😎2021: Restructuring Professionals Weigh In. Part I.😎

Experts Cite Purdue Pharma and Hertz as Bankruptcy Cases of the Year

Not to state the obvious, but it’s been a wild year. We’ve covered it like crazy, twice a week, every week with barely a break.

So now it’s time for us to shut the hell up and give others an opportunity to share their perspectives. We reached out to a variety of restructuring professionals* for their thoughts on a few things. Without giving anyone much lead-time whatsoever, we only had one bit of real guidance: “[t]he best answers are succinct with personality.”

In this edition you get to see what our panel had to say ⬇️.** You can be the judge as to who can follow instructions and who cannot. 😜

* Damian Schaible is a Partner at Davis Polk & Wardwell LLP. Rachael Albanese is the Vice-Chair of the Restructuring Group and a Partner at DLA Piper. Dan Dooley is a Principal and CEO at MorrisAnderson. Ryan Preston Dahl is a Partner at Ropes & Gray LLP. Chris Ward is a Partner and Practice Chair at Polsinelli. Brian Resnick is a Parter at Davis Polk & Wardwell LLP. Navin Nagrani is an Executive Vice President at Hilco Real Estate. Natasha Labovitz is a Partner and the Co-Chair of Debevoise & Plimpton’s restructuring group. Steven Korf is a Senior Managing Director at and Co-Founder of ToneyKorf Partners. Matthew Dundon is a Founder and Principal of Dundon Advisers LLC. David Meyer is a Partner and Co-Head of Vinson & Elkins’ Restructuring and Reorganization group. Pilar Tarry is a Managing Director at AlixPartners.

PETITION: What would be your selection for the chapter 11 bankruptcy case of the year and why (don't shamelessly list your own)?

Source: Getty Images

First, here is Damian — in true lawyerly fashion — threading the needle with a generous interpretation of our “don’t shamelessly list your own” instruction 😂….

Damian Schaible: “Purdue [Pharma] is likely the most complex Chapter 11 case in United States history. It had more than $40 trillion of filed claims, more than 614,000 claimants and more than 120,000 creditors voting on the plan, each of which is without precedent. The more than 15 interlocking settlements embodied in the plan include the federal government, 38 attorneys general and 11 ad hoc groups representing every conceivable category of claimant against the company and the Sackler family. The plan received virtually universal support, with more than 95% of creditors voting to accept. It contemplates turning the debtors into a public benefit company for the benefit of the American people and also embodies a $4.325 billion settlement with the shareholders.”

I know you said not list my own case. Davis Polk leads Purdue as you know, but I have nothing to do with it, and it’s really hard not to list it in my mind….”

Natasha Labovitz: “Purdue [Pharma] has to be the case of the year. It’s significant in dollar value, but much more importantly, it will have a meaningful impact in big cities and hometowns across the country. The company is on the verge of obtaining approval for a $4.35 billion settlement payment and leveraging that to provide critically important opioid abatement and treatment options in the local communities where help is needed. Hulu dramatizations and Elizabeth Warren criticism notwithstanding, the settlement in Purdue represents a faster, better and more evenhandedly positive outcome for claimants than endless years of litigation that would delay recoveries, reward some litigants at the expense of others, and divert available funding to the lawyers representing both sides instead of to the communities where it can be most helpful. I’m not saying paying lawyers is intrinsically a bad thing – but in this case, I think there’s a higher and better use for the Sacklers’ settlement funds.”

Dan Dooley: “Purdue Pharma. We will soon find out whether 3rd Party Releases in a Chapter 11 Plan are what Congress intended or not. I think they are not!”

Ryan Preston Dahl: “Purdue [Pharma], without question. Purdue has crystallized so many legislative, social, and public health issues beyond the scope of this particular article or any article for that matter—separate and apart from Purdue “just” being a massively complex chapter 11. And, for me, the most interesting part is the extent to which at least some members of Congress seem to have Purdue squarely in mind when they speak to, or about, legislating the Bankruptcy Code. But this legislative discourse seems to be occurring without at least some sense of irony or self-awareness. One might say that it’s largely a result of Congressional inaction in the face of a massive public health challenge that has caused the bankruptcy courts to become, it seems, the only forum available to address these challenges in a collective way.”

But there are others who thought Hertz stole the show…

Source: Getty Images

Rachel Albanese: “Hertz, because of the headlines and the positive outcome for stakeholders.”

Matthew Dundon: “Hertz. Rough start and then solid run to a par+ outcome. Broader economy helped, but still saw textbook executions of many different value creation strategies by different stakeholders.”

