⚡️Update: Destination Maternity Inc. ($DEST)⚡️

Speaking of ugly…

In the aforementioned October CBL update, we wrote:

The last thing CBL needed — on the heals of the downgrade — was near-instantaneous bad news. It got it this week.

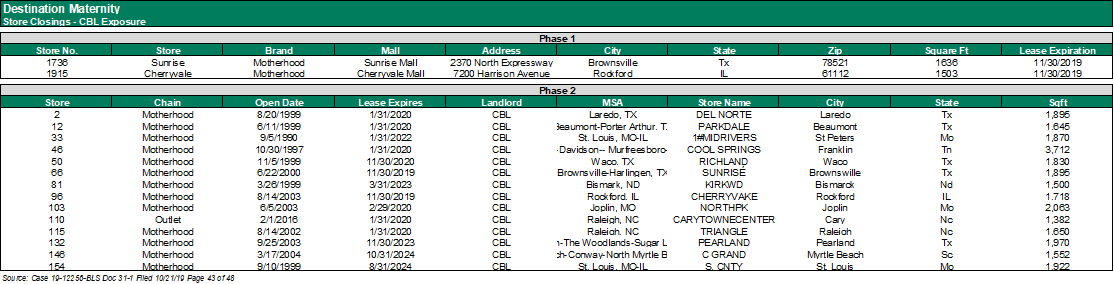

Yesterday, the bankruptcy court granted interim approval authorizing Destination Maternity Corporation ($DEST) to assume a consulting agreement with Gordon Brothers Retail Partners LLC. Gordon Brothers will be tasked with multiple phases of store closures. Among those implicated? CBL, of course:

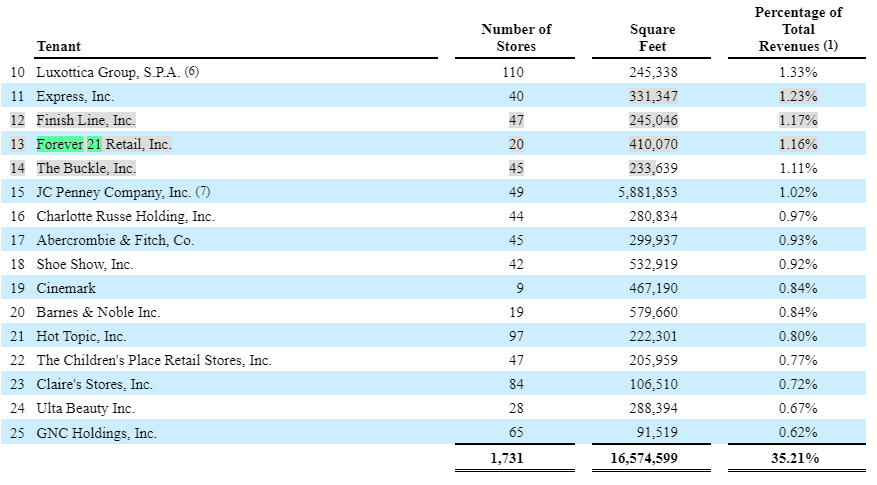

CBL is landlord to DEST on 16 properties that are slated for rejection. Considering that DEST cops to being party to above-market leases, this ought to result in a real economic hit to CBL as (a) it will lose a high-paying tenant, (b) it will take time to replace those boxes, and (c) it is highly unlikely to obtain tenants at as favorable rents.

Let’s pour one out for CBL, folks. The hits just keep on coming.

On Friday, Destination Maternity filed a motion seeking approval of a stalking horse bidder for its assets. In September’s “🤔Is it a "Destination" if Nobody Goes?🤔,” we concluded:

And so we’ll have to wait and see whether Greenhill can pull a rabbit out of their hats. Unfortunately, this is looking like another dour retail story. This looks like a liquidating ABL if we’ve ever seen one.

