⚾️Are "Distressed SPACs" Still a Thing?⚾️

Our coverage of Mudrick Capital LP’s second SPAC began with a detailed analysis of his first, Hycroft Mining ($HYMC).

TLDR: Mudrick’s first SPAC engineered a path forward for one of his long-held illiquid holdings in the 11th hour before the fund would have needed to return cash to investors. We tuned into a YouTube interview with Mudrick’s CIO, Jason Mudrick, where he speculated about a second SPAC vehicle, but insisted that his focus was “on making Mudrick Capital Acquisition I a success” before launching SPAC II.

Reasonable people can disagree on the definition of “success.” Success could be simply launching a SPAC in the first place. Or it could be successfully de-SPAC’ing into a viable merger candidate. Or it could be the post-merger entity shooting to the moon a la Draftkings Inc. ($DKNG). Pick your barometer but suffice it to say that many people wouldn’t choose “down 60% post-IPO” topped with “weak FY 2021 guidance” as their winning metric.

But past performance is not indicative of future performance. Nor is one investment enough to taint what otherwise appears to be an impressive investing run. And so surely Mudrick wasn’t going to let the absolute dumpster fire that is HYMC get in the way of launching SPAC II and then, in impressive short order, making a big announcement.

On April 6, 2021, Mudrick Capital Acquisition Corporation II announced the purchase of The Topps Company, Inc. Topps is a NY-based manufacturer of collectibles, chewing gum, and candy. A slide from the merger presentation breaks down the company’s mix of offerings:

A. Ownership Structure

Founded originally in 1938, Topps was acquired in October 2007 by The Tornante Company LLC (run by former Disney CEO Michael Eisner) and Madison Dearborn Partners, LLC for $385mm. The NYTimes stated that the original Tornante x MDP collab was “a bet on a brand that elicits an “emotional connection” as strong as Disney…” Topps’ content partners certainly fit that strategy; the company’s roster includes organizations and brands such as MLB, UEFA, The Formula One Group ($FWONA), Star Wars, Marvel, and World Wrestling Entertainment, Inc. ($WWE). Tornante Chairman Michael Eisner’s connections were no doubt invaluable in helping Topps make inroads. Disney properties include Star Wars and Marvel, and Tornante owns an equity stake in Portsmouth Football Club.

Pro forma for the Mudrick acquisition, Tornante retains 36% equity ownership in Topps. MDP and the existing management team will own 8%. Mudrick Capital will own 7% of the “Founder Shares,” while SPAC investors will own 28%. Filling out the cap stack is a $250mm PIPE offering, which accounts for 21% of the equity. Per the press release, the PIPE is led by Mudrick and names GAMCO Investors, Inc. and Wells Capital Management as co-investors. Based on merger presentation financials, Mudrick and friends are recapitalizing Topps at a 12.5x Pro Forma 2021 Adj. EBITDA multiple.

B. Segment Breakdown

Physical Sports & Entertainment is Topps’ largest segment. At $314mm of 2020 revenue, the segment makes up 55% of Topps’ total full year revenue. The business focuses on trading cards, stickers and “curated experiences” such as experiential events in partnership with UEFA Champions League.

In FY 2020, the Physical S&E segment grew 50% YoY. Topps’ estimates the segment will hit $398mm and $454mm in revenue for FY21 and FY22, growing 27% and 14% respectively. Topps has been able to quickly capitalize on the hot consumer flavor of the month, whether it was Star Wars: The Mandalorian, the WWE, Bundesliga, or Godzilla, aligning with the most recent film release. Additionally, Topps has driven margin growth through some preeetty aggressive pricing strategies. FinTwit was all over it:

Topps’ Confection Segment printed $198mm of revenue in FY 2020 and was ~35% of the business. Topps calls its brands, including Bazooka Gum, RingPop, PushPop, Baby Bottle Pop, and Juicy Drop Pop, “Edible Entertainment.” (This compilation for Baby Bottle Pop ads triggers all the early-90s nostalgia we can handle.) These brands are sold in major retail locations in the U.S. and Internationally, including 7-Eleven, Inc., BJs Wholesale Club Holdings Inc. ($BJ), Dollar Tree, Inc. ($DLTR), Kroger Co ($KR), Walmart Inc. ($WMT), Target Corporation ($TGT), Walgreens Boots Alliance Inc. ($WBA), and Carrefour S A F, REWE Group, and Tesco PLC. Topps confections are outperforming the broader confections category, and three of Topps’ products are in the top 5 best-selling non-chocolate items in U.S. Retail.

In 2020, the Confections segment was down 10% YoY, likely impacted by COVID-19: apparently the category gets some tailwinds from screaming toddlers demanding candy in the checkout aisle of the local grocery store. Damn you DoorDash Inc. ($DASH). Anyway, Topps sees that segment bouncing back 14% in FY21 before moderating to 5% in FY22.

C. Steak & Sizzle

Topps’ Digital Sports & Entertainment and Gift Cards together make up 10% of Topps’ total revenue. We’ve previously shared our thoughts on gift cards; we find it fascinating that between 6 - 10% of prepaid gift cards are never used by the customer, resulting in ‘breakage income’ at 100% margin to the business. But if Topps’ Physical S&E and Confections are the ‘steak’ of the investment thesis, Digital is certainly the “sizzle.”