Chris Ward: “Hertz. Plain and simple. Kudos to the professionals that shepherded Hertz through chapter 11. Taking a floundering car rental company through a process that turned a zero cent recovery into a 100% return for creditors and a distribution to equity. That is what chapter 11 is all about. The Hertz debtors used every play in the playbook to maximize value and were not afraid to take chances to get to the appropriate end game.”

Brian Resnick: “My vote for case of the year is Hertz. In summer 2020, many in the industry (maybe even me) chuckled when Hertz shares popped above $5. The company had just filed for chapter 11, the pandemic had shut down travel, and the restructuring community debated whether Judge Walrath should even let the bankruptcy estate exploit naïve speculators by selling $1 billion of shares that that debtors’ own lawyer admitted in open court “might be worthless.”

The story of 2021 is how equity investors got the last laugh. It wasn’t just frothy equity markets, the “meme stock” phenomenon, and masses of individual investors helping boost struggling companies like AMC and Gamestop. Large, sophisticated distressed funds that had raised significant war chests found themselves in competitive auctions for chapter 11 debtors like Hertz, putting shareholders in the money by billions of dollars. Equity committees also became important players in major 2021 bankruptcy exits of Latam and Garrett Motion. Economic logic says this trend cannot become the norm – companies generally will not file for chapter 11 when they can raise equity instead. But in the topsy-turvy world of 2021, betting on equity recoveries had a nice run.”

Steven Korf: “The Hertz bankruptcy. The case looked a lot more like the old school, successful, balance sheet restructurings we used to see in Chapter 11, versus the 363 liquidation sales that have become the standard more recently. Secondly, Belk deserves a notable mention for emerging from bankruptcy with record speed, though some think the jury is still out on whether the restructuring will ultimately be successful.”

David Meyer: “Hertz. A symbol of all that 2020 and 2021 have to offer including a freefall into chapter 11 near the height of the pandemic, an unprecedented (and successful!) effort to raise equity inside a chapter 11 process that was subsequently halted, the Company gathers itself and seeks to utilize the tools of chapter 11 to right-size its balance sheet while exploring alternatives, the company then becomes propped by and leverages the open capital markets, a robust auction ensues behind the scenes and then publicly involving significant competition among sophisticated financial investors fighting over more limited opportunities, an equity committee organizes and emerges with a voice while the company simultaneously operates in chapter 11 but yet traveling remains behind its pre-pandemic heights, and a multi-day in-person gathering in Florida to decide the Company’s fate (and the winning bidder). Normal?”

And then there is a offbeat choice which, we should point out, is rather interesting:

Navin Nagrani: “Rather than being micro and picking a specific case - will just zoom out and select "Subchapter V” and its second year of being in place as my selection here. More small to medium sized businesses are going to end up going thru some sort of formal restructuring via this route. It is important for restructuring players to understand not only the specific technical aspects of these new provisions but also some of the nuances and pitfalls associated with actually working within this relatively new framework. There is now enough case material to review and learn from.”

PETITION: What are 2-3 of the biggest restructuring themes to emerge out of 2021?

Source: Getty Images

Damian Schaible: “Junior capital coming into situations to buy runway – Unprecedented money raised and looking for homes has led to a number of situations where equity or junior creditors have been eager to put in additional junior capital quickly and flexibly in situations that in normal times would be restructurings. I have been involved in a number of situations in the past year where the presumptive fulcrum creditors have headed toward a traditional restructuring and equitization only to have junior capital come in behind them to prop up the companies. We will see how these work out in the coming year!

Third party releases – Purdue and the Boy Scouts cases have brought the somewhat arcane world of third party releases in bankruptcy cases under a real public microscope. There are a lot of social discussions underway about the propriety of non-debtors being released in cases, but the reality is that this type of release is completely de rigueur and more importantly often absolutely required to get settlements and restructurings done. Congress is now involved and some cases can become much tougher if the rules are monkeyed with extensively.

Super short prepacks – We are seeing more and more “one day prepacks” used to effectuate consensual restructurings. Once the very hard work of devising and achieving full consensus is done, we have traditionally had to wait (and pay for) about two months of process and delay. Courts like the Southern District of Texas have been leaders in designing “due process orders” to make sure that everyone gets notice and an opportunity to come to court in the event of any impact on their rights. So long as this important protection is provided, in the right case, it is just more efficient and significantly cheaper not to have to wait around in court to have a couple of extra hearings.”

Natasha Labovitz: “Well, the effects of the pandemic stimulus and easily available liquidity mean that we’ve all seen our kids and other loved ones a lot more. Let’s not lose sight of that being a really good thing. That said, it seems the restructuring professionals who have been re-deploying in the M&A, finance and mass tort arenas throughout 2021 are ready to return to more mainstream restructuring activity in the coming year. As the M&A and financing markets become increasingly more frothy at the same time the pandemic stimulus begins to recede and the US and global political environments begin to appear less stable, it looks increasingly like the kind of late-stage credit cycle that puts our industry on high alert. (Maybe a little like the way my dog perks up and trots to the kitchen when she hears the refrigerator door open … but surely we are more dignified than that.)”

Rachel Albanese: “(1) Where’s the Beef? Lots of money in the market led to dramatically less restructuring work in 2021. (2) The “toggle” plan – it was showing up everywhere for a while.”

Steven Korf: “The future of third-party releases (Purdue [Pharma]). The future of venue shopping (Johnson & Johnson and NRA).”

David Meyer: “Creditor on creditor tactics will continue with a dearth of restructuring opportunities. Continued shift from distressed for control funds to shareholder activist strategies and direct lending. Companies with scale that can tap capital markets do so and refinance or address near-term maturities; smaller companies are left behind for consolidation where available.”

Matthew Dundon: “Limits to third party releases, importance of fundamentals (e.g. EV:EBITDA relative value), and he who fights Fed is dead.”

Navin Nagrani: “First, in periods of market dislocation, the perception of value is sometimes more important than actual value (Wall Street Bets mania, etc.). Second, industry practitioners have continued to accomplish things remotely that would have historically only have happened in person (court appearances, pitches, internal meetings, etc.). And, third, no one that I know of was able to predict the general nature the markets inverted in 2021 (in a mostly positive way) from the depths of the chaos COVID created in 2020.”

Brian Resnick: “First, equity committees. Equity committees played major roles in several of the biggest cases of the year. From Hertz to Latam, bidding wars between sophisticated distressed investors put shareholders in the “fulcrum” position and gave them an important seat at the table negotiating bankruptcy exits. It took an unlikely set of circumstances (and singular pandemic), but with stock market exuberance continuing, equity committees may become a more regular feature in cases with unpredictable market upside potential. Second, the Texas Two-Step. J&J made the Texas-Two Step famous enough to get Congress’s (negative) attention, following attempts by a number of other companies (Georgia Pacific, CertainTeed, Trane Technologies) to try to cabin massive tort liabilities by running these types of divisive mergers through bankruptcy in the Western District of North Carolina. It is unclear whether any of these efforts will succeed or the tactic will be shut down legislatively or by the courts, but this novel maneuver may mark the high-water mark of restructuring aggressiveness and creativity. Until the next one. And third, remote hearings. Bankruptcy megacases in SDNY, Delaware, SD Texas and elsewhere continue to be conducted virtually even after many of their sister district courts and state courts are back in-person. There are good practical reasons that bankruptcy may be more conducive to Zoom. And it appears that a larger share of bankruptcy court business may stay online even after the pandemic ends. Aside from the obvious pros and cons, this development could also impact ongoing venue reform discussions. For better and worse, videoconferencing makes every jurisdiction “local” enough that any employee or creditor can easily and cheaply participate in proceedings. On the flip side, it also makes it less expensive for sophisticated bankruptcy professionals in the major restructuring markets to efficiently run megacases in faraway jurisdictions.”

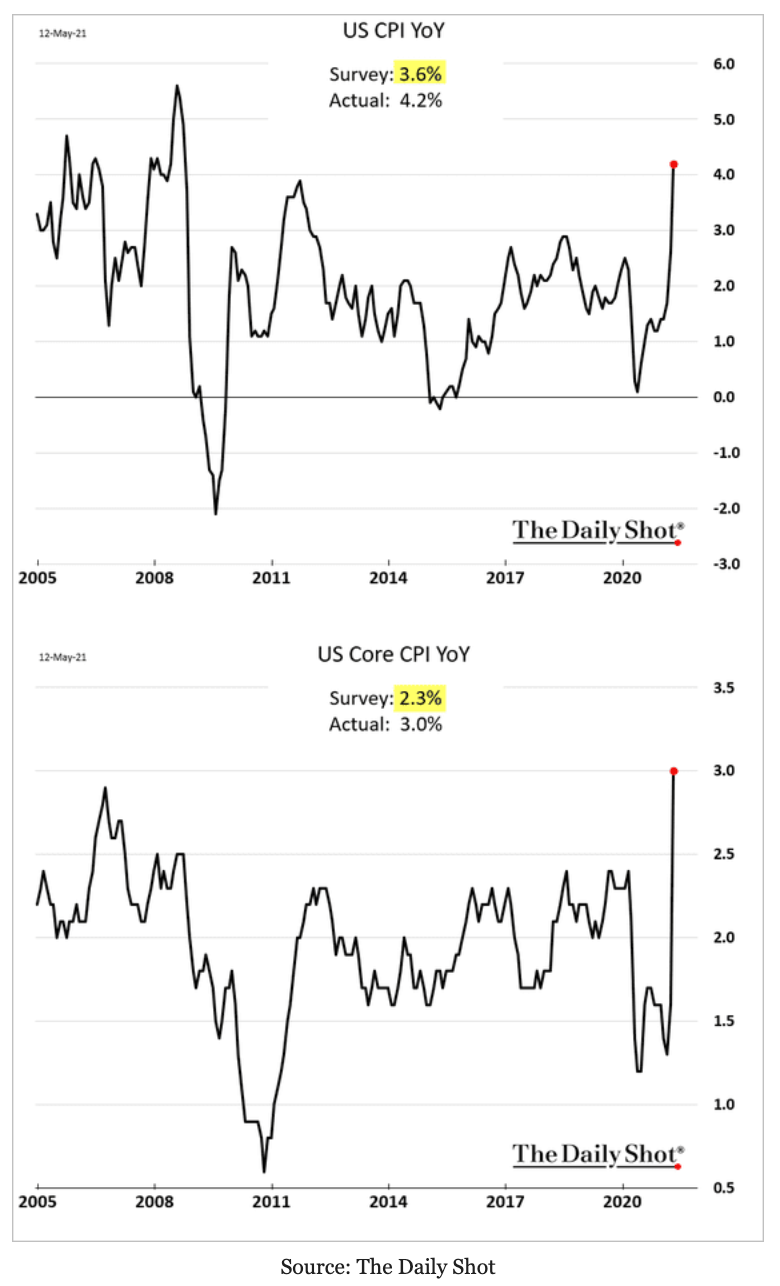

Ryan Preston Dahl: “Just one: inflation. This isn’t so much a 2021 theme as it is a precursor of things in the “Ghost of Christmas Yet to Come” sort of way. After all, inflation was “transitory” in 2021 until somebody told us it wasn’t. But inflation certainly feels real for every company I’m working with. And we have a generation of operational managers, financial professionals, and legal advisors that have never seen, let alone experienced, inflation in any real (pardon the pun) way. But now it’s here and we’re all going to figure out what to do with it.”

Dan Dooley: “Third Party Releases: will they survive? I doubt it. The Texas 2-Step. How is it possible to fraudulently convey assets under Texas law with legal insulation? I don’t believe the Texas 2-Step will survive federal legislation. Bankruptcy venue reform. Given the backdrop of 3rd party release abuse, the absurdity of the Texas 2-Step and some ridiculous bankruptcy venue abuses, I think venue reform is likely to be part of a Bankruptcy Reform Act which will significantly reduce the importance of NYC, Wilmington and Houston Bankruptcy Courts. This legislation will likely not happen until 2023.”

Chris Ward: “The three themes I took note of in 2021 were (i) the attack on the independent director (whether this is fact or fiction still needs to play out), (ii) the mass tort dump and run (unfortunately, we probably have not seen the last of these), and (iii) more chapter 11 filings in the “home” jurisdiction of the debtor (will Houston continue to dominate Delaware and New York in chapter 11 filings? Who knew so many companies had their primary place of business in Houston?).”

Source: Getty Images

PETITION: Given all of the excitement around mass tort cases like Boy Scouts of America, Purdue Pharma and J&J, what do you think Congress will do about venue and third-party releases, if anything? What should be done?

Natasha Labovitz: “It’s hard to see Congress accomplishing much of ANYTHING in 2022, and my best guess is that an amendment to the Bankruptcy Code isn’t going to be the “unicorn” type legislation that Democrats and Republicans are actually able to agree upon and get passed. But honestly, I’ve long given up being able to predict what is going to happen in Washington, and I haven’t forgotten the early 2000s, when bankruptcy reform legislation that had first been introduced in 1997 -- and had been tried, and failed, in just about every subsequent year – suddenly attracted bipartisan support (including from Joe Biden) and surprised us all by passing in 2005 in the form of BAPCPA. So, the pending legislation bears watching.”

Chris Ward: “Venue is not broken, so it doesn’t have to be fixed. The jurisdictions that have historically challenged venue have “fixed” their concerns via their local rules. The pandemic also mooted most venue concerns and now anyone can appear virtually at hearing. That phantom creditor from Enron from 20 years ago, could now participate – regardless of where the case was filed. Fortunately, Congress cannot get out of its own way and I do not see any momentum building to legislatively change third party releases, the “Texas Two-Step” or anything else.”

Pilar Tarry: “If Congress gets somewhere on this topic, I’ll be shocked. And not because they don’t seem to get there on anything else. That’s totally not it..(yes it is).”

Rachel Albanese: “I expect there will be more House hearings and more political posturing about taking action, but, particularly with this Congress, I’d be surprised if any game-changing legislation actually gets passed. That’s not to say there isn’t room for improvement on some of these issues, though. I guess I’d fall somewhere on the spectrum between Senator Warren and Professors LoPucki and Levitin, on the one hand, and Andy “Confessions of a Forum Shopper” Dieterich, on the other. The SDNY and EDVA bankruptcy courts have taken steps to ameliorate related concerns and recently entered orders requiring random assignments for mega cases filed in the districts.”

Damian Schaible: “I have long ago given up trying to predict what Congress will do on any topic! But venue and third-party releases are both extremely important topics and each currently works just the way it should. Choice of venue, including based on the experience of certain courts and the predictability that this experience provides, is extremely important to companies in need of restructuring and the capital providers that support them. And third-party releases permit deals to get done, without having to go to the lowest common denominator – the Code provides sufficient protections and the courts are good at making judgment calls in accordance with the law. For both, to “throw the baby out with the bathwater” would lead to unsatisfactory economic and practical limitations and loss.”

Ryan Preston Dahl: “I think the focus around mass tort cases and third party releases is asking at the wrong question. The real question is why have bankruptcy courts become the venue to deal with what are truly profound issues that can and do go well beyond the ‘traditional’ restructuring context? It’s also worth asking why there are so many soundbites from Congress around ‘bankruptcy reform’ and so little action taken on the underlying causes. In my own view, bankruptcy courts are dealing with fundamental questions of public health and safety (like Purdue) or the profoundly difficult case of something like Boy Scouts because the other two branches of government have simply failed to do so—for whatever reason.”

Brian Resnick: “I’ve long since stopped guessing what Congress will actually do, but clear, uniform nationwide legislation describing strict requirements for nonconsensual nondebtor releases would be the best way forward. There are situations where nondebtor releases are not just critical to a successful bankruptcy and a major source of value to bankruptcy creditors, but the most effective way to maximizing recoveries to creditors of nondebtors too. Congress should consider building in safeguards to prevent abuse—like approval by a super-majority of claimants, specific findings that the releases are truly necessary to the reorganization, financial disclosure by released nondebtors, and court findings of fairness. That type of nuanced law that limits releases to appropriate situations would preserve valuable flexibility and even encourage value-maximizing negotiations. In contrast, a blunt prohibition on any releases in all cases just encourages undemocratic holdup by minorities of claimants, less room for negotiation, and ultimately smaller creditor recoveries.

Venue reform feels like a political overkill for a problem that’s largely already been solved, if it ever existed. In recent years many of the largest cases have been filed in numerous jurisdictions outside of New York and Delaware. Abuses are few to start with, and when they exist, courts do not hesitate to use the existing statutory framework to transfer cases when they determine that venue was initially chosen in an improper manner or that the initial forum is unduly inconvenient for the relevant parties. Both the Southern District of New York and the Eastern District of Virginia have eliminated the assignment procedures that sparked much of the backlash by removing the ability to choose one or a few specific Judges, and other jurisdictions may follow. Ultimately, the system works best when debtors select an appropriate jurisdiction that will maximize the efficiency of the case and creditor recoveries. Also, while it sounds simple to just require a company to file where it is located, experience with COMI manipulation in international insolvencies shows just how tighter venue rules can introduce new gamesmanship and litigation, especially in an age of large multinational companies, where operations, assets and employees are often spread across different geographies.”

David Meyer: “The beauty of the American free enterprise system is the adaptation and creativity to find solutions to seemingly intractable problems. We think large and complex chapter 11 cases are generally best served by judges who routinely deal with such cases and provide a level of efficiency and predictability to all parties involved and this generally maximizes stakeholder recovery. Likewise, third party releases (and particularly non-consensual third party releases) have developed as a way to address mass tort liabilities in a way that can deliver substantial value to victims far quicker than years of drawn out litigation in trial-courts around the country. Perhaps neither is perfect in their current form, but wholesale prohibition through legislation doesn’t strike us as the right solution either. It falls on all restructuring professionals to develop and nurture the best features of the current system, while working to educate lawmakers on the opportunities and challenges.”