Magnetation Mines its Way Back into Bankruptcy Court (Long Due Diligence)

To read this, you must be a Member. You can do so here.

To read this, you must be a Member. You can do so here.

Is anything available in New York City for less than $5? Some of you are about to find out.

Yesterday, Bloomberg noted the following:

Retail rents are tumbling in Manhattan, especially in the toniest neighborhoods.

In the area around the Plaza Hotel on Fifth Avenue, home to the borough’s priciest retail real estate, rents fell 13.5 percent in the second quarter from the previous three months, the largest decline among the 16 neighborhoods tracked by brokerage CBRE Group Inc. The drop was due in part to a single space that had its price cut from $3,500 a square foot to $2,500, CBRE said in a report Tuesday.

Tenants have the upper hand in New York as landlords contend with a record number of empty storefronts. Across Manhattan, 143 retail slots have sat vacant for the past year, and rents have been reduced on more than half of those spaces, CBRE said. Property owners are increasingly willing to negotiate flexible terms in an effort to get tenants to commit to leases, according to the report.

Apparently a number of commercial real estate brokers didn’t get the memo. Brokers reportedly lashed out last week upon news that General Growth Properties ($GGP) leased out a large space to Five Below, a discount consumer products chain, at 530 Fifth Avenue. Per Commercial Observer:

Some brokers expressed disappointment with the tenant selection.

“It’s not a Fifth Avenue-type tenant. Everyone is pissed,” one broker said of the deal because of the nature of the tenant on a prized part of Fifth Avenue. He added: “There goes the neighborhood.” A more suitable location, the broker said, would have been south of 42nd Street.

“Not sure this was the tenant surrounding landlords with available space were hoping for,” said Jeffrey Roseman, a vice chairman at Newmark Knight Frank Retail, who was not involved in the deal.

Wait. What? Currently, there’s literally a JPMorgan Chase Bank, a Walgreens and a Kaffe 1668 right there there. Who among that lot can rightfully object?

What these brokers don’t appear to grasp is that the brick-and-mortar landscape has dramatically changed. There aren’t very many tenant options for landlords — at least not for 10,800 square foot spaces (which is what this is). And there’s no benefit to any of the other retailers in the vicinity of the space for it to remain vacant. Apropos, as noted in Commercial Observer, one broker appears to get it:

“Five Below is the updated variety store or five-and-dime store of our day—something for everyone,” said Faith Hope Consolo, the chairman of the retail leasing and sales division at Douglas Elliman. “As for the character or image of the street, that is not really affected or important. The key is that a big space was absorbed and this type of tenant will generate traffic.”

Our thoughts exactly. Those adhering to a New York City of yesteryear clearly haven’t noticed the influx of coffee shops, pharmacies and banks on every corner. Who else would take such a large space? Toys R Us?

What? Too soon?

We’ve previously covered this topic in “🍟Casual Dining is a Hot Mess🍟” and “More Pain in Casual Dining (Short Soggy Mozzarella Sticks).” Recall that, back in April, Bertucci’s Holdings Inc. filed for bankruptcy and said the following in its First Day Declaration:

"With the rise in popularity of quick-casual restaurants and oversaturation of the restaurant industry as a whole, Bertucci’s – and the casual family dining sector in general – has been affected by a prolonged negative operating trend in an ever increasing competitive price environment. Consumers have more options than ever for spending discretionary income, and their preferences continue to shift towards cheaper, faster alternatives. Since 2011, Bertucci’s has experienced a year-over-year decline in sales and revenue."

Unfortunately for those in the space, those themes persist.

On Monday, Luby’s Inc. ($LUB) — the owner and operator of 160 restaurants (86 Luby’s Cafeteria, 67 Fuddruckers and 7 Cheeseburger in Paradise) reported Q3 earnings and they were totally on trend. While the company reported positive same-store sales at Luby’s Cafeteria — its largest brand — the company’s financial results nevertheless cratered on account of increased costs (in food, labor and operating expense) without a corresponding acceleration in sales (via either increased prices or guest traffic). The company’s overall same store sales decreased 0.9%, its total sales decreased 3.1%.

The company noted:

“…the current competitive restaurant environment is making it difficult for our brand and the mature brands of many others to gain significant traction. We've been faced with the environment for quite some time, which has been a large drag on our financial results and our company valuation.

The challenge of rising costs, flattish-to-down sales, and a sustained debt balance are restricting the company's overall financial performance.”

Like many other chains, therefore, Luby’s is rationalizing its store count. The company previously committed to shedding at least 14 of its owned locations to the tune of an estimated $25mm in proceeds; it is accelerating its efforts in an attempt to generate an additional $20mm in proceeds. The use of proceeds is to pay down the company’s $44.2mm of debt. The company also announced that it hired Cowen ($COWN) to assist it with a potential restructuring of its Wells Fargo-agented ($WFC) credit facility. That hire was a requirement to a July 12-dated financial covenant default waiver (expiration August 10) provided by the company’s lenders.

This company does have one advantage over several distressed competitors: it owns a lot of its locations (in addition to its franchise business; a separate licensee operates an additional 36 Fuddruckers locations). The question therefore becomes whether the company’s lenders will provide the company with enough latitude (via continued waivers or otherwise) to sell enough locations to generate proceeds to pay down or “reduce [its] outstanding debt to near zero.” If patience wears thin or buyers balk at purchasing locations that later may become subject to a fraudulent conveyance attack, this may be yet another casual dining chain to find itself in bankruptcy. The stock, which has been range-bound for about a year, trades as follows:

*****

Likewise, Steak ‘n Shake is also beginning to look stressed — at least as far as its senior secured term loan goes. The casual dining restaurant company has somewhere between 580 and 616 locations, approximately 2/3 of which are company-owned. According to Reorg Research, it also has a group of lenders who are agitating given (i) under-budget revenues, (ii) liquidity concerns, and (iii) lower loan trading levels. Per Reorg:

The lenders’ move to organize comes as Steak ‘n Shake has shifted its focus from company-owned locations to franchise opportunities in the face of declining revenue, same-store sales and customer traffic as well as increased costs. A wholly owned subsidiary of Biglari Holdings, Steak ‘n Shake is a casual restaurant chain primarily located primarily in the Midwest and South United States; the chain is known for its steak burgers and milkshakes. Biglari says that unlike company-operated locations, franchises have “continued to progress profitably.” “Franchising is a business that not only produces cash instead of consuming it, but concomitantly reduces operating risk,” the 2017 chairman’s letter says.

Even so, 415 of the total 616 Steak ‘n Shake locations are company-operated and creditors are pushing the company to bring in operational advisors, sources say. The company’s $220 million term loan due in 2019, which according to the Biglari 10-Q had $185.3 million outstanding as of March 31, has dipped to the 86/88 context, according to a trading desk. The term loan, which matures March 19, 2021, is secured by first-priority security interests in substantially all the assets of Steak ‘n Shake, although is not guaranteed by Biglari Holdings.

The company has been struggling for years. Per Restaurant Business:

Same-store sales fell 0.4% in 2016 and another 1.8% in 2017. Traffic last year fell 4.4%.

The decline in traffic wiped out the chain’s profits. Operating earnings per location declined from $83,300 in 2016 to just $1,000 in 2017.

Part of the issue may be the company’s geography-agnostic “consistent pricing strategy” which keeps prices static across the board — regardless of whether a location is in a higher cost region. This strategy has franchisees in an uproar which, obviously, could curtail efforts to switch from an owner-owned model to a franchisee model. Indeed, a franchisee is suing. Per Restaurant Business:

For franchisees that operate 173 of the 585 U.S. locations and have to pay for royalties on top of other costs, the traffic declines risk sending many locations into financial losses. In addition, rising minimum wages in many markets, along with competition for labor, could put further pressure on that profitability.

Steaks of Virginia, the franchisee that filed the lawsuit last week, claimed it was losing money at all nine of its locations.

Curious. Apparently the company’s reliance on higher traffic to generate profits didn’t come to fruition. Insert lawsuit here. Insert lender agitation here. Insert questionable business model shift here.

In a February shareholder letter, Biglari Holdings Chairman Sardar Biglari channeled his inner-Adam Neumann (of WeWork), stating:

We do not just sell burgers and shakes; we also sell an experience.

And if by “experience” he means getting shot, being on the receiving end of an armed robbery or getting beat up by an employee…well, sure, points for originality? 👍😬

Given all of the above and the perfect storm that has clouded the casual dining space (i.e., too many restaurants, the rise of food delivery and meal kit services, the popularity of prepared foods at grocers), lender activity at this early stage seems prudent.

Late last night Toys R Us filed a motion seeking approval of a “global settlement” in its chapter 11 cases. A consensual deal to move the cases forward in a way that maximizes what remains of the estate — without the value leakage that would result from protracted litigation — is undoubtedly a good thing for all parties in interest.

Still, we’d be remiss if we didn’t note the following considering recent noise in the market:

Source: Settlement Motion, 7/17/18

Ah, the sacrifices.

Literally a week ago in “💥KKR Effectively Tells Bernie Sanders to Pound Sand💥” we wrote:

Remember all of those early year surveys about where the distressed activity was going to be? Yeah, so do we. Everyone was bullish about healthcare distress. And, sure, there have been pockets here and there but nothing that’s been truly mind-blowing in that sector. In other words, wishful thinking. Unless you’re DLA Piper (Orion Healthcare Corp., 4 West Holdings LLC), the (limited) healthcare activity has meant basically f*ck all for you.

The Gods have acted to make us look stupid. Look! Healthcare distress!

Neighbors Legacy Holdings Inc., an operator of 22 freestanding emergency centers throughout the state of Texas filed for bankruptcy on July 12, 2018. The company blames its filing on "financial difficulties caused in large part by increased competition, less favorable insurance payor conditions, declining revenues, and disproportionate overhead costs as compared to their operational income." In other words, its owners did too much too fast, taking on too much debt to expand too rapidly in a space that requires significant upfront capital investment in exchange for a 12-18 month lag in cash flow generation. Initiate death spiral.

