an “unsustainable liquidity crisis,” so about a week after filing the motion, on February 5, 2025, they followed up with a “stipulation and agreed order” to appoint FTI Consulting, Inc. ($FCN) (“FTI”) as receiver for the PA hospitals, which would keep hospital doors open through March 14, 2025.**** The Foundation objected to that too, but faced with a loser of a company like this and the Pennsylvania AG’s support, Judge Jernigan didn’t have too many options: she got right comfortable with the arrangement, comparing it to a trustee, before officially signing the order on February 7, 2025.

But we’re obviously past March 14, 2025, so you might want to know what happened next. A week before the outside date, on March 6, 2025, the court held a status conference to get the 411 and learned the debtors would be filing a motion to close the PA hospitals later that day (which they did) because, once again, they burned through the financing at hand. Displeased with that outcome, Judge Jernigan repeatedly expressed her desire for a “hero” to surface, and it seemed like she had one in mind: the Foundation itself, which she pressed HARD to find a way to fill that role. How? Back in ‘16, the debtors and the Foundation got intertwined through the debtors’ purchase of Pennsylvania-based hospitals, for which the Foundation received upwards of $55mm,***** and the court wasn’t afraid to entertain (and throw around) a few suggestions of transaction-related claims that could exist.******

She also forced the conversation to continue outside the courtroom, ordering the debtors, the Pennsylvania AG, and the Foundation to hold “settlement discussions” before March 10, 2025. But hey, either cooler heads prevailed or Her Honor’s bullying worked; on March 11, 2025, everyone headed back to court, where the debtors were just delighted to share that Foundation had reached into its pocket and found an undisclosed amount of cash to fund the PA hospitals’ receivership a bit longer — two weeks for now, subject to further conversations about a longer-term solution.*******

Rewinding back to early February ‘25 for the second motion, the debtors also teed up a sale of their Rhode Island assets to The Centurion Foundation, Inc. and CharterCARE Health of Rhode Island, Inc. That one went a lot smoother, but it wasn’t without controversy — Fifth Third Securities, Inc. (“Fifth Third”) tossed in an objection.******** What’s Fifth Third’s connection to the cases? Back in ‘21, the debtors hired them to serve as their “exclusive investment banker and financial advisor” and identified those buyers, but the proposed sale didn’t include their fee. You know who would get a fee for the sale? The debtors’ (bankruptcy) investment banker, Houlihan Lokey, Inc. ($HLI). LOL, talk about adding insult to injury — not only did Fifth Third get shafted, but someone else is getting paid for the work. The audio for that hearing was never published, but we imagine the court told them to shut up and file their (worthless) GUC claim against the estates because it docketed a signed sale order the next day, which should net the estates about $25mm (after purchase price adjustments) to burn.

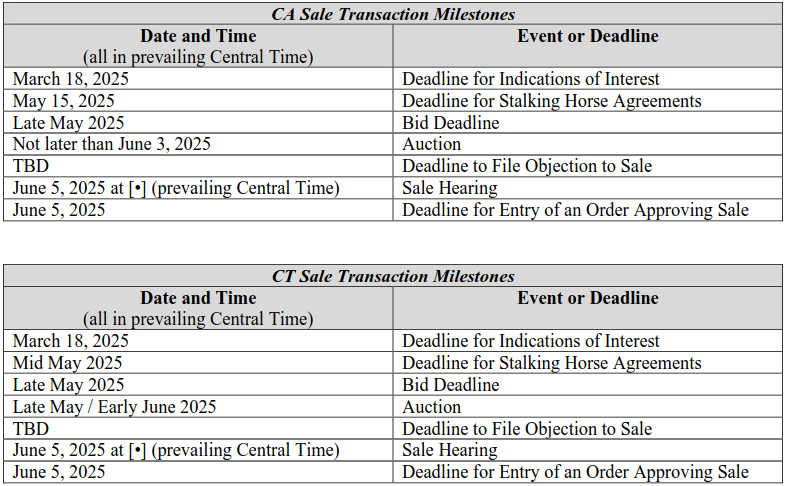

Finally, on February 18, 2025, the debtors dropped a third sale-focused motion on the docket — this time for their California and Connecticut assets — subject, refreshingly, to an actual bidding process. Well, like a generic diet cola level of refreshing; there’s no stalking horse. This is the one that drew the UCC’s ire. It didn’t love the special rights and privileges MPT’s set up to receive and the parts that bake in the “global” settlement (e.g., credit biddings). That motion is also slated to be heard later today, so folks can fight about it, the DIP, and the settlement in one, probably-painfully-long-go. But if the debtors get the go-ahead, bidders will get to enjoy these murky-a$$ deadlines:

Really, just one more example of the total chaos that these cases are. But maybe that was predestined — hard to imagine something better when day 1 serves up a priming DIP that prepetition lenders weren’t told about. To be frank, we’re hoping this business sells ASAP. And no, not because we’re overly focused on patients receiving the care they need (although we hope they do), but because keeping up with this dumpster fire has already occupied too many hours of our lives. That said, we don’t have that kind of luck, so stay tuned.

*The ombudsman is represented by Greenberg Traurig, LLP (Nancy Peterman) as legal counsel and SAK Management Services, LLC d/b/a SAK Healthcare – Ms. Koenig’s firm, of course – as medical operations advisor.

**The UCC is composed of the Pension Benefit Guaranty Corporation, Connecticut Health Care Associates District 1199, Julia Russell, Axis Spine, LLC, Compass Group, Accuity Delivery Systems, LLC, and R4 Solutions, Inc.

***The Foundation is represented by Lewis Brisbois Bisgaard & Smith LLP (Scott Cousins, Mark Cronenwett, Vivian Lopez).

****WTF, y’all. This is new relief that should have been subject to its own emergency motion, not a damn stipulation and agreed order.

*****The Foundation wasn’t certain this figure was accurate, but it was the one the debtors used.

******This transaction is well outside the traditional fraudulent transfer window, but perhaps folks have a “golden creditor” argument in mind.

*******On February 19, 2025, the Foundation filed their own motion. To compel the debtors to make good on their promise to pay ~$4.4mm in postpetition rent or, in the alternative, to convert the cases. That was initially teed up for today’s hearing too, but it’s on pause at the moment given that the Foundation is throwing cash at this company.

********Fifth Third is represented by Frost Brown Todd LLP (Joy Kleisinger, Rebecca Matthews).

📚Resources📚

We have compiled a list of a$$-kicking resources on the topics of restructuring, tech, finance, investing, and disruption. 💥You can find it here💥.

📤 Notice📤

Joseph Shifer (Partner) joined Pryor Cashman from Kramer Levin Naftalis & Frankel LLP.

🍾Congratulations to…🍾

FTI Consulting Inc. (Liz Hu) for securing the financial advisor mandate on behalf of the official committee of unsecured creditors in the Liberated Brands LLC chapter 11 bankruptcy cases.

Logan Hurst on his promotion to Portfolio Manager at Voya Investment Management.