As loyal PETITION readers know, our tagline is “Disruption, from the vantage point of the disrupted.” After its Chapter 11 bankruptcy last week, Cenveo Inc. may very well be the poster child for disruption.

Founded in 1919, Cenveo is a 100 year-old, publicly-traded ($CVO), Connecticut-based large envelope and label manufacturer. You may not realize it, but you probably regularly interact with Cenveo’s products in your day-to-day life. How? Well, among other things, Cenveo (i) prints comic books you can buy at the bookstore, (ii) produces specialized envelopes used by the likes of JPMorgan Chase Bank ($JPM) and American Express($AMEX) to deliver credit card statements, (iii) manufactures point of sale roll receipts used in cash registers, (iv) makes prescription labels found on medication at national pharmacies, (v) produces retail and grocery store shelf labels, and (vi) prints (direct) mailers that companies use to market to potential customers. Apropos to its vintage, this is an old school business selling old school products in the new digital age.

And, yet, it sells a lot of product. In fiscal year ended December 31 2017, Cenveo generated gross revenue of $1.59 billion with EBITDA of $102.8mm. Those are real numbers. But so are those on the other half of the company’s balance sheet.

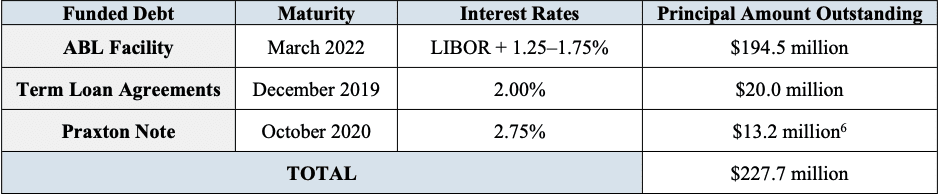

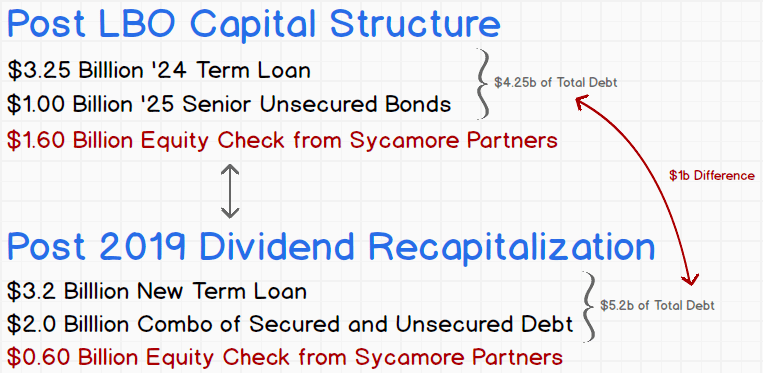

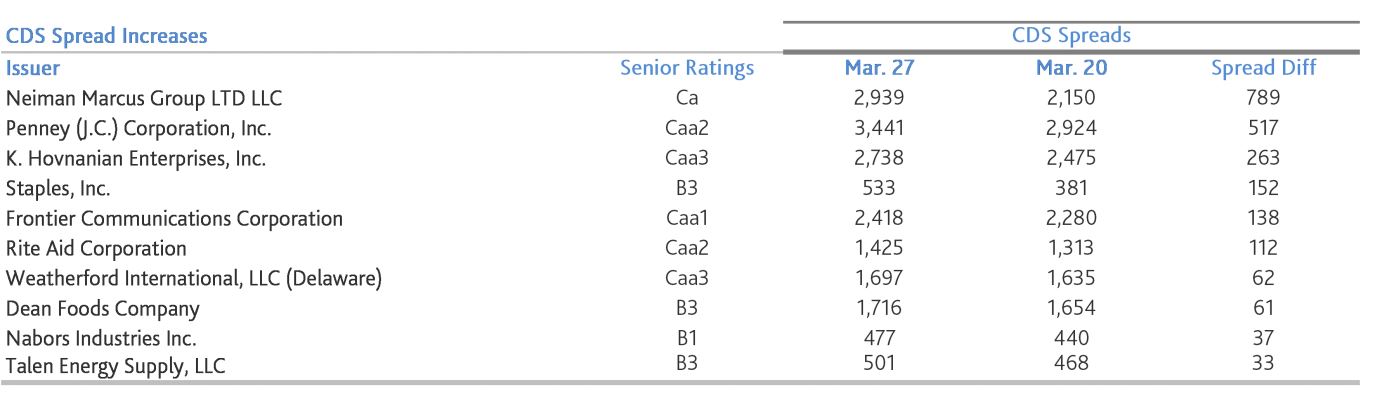

After years of acquisitions (16 between 2006 and 2013, representing a strategic shift from print-focus to envelope manufacturing), Cenveo has more than $1 billion of funded debt on its balance sheet and a corresponding $99.4mm in annual debt payment obligations (inclusive of cash and “principle” payments). That’s the problem with a lot of debt: eventually you’re going to have to pay it back. And the only way to do that is to have sustained and meaningful cashflows that are, hopefully, trending upwards rather than down. Therein lies the problem with Cenveo. As liquidity gets tight, a business may start getting a bit looser with payments, a bit less reliable. Savvy trade creditors sniff this from a mile away. With the company (very) publicly struggling under the weight of its balance sheet, vendors started hedging by contracting trade terms and de-risking; they start throwing off business to Cenveo’s competitors, further challenging Cenveo’s liquidity — to the tune of a net liquidity reduction of approximately $20mm. Initiate death spiral.

But, wait! There’s more. And it’s textbook disruption. Per the company,

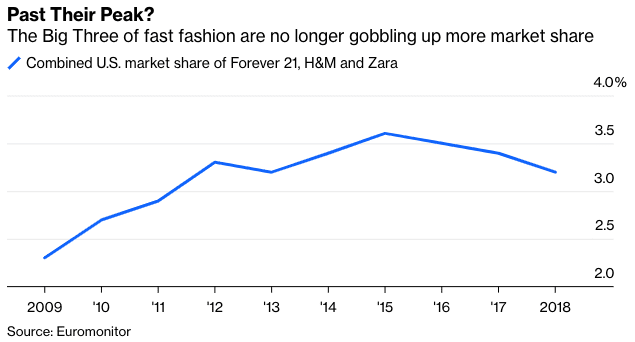

“In addition to Cenveo’s leverage issues, macroeconomic factors, including the introduction of new e-commerce, digital substitution for products, and other technologies, are transforming the industry. Consumers increasingly use the internet and other electronic media to purchase goods and services, pay bills, and obtain electronic versions of printed materials. Moreover, advertisers increasingly use the internet and other electronic media for targeted campaigns directed at specific consumer segments rather than mail campaigns.”

Ouch. To put it simply, every single time you opt-in for an electronic bank statement or purchase a comic book on your Kindle rather than from the local bookstore (if you even have a local bookstore), you’re effing Cenveo. More from the company,

“As society has become increasingly dependent on digital technology products such as laptops, smartphones, and tablet computers, spending on advertising and magazine circulation has eroded, resulting in an overall decline in the demand for paper products, and in-turn lowering reliance on certain of Cenveo’s print marketing business. In addition, there is generally a decline in supply of paper products in the industry, such that only a handful of paper mills control the majority of the paper supply. As a result, paper mills and other vendors that sell paper products have a large amount of leverage over their customers, including Cenveo. The overall decline in the paper industry combined with the diminished supply in paper products has led to overall decline in the industry, dramatically impacting Cenveo’s revenues.”