The company's financial numbers look brutal. Per the First Day Declaration:

To continue reading, you must be a PETITION Member. Become one here.

With interest rates rising and fears of an imminent recession gaining increasing traction (see below), many remain concerned about the subprime auto lending market. The professionals at Davis & Gilbert LLP note:

Total auto loan debt increased to $1.23 trillion in Q1 2018, up from $1.17 trillion versus a year ago, and accounted for 9.3% of the $13.21 trillion in national household debt – remaining greater than credit card debt, but less than student loan and mortgage debt, according to Federal Reserve Bank of New York data.

While subprime originations have...

To continue reading, you must be a PETITION Member. Become one here.

Back in March, in “Nine West & the Brand-Based DTC Megatrend,” we noted the following:

The Walking Company. Payless Shoesource. Aerosoles. The bankruptcy court dockets have been replete with third-party sellers of footwear with bursting brick-and-mortar footprints, high leverage, scant consumer data, old stodgy reputations and, realistically speaking, limited brand value. Mere days away from a Nine West bankruptcy filing, we can’t help but to think about how quickly the retail landscape is changing and the impact of brands. Why? Presumably, Nine West will file, close the majority of - if not all of - its brick-and-mortar stores and transfer its brand IP to its creditors (or a new buyer). For whatever its brand is worth. We suppose the company’s lenders - likely to receive the company’s IP in a debt-for-equity swap, will soon find out. We suspect “not a hell of a whole lot”.

Shortly thereafter, Nine West did file for bankruptcy but we were a little off on the rest. That is, unless $340mm constitutes “not a hell of a whole lot.” That amount, landed on after a competitive bidding process, resulted in a greater-than-expected value to Nine West’s estate. Remember: the company filed for bankruptcy with a stalking horse bidder offering “approximately $200 million (inclusive of the above-stated $123 million allocation to IP, subject to adjustment).” This is where bankruptcy functions as a bit of alternative reality: $340 million is a good result for a company with $1.6 billion of debt, exclusive of any and all trade debt — particularly when the opening bid is meaningfully lower. For a more fulsome refresher on Nine West’s bankruptcy filing, go here.

Subsequent to Nine West’s filing, the tombstones for footwear retailers continued to pile up. For instance, in mid-May, The Rockport Company LLC filed for bankruptcy with a telling narrative. We highlighted:

The company notes, "[o]ver the last several years the Debtors have faced a highly promotional and competitive retail environment, underscored by a shift in customer preference for online shopping." And it notes further, "[t]he unfavorable performance of the Acquired Stores in the current retail environment has made it difficult for the Debtors to maintain sufficient liquidity and to operate their business outside of Chapter 11." PETITION NOTE: This is like a broken record, already.

We continued:

In light of this, armed with a $20 million new-money DIP credit facility (exclusive of rollup amounts) extended by its prepetition ABL lenders, the company has filed for bankruptcy to consummate a stalking horse-backed asset purchase agreement with CB Marathon Opco, LLC an affiliate of Charlesbank Equity Fund IX, Limited Partnership for the sale of the company's assets - OTHER THAN its North American assets — for, among other things, $150 million in cash. The buyer has a 25-day option to continue considering whether to purchase the North American assets but the company does "not expect there to be any significant interest in the North American Retail Assets." Read: the stores. The company, therefore, also filed a "store closing motion" so that it can expeditiously move to shutter its brick-and-mortar footprint at the expiration of the option. Ah, retail.

And, ah, footwear. Check out this lineup:

And so we asked:

Given all of that, would you want Rockport’s brick-and-mortar business?

Answer: no. Apparently nobody did. And, in fact, nobody — other than the stalking horse, CB Marathon Opco, LLC — wanted any part of Rockport’s business.

On July 6, the company filed a notice that it cancelled its proposed auction. There were no qualified bidders, it noted, thereby making CB Marathon Opco, LLC the winning bidder by default. And given that the stalking horse agreement excluded the U.S. brick-and-mortar assets, those assets are now officially kaput. A hearing at which the bankruptcy court will bless the sale is scheduled for July 16. Aside from some additional administrative matters in the case, that hearing will mark a wretched ending for a company founded in the early 1970s.

*****

Juxtapose that doom and gloom with this Techcrunch piece about the rise of venture capital in footwear:

Over the past year-and-a-half, investors have tied up roughly $170 million in an assortment of shoe-related startups, according to an analysis of Crunchbase data. The vast majority is going to sellers and designers of footwear that people might actually want to walk in.

Top funding recipients are a varied bunch, including everything from used sneaker marketplaces to high-end designers to toddler play shoes. Startups are also experimenting with little-used materials, turning used plastic bottles, merino wool and other substances into chic wearables.

The piece continues:

It should be noted that recent footwear funding activity comes on the heels of some positive developments for the shoe industry.