Digital Sports & Entertainment provides app-based, digital collectibles and games with the ability to print on-demand. This segment grew 72% YoY as Topps directly monetized the Intellectual Property of its partnerships through its mobile apps. Per the merger presentation, daily active users on Topps’ apps have grown at a ~50% CAGR from January 2019 to January 2021. Per a NYTimes article, Tornante, MDP, and company management have been prioritizing this shift:

“In the years since Mr. Eisner’s initial purchase, Topps has focused on a shift to digital, starting online apps for users to trade collectibles and play games. It also created “Topps Now,” which makes of-the-moment cards to capture a defining play or a pop culture meme. (It sold nearly 100,000 cards featuring Senator Bernie Sanders at the presidential inauguration in his mittens.) And it has moved into blockchain, too, via the craze for nonfungible tokens, or NFTs.”

While we have no f*cking clue what’s going on with NFTs, there’s no question pandemic lockdowns have fueled a resurgence across all of memorabilia. The article continues with some comments from Mr. Mudrick and Topps’ current CEO Michael Brandstaedter:

“The secondhand market is particularly hot, with a Mickey Mantle card recently selling for more than $5 million. “Topps probably made something like a nickel on it, 70 years ago,” said Jason Mudrick, the founder of Mudrick Capital. NFT mania will allow Topps to take advantage of the secondhand market by linking collectibles to digital tokens. Topps is also growing beyond sports, like its partnerships with Marvel and “Star Wars.”

It continues to see value in its core baseball-card business, as athletes come up from the minor leagues more quickly. “The trading card business has been growing for the last several years,” Michael Brandstaedter, the chief executive of Topps, said. “While it definitely grew through the pandemic — and perhaps accelerated — it did not arrive with the pandemic.” (emphasis added)

Topps’ foray into NFTs through its collaboration with Wax Blockchain on ‘Garbage Pail Kids’ has been wildly successful, selling out in 27 hours with $100k+ in revenue. But the reported numbers indicate Topps derives limited value from digital today:

But that looks set to change. Perhaps quickly. It looks highly likely that Topps is going to do some exciting digital things with the likes of the Anaheim Angels’ Mike Trout and Shohei Ohtani, among others; it signed both to long-term card and autograph deals that, while the details are not entirely clear, likely includes some sort of digital element to it (at least with Trout given the timing).

Topps is innovating in real time. The Verge reported on Major League Baseball’s latest initiative earlier this week:

Major League Baseball has announced its latest move to cash in on the NFT craze: official blockchain-based versions of classic Topps baseball cards. Topps is selling the new NFT baseball cards through the WAX blockchain, which the company has used for its earliest blockchain-based collectibles.

The first “Series 1” cards will be sold starting on April 20th, with 50,000 standard packs (containing six cards for $5) and around 24,000 premium packs (offering 45 cards for $100) set to be sold in the first wave. Topps is also offering a free “exclusive Topps MLB Opening Day NFT Pack” to the first 10,000 users who sign up for email alerts for new releases.

It’s a similar idea to the NBA’s white-hot Top Shot NFTs, which offer fans purchasable video clips (called Moments) in card-like packs. Top Shot Moments are already a massive business — some have sold for upwards of $200,000, and more than 800,000 accounts have yielded over $500 million in sales so far.

Not too shabby.

While the future may be digital, Mudrick’s investment thesis as outlined in the NYTimes’ article is focused on the longevity and stability of the physical business.

“That resilience is part of the bet that Mudrick Capital is making on the 80-year old Topps. It’s a surer gamble, Mr. Mudrick said, than buying one of the many unprofitable start-ups currently courting SPAC deals.”

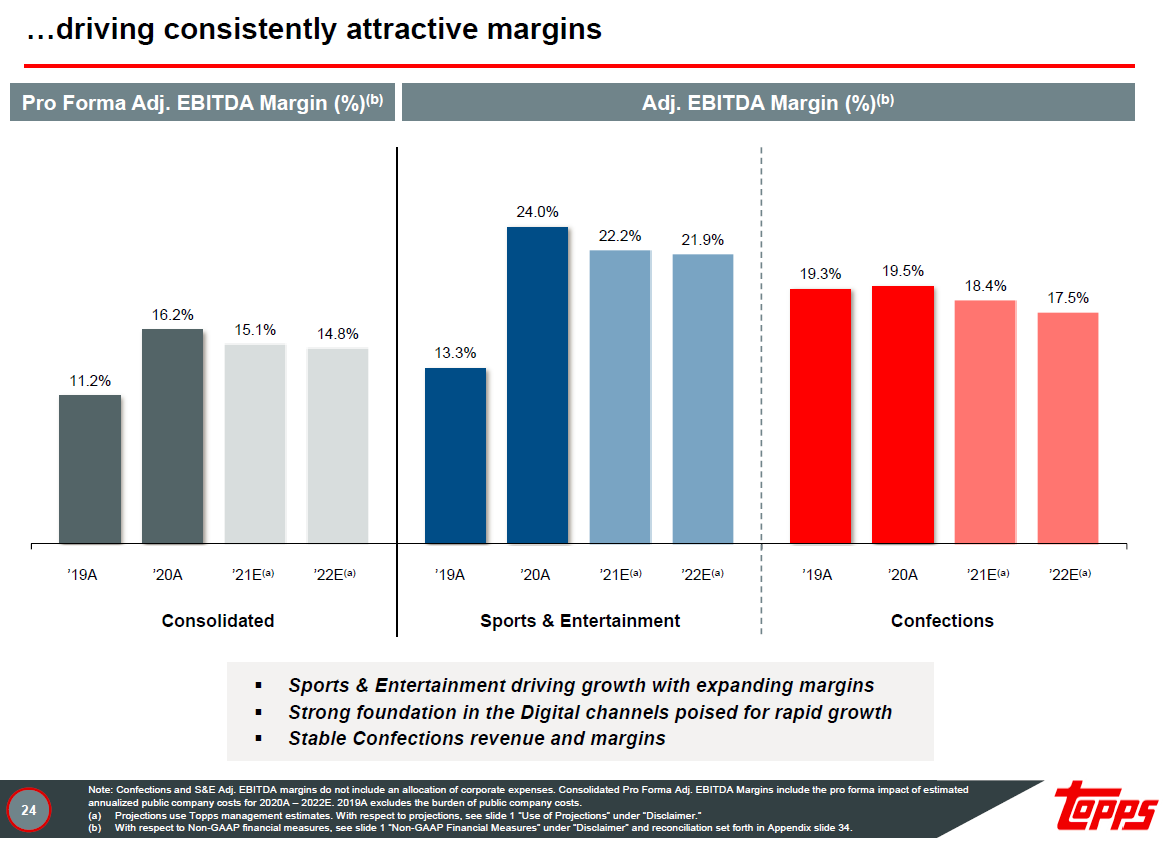

PETITION and other public investors only have a limited period of financials to digest, so we can’t refute Mr. Mudrick’s claims of Topps’ financial resilience. From the financials we can see, Topps is growing and profitable. FY20 revenue of $567mm represented growth of 23% from prior year levels, and the company projects — ah, the beauty of SPACs, go-forward projections! — those trends to continue. FY21 and 2022 are estimated to grow to $692mm and $777mm, or 22% and 12% respectively. EBITDA margins expanded considerably in 2020, from 11% to 16%, and CapEx is incredibly low.

The largest part of Topps’ business is growing with the highest EBITDA margins – a positive sign.

But is Topps really the sort of business Mudrick Capital intended to acquire with MUDS II? On one hand, the S-1 spins a different story:

“Our business strategy is to identify, combine with and maximize the value of a company that has either recently emerged from bankruptcy court protection or will require incremental capital as part of a balance sheet restructuring. In particular, we believe that many post-restructured companies suffer from a valuation discount due to their opaqueness, complexity, non-long term ownership base and overall illiquidity. We believe that our in depth understanding of restructurings and post-restructuring company analysis, coupled with the more liquid publicly traded vehicle the company offers in an initial business combination, could result in significant value creation for our stockholders. Creating value for our stockholders is the ultimate goal of this business strategy.” (emphasis added)

It's clear from the language that Mudrick Capital Acquisition Corporation II was intended to be a distressed-oriented SPAC. But Mudrick & Co. went in the complete opposite direction. Comparing Topps and Hycroft Mining, this couldn’t be a more divergent duo of companies; we liken the two businesses to ‘apples and napalm grenades’. The market seemingly concurs. Juxtapose this ⬇️ with the Hycroft chart ⬆️:

Just to piss in everyone’s faces, Ares Management Corp’s CEO Michael Arougheti added (in a conversation with Bloomberg’s Kelsey Butler):

“There’s underlying stress that will find its way into the markets but I don’t think that’s anytime soon,” Arougheti said at a virtual Bloomberg News event this week. Default rates are “artificially low” and asset prices are buoyant because “there’s so much liquidity masking that default rate that we’ve all grown accustomed to seeing at this point in the cycle that we’re probably two to three years out before we start seeing a traditional default cycle play out.”

And so maybe Topps should be viewed in the same lens as the infamous Howard Marks’ ‘Something of Value’ investor letter — a sign of capitulation among notable distressed managers. We’re taking a more passive view on this. From our perspective, turning around a distressed businesses today requires a significant investment in both capital and time. And there’s huge terminal value risk – many distressed businesses models are structurally challenged and may not exist in the next 5 – 10 years. In that context, Mudrick’s move to acquire a stable, healthy business at a full valuation makes intuitive sense. Why not sacrifice a few basis points of alpha to write a big check that doesn’t cause heartburn for a decade? (Side note: we think Starboard Value’s acquisition of Cyxtera ties back to this theme, which we previously covered here).

As times change, so must distressed managers. In our humble opinion, Topps and Hycroft are worth paying attention to not only as interesting businesses in their own right, but as bellwethers for capital flows.

Of course, as we continue to evaluate all of this, we may get some additional data points: