News for the Week of 12/04/16

Filings down this week so packing in the news...

- Aeropostale. Cascading effect. American Eagle Outfitters blames Aeropostale's going-out-of-business sales for same store sales declines and lowered forward guidance. Seems, however, that the pain is more widespread than that: this week mall retailer Express Inc.'s stock got trounced after reporting YOY net and comp sales declines (silver lining: e-commerce sales were up 15%). E-commerce isn't immune to downtrends either: Bodybuilding.com laid off 90 workers this week with minority owner Ryan DeLuca stating the VERY obvious, "E-commerce is tough and getting tougher with competition from Amazon and thousands of others."

- Salus Capital. The zombie that was once Salus Capital is in the news again as it funds the Chapter 11 wind-down of Hampshire Group.

- Sobey's. Another deadbeat (Canadian) grocer. Apparently the synergies expected from buying Safeway's Canadian stores haven't come to fruition.

- Solar. A synopsis of the industry's convergence with restructuring and challenges that lay ahead.

- Fast Forward: Many are now starting to call Uber's business model into question: an argument made easier by a $1.2b cash burn loss in the first six months of '16.

- Rewind I: Cosi Inc. was unable to find a new buyer, settling, in the end, on a $10mm sale to the original stalking horse bidder (including a credit bid).

- Rewind II: Nasty Gal. If this report is true, there is something strangely disturbing about a company called "Boohoo" buying another called "Nasty Gal."

- Rewind III: Bennu Oil & Gas, LLC filed for Chapter 7 weeks after the involuntary chapter 11 filing against its subsidiary, Bennu Titan. Last week we discussed feasibility and the (seeming) proliferation of Chapter 22s. This story is too brutal to even be a 22.

- Chart of the Week: This International Energy Agency chart forecasts that we've reached peak oil demand. Still, tepid interest in Verengo Inc.'s SoCal solar assets (no bid topping stalking horse: effectively sold for credit bid).

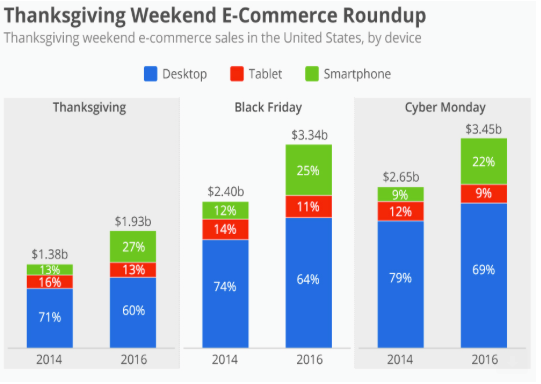

Chart of the Week II: Nike. The sneaker manufacturer announced this week that it would skip conventional wholesale channels like Dicks Sporting Goods, Foot Locker and others and sell its self-tying $720 HyperAdapt sneakers BtoC via its Nike+ app and at the NYC retail store. Clearly, Nike is paying attention to these recent consumer trends: