Professional-Services.ai

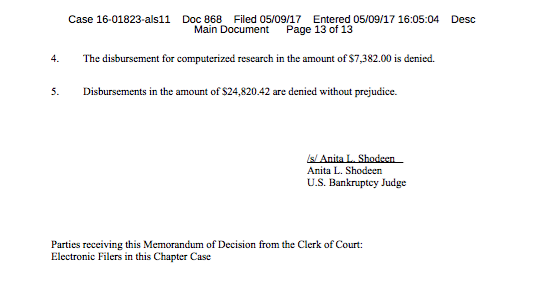

Short junior attorneys...the machines are coming for them. And, frankly, why shouldn't they come for attorneys at ALL levels? After all, are there situations where there is "overzealous advocacy and hyperactive legal efforts"? When there are "so many attorneys and their respective billings"? "When the hourly rates and amount of time billed are simply unreasonable"? "Staggering," in fact? Suffice it to say, you won't see Weil filing any cases in Southern District of Iowa anytime soon (see below). Frankly, "overzealous advocacy and hyperactive legal efforts" seems like it could have just as easily applied to the pissing contest that was the equitable subordination claim in Aeropostale but who are we to judge a grudge match between Weil and Kirkland & Ellis (which the the latter convincingly won)? We were too busy popping popcorn and putting our feet up. Switching gears and looking elsewhere in changing labor markets, here's to wondering: is the "gig economy" working? And what becomes of those 89,000 lost retail jobs?

Speaking of retail jobs, it looks like the bankers have all of them. Now there's M&A noise around Neiman Marcus, which is heating up with Hudson's Bay sniffing around hard but trying to avoid assumption of Neiman's substantial debt-load. Meanwhile Nine West Holdings has hired Lazard to figure out its capital structure. Elsewhere in retail, Macy's ($M), Kohl's ($KSS), Nordstrom ($JWN) and J.C. Penney ($JCP) all reported earnings that looked like a dumpster fire and the stocks promptly got decimated. We're sure the bankers are salivating. And speaking of retailers with jacked-up debt (and bankers), GNC Holdings Inc. and its agent bankers JPMorgan reportedly attempted but ultimately failed to extend GNC's $1.13b loan by three years. Now GNC says it will use its "strong" free cash flow to fund ops and deal with its '18 maturity. This is an interesting story on many levels. First, there have been a TON of share buybacks in recent years (the public equivalent of a dividend recap - our favorite) and so it was only a matter of time before one of them bit an uncreative and misled -- uh, we mean, generous shareholder-minded - management team in the bum. Second, the "Amazon-effect" apparently applies to meatheads too with vitamin sales allegedly shifting online. Who knew Biff could function in an m-commerce world? Go Biff. Third, despite a variety of downward trending financials, GNC's loan is still trading at a tick below par and so the proposed transaction might have affected the lenders' yield metrics (hence the rejection). Which gets us to #4: with crappy loans like GNC's ticking up so far upward, most distressed players can't stop complaining about a dearth of opportunities to target: everything is priced to perfection. Sadly, everyone needs the yield wherever they can get it hoping (praying?) that when the going gets rough, they'll be the first to hit eject. No, no (rate-fueled) bubble to see here.