Positive developments huh? “Some” must be the operative word given the preface above. There’s more:

First, this is a huge and growing industry. One recent report pegged the global footwear market at $246 billion in 2017, with annual growth rates of around 4.5 percent.

Second, public markets are strong. Shares of the world’s most valuable footwear company — Nike — have climbed more than 50 percent over the past nine months to reach a market cap of nearly $130 billion. Stocks of several smaller rivals, including Adidas, have also performed well.

Third, men are spending more on footwear. Though they’ve long been stereotyped as the gender with more restrained shoe-buying habits, men are putting more money into footwear and could be on track to close the spending gap.

And:

…one other bullish sneaker trend footwear analysts point to is the changing buying habits of women. Driven perhaps by a desire to walk more than a few blocks without being in pain, we’re buying fewer high heels and more sneakers.

The piece goes on to list a lineup of well-funded footwear companies. In marketplaces, GOAT and StockX. In streetwear, Stadium Goods. For children, Super Heroic. For comfort, Allbirds, Rothy’s, and Birdies. And the article neglected to mention Koio, Greats, and M. Gemi, to name a few. If you feel as if these names are unfamiliar because you didn’t see them at a brick-and-mortar footwear retailer in your last trip to the mall, well…yeah. That ought to explain a lot.

Interestingly, before unironically asking (and not entirely answering) whether any of these companies actually make money, the article also highlights Tamara Mellon,“a two-year-old brand that has raised more than $40 million to scale up a shoe design portfolio that runs the gamut from flats to spike heels.” Indeed, the company recently raised a $24mm Series B round* to grow its Italian-made pureplay e-commerce direct-to-consumer brand. In reality, though, Tamara Mellon is only technically two years old. It was around before 2016. In a different iteration. That iteration filed for bankruptcy.

In early 2016, Tamara Mellon Brand LLC filed for bankruptcy because of a liquidity crisis. And it couldn’t sufficiently raise capital outside of a chapter 11 filing to ensure its survival. After filing for bankruptcy, the company took on a $2mm debtor-in-possession credit facility from Ms. Mellon and, after combatting an equityholder-led “recharacterization”** challenge (paywall), swapped its term loan debt into equity. Winning prepetition equityholders like Ms. Mellon and venture capital firm New Enterprise Associates (NEA) came out with 16 and 31.1 percent of the equity, respectively. In turn, NEA capitalized the company to the tune of approximately $12mm.

Which highlights the obvious: not all of these companies will ultimately have renowned founders who merit second chances. A number of these high-flying e-commerce upstarts will fail; some of them will file for bankruptcy. The question is: as the funding rounds pour in from venture capitalists looking for the next big exit, how many other brands and shoe retailers will they push into bankruptcy first?

*****

*In October 2017, we wrote the following in “Sophia Amoruso's Nasty Gal Failure = Trite Lessons (Short Puffery)”:

We love how entrepreneurs are all about "move fast and break things" and "don't be afraid to fail" but then when they do, and do so badly, there is barely anything that really provides an in-depth post-mortem…Take, for instance, this piece of puffy garbage about Sophia Amoruso, which purports to inform readers about what Ms. Amoruso learned from Nasty Gal's rapid decline into bankruptcy. Instead it provides some evergreen inspirational advice that applies to virtually...well...everything and anything. TOTALLY USELESS.

Apropos, the above-cited Fast Company piece is lip service Exhibit B. The piece notes:

Tamara Mellon cofounded Jimmy Choo with, well, Jimmy himself back in 1996. But in 2016, she decided to launch her own eponymous luxury shoe brand. It wasn’t easy, though: When she tried to go to high-end factories in Italy, she discovered that many refused to work with her, citing non-compete clauses with the Jimmy Choo brand.

But through persistence, she prevailed, and found factories that made shoes for other luxury brands.

We gather that what happened earlier in 2016 wasn’t relevant to the PR piece. Curious: is “persistence” a new euphemism for “bankruptcy”?

**If we understand what happened here correctly, other existing equityholders tried to recharacterize Ms. Mellon’s term loan holding as equity, effectively squashing her priority secured claim and demoting that claim to equal to or less than the equityholders’ claims. If successful, Ms. Mellon would not have been able to swap her debt for equity. Moreover, the other equityholders would have had a greater chance of a recovery on their claims. They failed, presumably recovering bupkis.

Welcome to Part 9 of our ongoing series “What to Make of the Credit Cycle.” You can view previous parts here, here, here, here, here, here, here, and here (some paywall, some not…roll the dice).

Around a year ago, a partner at a major law firm shared his view with us that a clear-cut sign of a market top is when biglaw associate salaries go up. Subsequently, per CBS, this happened:

Some lines of work pay more than others. While Americans have largely seen lackluster wage growth during the past year, the roughly 500 associates laboring at Milbank, Tweed, Hadley & McCloy just drew a large bump in pay, putting the law firm at the top of the legal heap in terms of salaries paid to attorneys just starting out.

A spokesperson for the 690-lawyer firm confirmed that it is hiking associate salaries by $10,000 to $15,000, bringing a first-year associate's salary to $190,000. A second-year associate at the firm will now make $200,000, while an eight-year associate will pull in $330,000.

The prior high mark had been set two years ago by Cravath, Swaine & Moore, which upped starting pay by $20,000 to $180,000, an industry standard that was quickly matched by Milbank and multiple other firms.

Not to be over-powered in the ever-feverish stampede for the next generation of, cough, ”legal talent,” multiple firms (got bent and) fell in line, upping associate pay to match (or exceed) Milbank’s salary raise. Count on Abovethelaw for some added color:

Summer 2018 has really been the summer of money for Biglaw associates. Milbank got the party started by finally bringing NY (and its other offices) to $190K. Simpson Thacher upped the ante just two days later by matching the new salary scale and adding in special summer bonuses. And just a few days after that, Cravath reasserted its dominance as the firm that sets the market standard by increasing the standard base salary for senior associates over what was set by Milbank.

And yet, elsewhere in the broader macroeconomy, economists everywhere are wondering why there are underwhelming wage increases (maybe because corporate legal bills just went up?!? 🤔). Per Forbes:

Wages rose 2.7% from a year earlier in June, below the 2.8% increase economists had expected and the increase may make little difference because inflation is also picking up and could soon outpace wages, meaning many workers have no real increase in buying power.

There are currently 6.7 million job openings — a record high. And the rate at which workers are quitting their jobs is higher than it was before the onset of the Great Recession. But wage growth is still noticeably slower than many economists and analysts expect (despite all the stories about employers desperate for workers).

Meanwhile, after a 5% salary increase prior to even working for a single (billable) hour, entering Milbank associates be like:

Source: Giphy

(PETITION Note: hopefully those associates don’t ever run the hourly calculation).

Law students looking forward to these new riches need to work hard this summer to ensure that they get an offer at the end of their respective summer associate programs. Indeed, they need to not screw up this:*

Nothing gives a realistic snapshot of life as a biglaw attorney like axe throwing, escape the room(s), the Olympics, cooking classes, and spectacular rooftop views. We’re serious.

Really. We are.

Having the aggressiveness, discipline and vigilance of an Olympic athlete is needed to navigate the halls of a biglaw firm (PETITION Note: sadly, they don’t teach you inter-office politics in law school). Knowing how to throw an axe may actually help lawyers wade through the morass. In fact, if we were associates, we would go on a shopping spree at Best Made and hang some dope-looking axes on the wall to leverage the intimidation factor.

Escape the room? Junior associates will want to do that every Friday evening to avoid the inevitable partner phone call asking for an “urgent!!”memo on some esoteric legal question that more-likely-than-not will NEVER come up. By Monday morning, of course. (Hot PETITION tip: the likelihood of said partner reading that memo on Monday morning — let alone by the end of the following week — is roughly about 1.27%).

Cooking classes? Sh*t. The closest you’ll get to cooking once you’re making that sweet $190k is receiving someone else’s via Seamless, UberEats or Caviar. In the office. Of course.

Rooftop views? Awesome. There’s nothing more lit than having a bird’s eye view to thousands of New Yorkers living their lives eating drinking and being merry while you’re stuck in the office. Those views are a double-edged sword, broheim. Make no mistake about that.

So, again, kudos to Milbank for giving its summer associates a realistic view of practice.

*Milbank “promoted” this tweet, by the way, which means that it wanted the world to know that we’ve once again reached peak-summer-associate. We’re old enough to remember when the earth exploded and summer associate offers were reneged or deferred starting dates. This will end just as well.

What is the statute of limitations for declaring an IPO busted?

We previously wrote about Tintri Inc. ($TNTR) here and, frankly, there isn’t much to add other than the fact that company has, indeed, filed for bankruptcy. The filing is predicated upon a proposed 363 sale of the company’s assets as a “going concern” or a liquidation of the company’s intellectual property in what should be a fairly short stint in bankruptcy court. Shareholders likely to be wiped out include New Enterprise Associates (yes, the same firm mentioned above in the Tamara Mellon bit), Insight Venture Partners, Lightspeed Venture Partners and Silver Lake Kraftwerk.

Meanwhile, in the above-cited piece we also wrote:

Nothing like a $7 launch, a slight post-IPO uptick, and then a crash and burn. This should be a warning sign for anyone taking a look at Domo — another company that looks like it is exploring an IPO for liquidity to stay afloat.

This bit about Tintri''s financial position offers up an explanation for the bankruptcy filing -- in turn serving as a cautionary tale for investors in IPOs of companies that have massive burn rates:

"The company's revenue increased from $86 million in fiscal 2016 to $125.1 million in fiscal 2017, and to $125.9 million in fiscal 2018, representing year-over-year growth of 45% and 1 %, respectively. The company's net loss was $101.0 million, $105.8 million, and $157.7 million in fiscal 2016, 2017, and 2018, respectively. Total assets decreased from $158.1 million as of the end of fiscal 2016 to $104.9 million as of the end of fiscal 2017, and to $76.2 million as of the end of fiscal 2018, representing year-over-year change of 34% and 27%, respectively. The company attributed flat revenue growth in fiscal 2018 in part due to delayed and reduced purchases of products as a result of customer concerns about Tintri's financial condition, as well as a shift in its product mix toward lower-priced products, offset somewhat by increased support and maintenance revenue from its growing installed customer base. Ultimately, the company's sales levels have not experienced a level of growth sufficient to address its cash burn rate and sustain its business."

With trends like those, it's no surprise that the IPO generated less capital than the company expected. More from the company:

"Tintri's orders for new products declined, it lost a few key customers and, consequently, its declining revenues led to the company's difficulties in meeting day-to-day expenses, as well as long-term debt obligations. A few months after its IPO, in December 2017, Tintri announced that it was in the process of considering strategic options and had retained investment bank advisors to assist it in this process."

As we previously noted a few weeks ago, "[t]here's no way any strategic buyer agrees to buy this thing without a 363 comfort order." With Triplepoint Capital LLC agreeing to provide a $5.4mm DIP credit facility, this is precisely the path the company seeks to take.

*****

Meanwhile, Domo Inc. ($DOMO) is a Utah-based computer software company that recently IPO’d. Per Spark Capital’s Alex Clayton:

Domo recently drew down $100M from their credit facility and currently only has ~6 months of cash left with their current burn rate. Given they raised $730M in equity capital from investors and another $100M through their credit facility, it implies they have spent roughly $750M over the past 8 years to reach a little over $100M in ARR, an extraordinary and unprecedented amount of cash burn for a SaaS company. They have $72M in cash.

That was before the IPO. This is after the IPO:

Draw your own conclusions.

Remember all of those early year surveys about where the distressed activity was going to be? Yeah, so do we. Everyone was bullish about healthcare distress. And, sure, there have been pockets here and there but nothing that’s been truly mind-blowing in that sector. In other words, wishful thinking. Unless you’re DLA Piper LLP, the (limited) healthcare activity has meant basically f*ck all for you.

Fitch Ratings recently released a report indicating that it expects healthcare-related defaults to remain low. Choice bit:

"We don't see any catalyst for there to be a great increase in defaults in the sector," said Megan Neuburger, Fitch's team head for healthcare and an author of the report. "It tends to be a fairly stable sector from a cyclical perspective, so the drivers of bankruptcies tend to be more idiosyncratic."

In other words, the chief drivers of healthcare bankruptcies aren't the same as in other sectors, which are more influenced by economic downturns or factors related to the commodity cycle, she said. Neuburger said her team doesn't see any catalyst on the horizon that would prompt an uptick in healthcare defaults this year or in 2019.

We’ll see if the early 2019 surveys reflect this view.

Toys R Us (Short Severance Payments). Ok, this is getting out of hand. Shortly after Dan Primack wrote that KKR ought to pay for 30,000 employees’ severance OUT OF THE GOODNESS OF KKR’S HEART, Pitchbook jumped in parroting the same nonsense.

Look. Don’t get us wrong. Long time readers know that we’ve been hyper-critical of the PE bros since our inception. But this is just ludicrous already. In “💩Will KKR Pay Toys' Severance?💩” and again in “🔥Amazon is a Beast🔥” we noted that “[t]here’s ZERO CHANCE IN HELL KKR funds severance payments.” We stand by that. Without any legal compunction to do so, these guys aren’t going to just open up their coffers to dole out alms to the affected. That’s not maximizing shareholder value. Those affected aren’t exactly future LPs.

But wait. This keeps getting better.

On Friday, The Wall Street Journal reported that on July 5:

Nineteen members of Congress sent a letter to the private-equity backers of Toys “R” Us Inc. questioning their role in the toy retailer’s bankruptcy and criticizing the leveraged-buyout model as an engine of business failure and job loss.

The letter’s content? Per the WSJ:

It asks whether the investment firms deliberately pushed Toys “R” Us into bankruptcy and encourages them to compensate the roughly 33,000 workers who lost their jobs.

Take a look at this letter. It demonstrates an utter lack of understanding of how private equity works.

Meanwhile, Congress cannot get the President of the United States to turn over his tax returns with the entire country waiting for that to happen and yet we’re supposed to believe that a letter will compel KKR to make severance payments. Utterly laughable. KKR owns those fools and they know it. Okay: maybe not Bernie Sanders.

Imagine the response:

“Um, yes, Representative Poindexter. We did. We deliberately flushed hundreds of millions of dollars of equity checks down the toilet. We hear that makes a compelling marketing message to potential LPs of our next big fund.”

Thankfully, you don’t have to imagine the response because KKR already responded. Per the WSJ:

KKR issued a response dated July 6 stating that Toys “R” Us’s troubles were caused by market forces—specifically the growth of e-commerce retailers—and that the decision to liquidate was made by the company’s creditors, not KKR, and was against the firm’s wishes.