According to the motion, Greenhill dug deep. They reached out to over 180 potential buyers, executed 50 CAs, and granted due diligence access to nearly two dozen parties.* They also conducted 8 management presentations with potential bidders. If you’ve ever wondered why investment bankers make what they make, this ought to illustrate why: it can be a lot of work trying to garner interest and herd cats. Then again, they did accept a mandate where there was a questionable likelihood that the asset value would clear the debt. 🤔

Unfortunately, the result is not — as predicted — particularly stellar. To be clear, this isn’t a reflection upon Greenhill. This was a difficult assignment in a challenging retail environment: it’s a reflection of that.

And so Marquee Brands LLC** and a contractual joint venture between Hilco Merchant Resources LLC and Gordon Brothers Retail Partners LLC (together, the “Agent”) entered into an asset purchase agreement (APA) with the debtors pursuant to which they will purchase “the Debtors’ e-commerce business, intellectual property, store-in-store operations, and the right to designate the sale of certain inventory and related assets” for an estimated $50mm (subject to adjustments). Repeat: an estimated $50mm. The Agent will liquidate the company’s inventory, fixtures and equipment and conduct store closing sales at the 235 stores where closing sales are not already in process. Said another way: the company’s retail footprint is going the way of the dodo. Clearly this isn’t credit positive for CBL and other landlords.

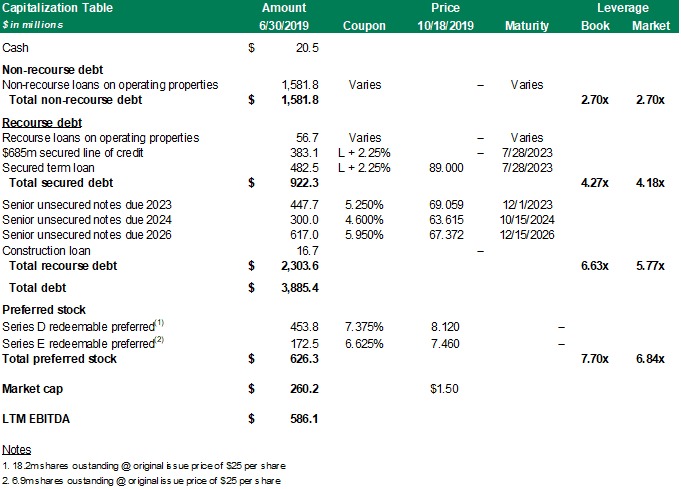

To refresh everyone’s recollection, here is what the company’s capital structure looked like at the time of its bankruptcy filing:

We previously noted when highlighting the aggressive milestones baked into Wells Fargo Bank’s consent to use its cash collateral:

Wells clearly wants this sucker off its books in 2019.

Rightfully so. The $50mm purchase price is subject to a $4mm holdback. In other words, the actual value transfer may be approximately $46mm. That puts the purchase price at riiiiiiiiiiiiight around Wells Fargo’s exposure. Its aggressive handling of the case appears to be warranted: this thing looks a hair away from administrative insolvency.

Apropos, the official committee for unsecured creditors — in a grasp for some sort of relevance here — filed a limited objection to the motion. The committee argued that the break-up fee (3.5%) and expense reimbursement (up to $750k) were unwarranted given the size of the bid and the lack of a going concern offer.

They were shot down. They did, however, wrestle some concessions. They apparently got the purchase price increased by $225k (in exchange for avoidance actions) and an additional $225k to be paid to 503(b)(9) admin claimants prior to Wells getting its money. A small victory but something for some creditors here.

And that ladies and gentlemen is what bankruptcy boils down to. Is there value? And if so, who gets it? Here, it’s hard to see any real winners. Not the company. Not Wells. Not CBL and the company’s other landlords. Not vendors. Or suppliers. Or employees. Or, really, even the professionals (for once). Time will tell whether Marquee can do something with this brand that makes it one of the rare winners. It’s not clear from the papers how much of the $50mm is attributable to them and, therefore, how much they’re putting at risk. Clearly nobody else was comfortable with the risk here. However you quantify it.

*At the time of filing, the numbers were 170 parties contacted and 34 executed CAs. So, there wasn’t much additional interest in the assets post-filing.

**Marquee Brands also owns BCBG which, itself, traversed the bankruptcy process not long ago.