Consequently, the company has spent years trying to implement an operational restructuring (read: streamline operations and cut costs). The company adds,

“Faced with an industry in transformation, Cenveo, beginning in 2014, commenced a strategic review of a significant portion of its businesses and concluded that it needed to focus its portfolio on profitable segments that would be better-positioned to grow in the future and to divest non-core, unprofitable segments. To implement this strategy, between 2014 and 2017, Cenveo applied a number of broad-based cost savings and profitability initiatives, which included downsizing its workforce, reducing its geographic footprint, and divesting certain non-core business segments, which was designed to reduce costs, minimize the possible effect of decreased sales volume for underperforming product lines, and remain competitive.”

While the company notes that it currently employs nearly 5200 people in the US, it is clear that many people have lost their jobs. 100 people in Orchard Park, New York. 108 people in Exton, Pennsylvania. 112 people in the Twin Cities. 91 people in Portland, Oregon. You get the point. You should read theGlassdoor reviews for this company. The employees sound miserable. The comment board is riddled with critiques of management, allegations of squandering, tales of job cuts and no raises. Even sexual harassment. We can’t wait for the uproar over the inevitable Key Employee Incentive Plan.

So what now? The company claims it’s ready for the e-commerce age and that it can make a ton of money on package labels. Provided that it can shed its debt. Accordingly, the company engaged the holders of its first and second lien debt and was able to secure a (shaky?) restructuring support agreement (RSA) and a commitment of $290mm in financing. The RSA exhibits the company’s intent to equitize the first lien holders’ debt. Notably, Brigade Capital Management — representing over 60% of the second lien debt and a meaningful percentage of first lien debt — isn’t on board with the RSA and noted in a filing that the bankruptcy may be “more contentious and protracted than indicated” by the company. Indeed, they are already agitating against the company and certain insiders alleging, among other things, that the Burton family has received approximately $80mm of disclosed compensation between 2005 and 2016 that ought to be investigated. And that the RSA seeks to enrich the insiders with a generous post-reorg equity grant of 12%. In other words, this could get ugly. Fast.

We should also note that the company will also need to address its underfunded pensions (approximately $97.3mm) and 18 active collective bargaining agreements. Funding contributions for 2018 are over $10mm. The pension plan(s) cover 5700 retirees and 734 active employees. And so while sophisticated funds duke it out over valuation and the corresponding value of their claims/recoveries, thousands of employees and retirees will be left in the lurch. Yikes.

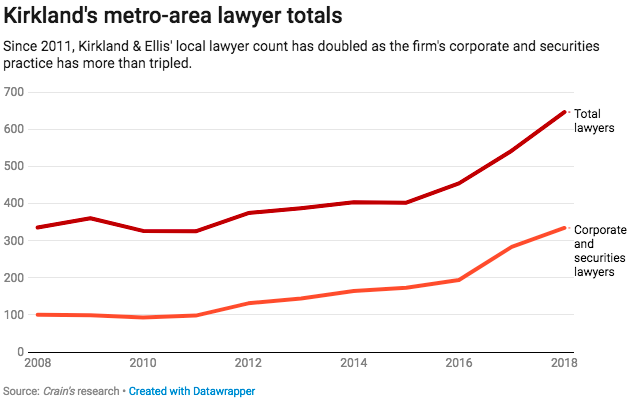

As you can see, disruption is hard. Silicon Valley types love to talk about their big revolutionary products and how they’re going to change the world. That sexy stuff gets CEOs on magazine covers. Cameos in Iron Man movies. And more. The attorney from Kirkland & Ellis LLP representing Cenveo used an IPad in court. Symbolic.

But there is a dark underbelly to disruption too. As new technologies come online and habits change, long-standing businesses like Cenveo falter. People lose jobs — or struggle one day at a time to keep them. People lose pensions they’d planned to live on. Hopefully the professionals who make money managing these elements in-court don’t lose sight of these factors and work hard to optimize efficiency in the process. And hopefully the engineers and disrupters take note of what their “big revolution” may mean for others. Cenveo is a great reminder.