Anyone interested in a game of hot potato?

Cafe Holdings Corp. is a privately-owned chain of fast casual dining restaurants called Fatz Cafe. Fatz Cafe has 38 locations across 5 states and, as you can surely note from the image above, has an abundance of potato options on its menu. And it, in this scenario, is the hot potato.

The company filed for bankruptcy in the District of South Carolina earlier this week — exhibiting yet another sign, as PETITION has discussed at length previously, that casual dining is a really tough space right now. The company, itself, acknowledges:

Over the past several years, casual dining chains have experienced strong headwinds due to a combination of shifting consumer tastes and preferences, growth in labor and commodity costs, increased competition, and unfavorable lease terms. Indeed, a number of national and regional restaurant chains – including Real Mex Restaurants, certain Applebee’s franchisees, Ignite Restaurant Group, Macaroni Grill, Garden Fresh, Bertucci’s, and Logan’s – have buckled under these secular pressures and were forced to restructure their balance sheets and operations through a chapter 11 bankruptcy.

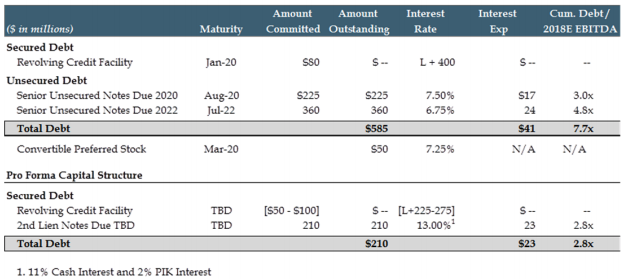

The company blames its unsustainable $30mm capital structure, “industry-wide challenges, trade market changes and challenges, underperforming strategic initiatives, and unsatisfactory business performance.” All of this is despite efforts to run the typical distressed restaurant playbook: install new management, refinance debt, restructure leases, shutter underperforming locations, deploy overhead rationalization, innovate around new product and promotional strategies, update the menu, invest in tech, renegotiate with vendors, etc. PETITION Note: nothing in the standard playbook can do anything about the fact that there are just far too many dining options available to consumers today. Period. The company’s consolidated adjusted network-wide EBITDA for the 12 months ended September 2018 and the fiscal year ended 2017 were approximately ($635,087) and $1.40 million, respectively.

And so the company turned to the next page in the playbook: a marketed sale. Yet, despite outreach to more than 200 parties, including both potential financial and strategic partners, the company didn’t generate any bids. Then comes the hot potato:

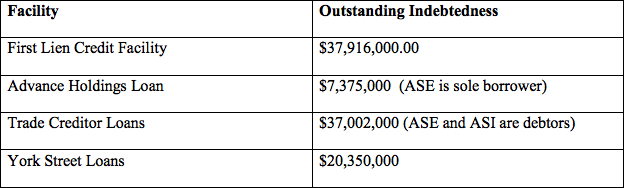

Unfortunately, after months of effort and outreach to more than 200 parties, including both potential financial and strategic purchasers, the Company was not able to obtain any bids for the Fatz assets. Moreover, the Company’s then first lien lender, Madison Capital Funding LLC (“Madison”), informed the Company that it did not wish to offer financing or serve as a stalking horse bidder in a chapter 11 sale process, and ultimately sold its debt position to Shrayne Capital, LLC (“Shrayne”). After further diligence, ultimately Shrayne decided it also did not wish to serve as a stalking horse bidder in a chapter 11 sale process and, in turn, sold its position to Atalaya Capital Management, LP and certain of its affiliates (collectively, “Atalaya”), who agreed to provide debtor in possession financing and to serve as a stalking horse bidder in a section 363 sale of substantially all of the Company’s assets.

You have to think that Atalaya Capital Management got that first lien paper at a meaningful discount to face value. Indeed, Shrayne only owned the paper for 5 weeks and then ran for the hills. Atalaya will provide the company with a $3.2mm DIP and, though the company has not filed its bidding procedures or stalking horse asset purchase agreement, presumably credit bid its debt to own the company out of Chapter 11. Now, for the uninitiated, the bankruptcy code permits a creditor to “credit bid” its debt, which is basically, as payment, exchanging a claim for the assets. A creditor can do that to the full extent of the claim, regardless of the the price said creditor paid for that claim. In other words, Atalaya may have paid Shrayne $0.01 for the first lien paper but because the face value of the first lien paper is $9.7mm, Atalaya can, but doesn’t have to, “bid” up to $9.7mm of that claim (like a coupon, in effect) for the company. Alternatively, it can provide the $3.2mm DIP credit facility and just credit bid that amount. There are a number of ways that this can be structured. Suffice it to say that Atalaya will need to infuse the business with capital if it wants it to have a fighting chance but it is under no obligation to cover and pay down the full extent of the debt. Indeed, the junior lenders and the ~63.5% equityholder, Milestone Partners III LP I and II, can effectively kiss their investments goodbye.

Opportunistic players who love feasting on the restaurant space will continue to have an abundance of opportunities like this one.

Jurisdiction: D. of South Carolina

Capital Structure: $9.7mm first lien (Atalaya Capital Management), $2mm second lien, $17.5mm mezzanine unsecured loan, $1.9mm unsecured subordinated note

Company Professionals:

Legal: Haynes and Boone LLP (Ian Peck, J. Fraser Murphy, David Staab) and (local) McNair Law Firm PA (Michael Weaver, Robin Stanton, Weyman Carter)

Financial Advisor: Loughlin Management Partners & Co.

Investment Banker: Duff & Phelps LLC (Vin Batra)

Claims Agent: Donlin Recano & Company Inc. (*click on company name above for free docket access)

Other Parties in Interest:

Updated 11/17/18