Furthermore:

KKR stated in its response that it reinvested $3.5 billion in Toys “R” Us over the course of its ownership and didn’t take any investment profits. It added that it wrote down its entire equity investment of $418 million and challenged reports that it had earned a profit on the investment.

“Even accounting for fees received from Toys ‘R’ Us, we have lost many millions of dollars. To find anyone who profited, one would need to look at the institutions that pushed for Toys to liquidate its U.S. business,” the firm wrote.

In other words: “Pound sand, Sanders.”

In “👎Nobody Wants a David's Bridal Dress👎,” we may have been a bit too flip in saying nobody. We wrote:

To continue reading, you must be a PETITION Member. To become one, please visit here.

This Morgan Housel piece talks about the psychology of bubbles. Good investors understand fundamentals but also have a sense for which direction the wind is blowing. This bit resonated:

Lehman Brothers was in great shape on September 10th, 2008. That’s what the statistics said, anyway.

Its Tier 1 capital ratio – a measure a bank’s ability to endure loss – was 11.7%. That was higher than the previous quarter. Higher than Goldman Sachs. Higher than Bank of America. Higher than Wells Fargo. It was more capital than Lehman had in 2007, when the banking industry and economy were about the strongest they had ever been.

Four days later, Lehman was bankrupt.

The most important metric to Lehman during this time was confidence and trust among short-term bond lenders who fed its balance sheet with capital. That was also one of the hardest things to quantify.

This week was a big financing week for startups. In addition to the Pillpack purchase noted above, there was a ton of action in the direct-to-consumer consumer products space that should definitely have incumbents concerned.

Away, the NY-based “thoughtful” startup that makes travel products that “solve real travel problems” raised $50mm in fresh Series C funding from prior investors Forerunner Ventures, Global Founders Capital and Comcast Ventures. The company intends to use the funds to tap into global markets, expand its product line and continue its clicks-to-bricks initiative with six new retail stores in the second half of 2018. The company recently moved its headquarters within New York City in part thanks to a $4mm Empire State Development performance-based tax credit through the Excelsior Jobs Program.

Hims, the one-year old SF-based company that sells men’s prescription hair and sex products, raised $50mm in Series B-2 funding at a $400mm post-money valuation. Investors include IVP, Founders Fund, Cavu Venture Partners, Thrive Capital, Redpoint Ventures, Forerunner Ventures (notice a pattern here?), and SV Angel.

Earlier this year, beauty products maker Glossier raised $52mm in Series C funding (and subsequently added Katrina Lake from Stitch Fix to its board of directors), shaving company Harry’s raised $112mm in Series D funding, and athleisure brand Outdoor Voices raised $32mm.

But, wait. There’s more: here, there are a variety of startups going after your kitchenware and your bed. Parachute announced this week that it raised $30 million in Series C funding led by H.I.G. Growth Partners. Other investors include Upfront Ventures, Susa Ventures, Suffolk Equity, JAWS Ventures, Grace Beauty Capital and Daher Capital. With three stores currently, the company intends to take the funding to, like Away, expand its clicks-to-bricks plan with 20 more locations in the next 2 years.

Meanwhile, mattress e-tailer Purple is (strangely) doubling-down on its relationship with Steinhoff-owned Mattress Firm, the struggling bed B&M retailer. The tie-up now includes Mattress Firm locations in Sacramento, Austin, DC, Chicago and SF. We hope Purple has baked in bankruptcy protections into its deal agreements so that there’s not question as to ownership.

If you don’t think all of this has incumbent CPG executives worried, you’re not paying close enough attention.

Not to mention the private equity bros:

More from Ryan Caldbeck’s interesting thread here.

Slight tangent: note that nowhere is there any mention of disruption from consumer product subscription boxes.

We were tempted to just leave it alone at “yes,” but we’ll at least add what Moody’s had to say:

"Despite the lower debt burden following the company's emergence from bankruptcy in 2016, we believe Fairway's capital structure is unsustainable given weaker than anticipated operating performance and upcoming debt maturities," stated Moody's Vice President and lead analyst for the company, Mickey Chadha. "Fairway is facing an extremely promotional business environment, and with competitive openings in its markets expected to continue, the ability to improve profitability at a level sufficient to support the current capital structure looks highly suspect, rendering a further debt restructuring highly likely in our estimation over the next 12-18 months," added Chadha.

Furthermore:

The ratings reflect elevated risk of another requisite debt restructuring or distressed exchange given Fairway's deemed untenable capital structure, evidenced in part by very weak credit metrics, weak and eroding liquidity, and upcoming debt maturities including a $25 million LC facility that matures October 2018 and more than $100 million (including PIK interest) of senior secured term loans that mature in January 2020. Moody's estimates lease adjusted debt-to-EBITDA in excess of 10 times, and EBIT-to-interest of less than 1.0 time over the next twelve months.

