☠️R.I.P. Sears (Finally)?☠️

Sears, Malls & Shorting the "End of the #Retailapocalypse" Narrative (Short Karl).

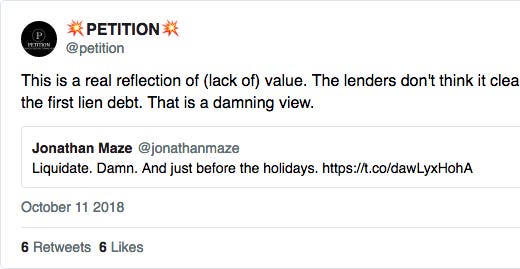

It’s official: the media apparently cares more about Sears Holding Corp. ($SHLD) than consumers do. Sure, it’s a public company and so “investors” may also care but, no offense, if you’re still holding SHLD stock than you probably shouldn’t be investing in anything other t…