Remember: this company already shed $140mm of secured debt and $8mm in annual interest expense in the last bankruptcy a mere two years ago. In the company’s Disclosure Statement, company counsel Weil Gotshal & Manges LLP wrote:

Upon emergence from bankruptcy, all borrowings under the DIP Term Loan will be converted into an exit facility on a first out basis leaving an estimated $42 million of cash and cash equivalents on Fairway’s balance sheet that will allow it to maintain its operations and satisfy its obligations in the ordinary course of business and position Fairway for long term success.

Not to get ahead of ourselves here as Moody’s can surely be wrong. But, are we crazy or has the definition of “long term success” dramatically changed?

Which begs an interesting series of questions. First, at what point do professionals who have multiple chapter 22s attached to their names start to feel the affect of that in the marketplace? At what point do they get credibility checked on plan feasibility by judges at the confirmation hearing? “Mr. Lawyer ABC and Mr. Restructuring Advisor XYZ. Could you please explain why I should believe a thing you say about feasibility given that your last [insert applicable number here] grocery restructurings have all ended up back in bankruptcy court within short order? Have you properly guided your client to a truly ‘feasible long term success’ trajectory? Or are you really just succumbing to the wishes of stakeholders at the other side of the table (cough, GSO) whose business you hope to obtain in the future?

To be fair, we suppose if you service a monopoly of cases is a given sector and that sector is going to hell in a hand basket the way the grocery space is the likelihood of repeat bankruptcies goes up. Still, you’d think management teams (and/or the sponsors) would start to question the value of “quals” when those quals all ultimately result in an expensive round-trip ticket back to bankruptcy court.

On Wednesday we bashed Dan Primack’s notion that KKR would fund Toys R Us’ severance payments. Apparently we weren’t the only ones. Primack subsequently wrote:

• Equity share: In writing about Toys "R" Us on Tuesday, I mentioned that private equity firms have an obligation to portfolio company employees. Some readers pushed back via email, but it's worth noting that Toys backer KKR has been providing equity to some of its portfolio companies (including Gardner Denver, CHI Overhead Doors and Capsugel).

Obviously it's not apples-to-apples with Toys, but such equity-share does reflect a more modern private equity mentality toward portfolio company employees. Bloomberg wrote about the Gardner Denver example last year.

There’s ZERO CHANCE IN HELL KKR funds severance payments. Just stop Dan. If we’re wrong, we’ll gladly eat this.

In “🚗Where's the Auto Distress?🚗,” we poked fun at ourselves and our earlier piece entitled “Is Another Wave of Auto-Related Bankruptcy Around the Corner?” because the answer to the latter has, for the most part, been “no.” But both pieces are worth revisiting. In the latter we wrote,

Production levels, generally, are projected to decline through 2021. Obviously, reduced production levels and idled plants portend poorly for a lot of players in the auto supply chain.

And in the former we noted,

So, sure. Distressed activity thus far in 2018 has been light in the automotive space. But dark clouds are forming. Act accordingly.

And by dark clouds, we didn’t exactly mean this but:

With a seeming snap-of-the-finger, Harley Davidson ($HOG) announced that it would move some production out of the US to Europe, where HOG generates 16% of its sales, to avoid EU tariffs on imported product. Per the Economist:

It puts the cost of absorbing the EU’s tariffs up to the end of this year at $30m-45m. It has facilities in countries unaffected by European tariffs that can ramp up relatively quickly.

Trump was predictably nonplussed, saying “don’t get cute with us” and this:

AND this:

AMERICAN companies “will react and they will put pressure on the American administration to say, ‘Hey, hold on a minute. This is not good for the American economy.’” So said Cecilia Malmström, the European Union’s trade commissioner, on news that Harley-Davidson plans to move some production out of America to avoid tariffs imposed by the EU on motorcycles imported from America.

Will react? Harley Davidson has reacted. Likewise, motorcycle-maker Polaris Industries Inc. ($PII) indicated Friday that it, too, is considering moving production of some motorcycles to Poland from Iowa on account of the tariffs. Per the USAToday:

In its first quarter earnings released in April, Polaris projected around $15 million in additional costs in 2018. Rogers said the latest tariffs would raise costs further, declining to estimate by how much. "But we're definitely seeing an increase in costs," she said.

General Motors Co. ($GM) also weighed in. Per Reuters:

The largest U.S. automaker said in comments filed on Friday with the U.S. Commerce Department that overly broad tariffs could "lead to a smaller GM, a reduced presence at home and abroad for this iconic American company, and risk less — not more — U.S. jobs."

Zerohedge noted:

The Auto Alliance industry group seized on the figure, arguing that auto tariffs could increase the average car price by nearly $6,000, costing the American people an additional $45 billion in aggregate.

Moody’s weighed in as well:

US auto tariff would be broadly credit negative for global auto industry. Potential US tariffs on imported cars, parts are broadly credit negative for the auto industry. The Commerce Department is conducting a review of whether auto imports harm national security. A similar probe resulted in 25% tariffs on imported steel and 10% on aluminum being implemented 1 June. A 25% tariff on imported vehicles and parts would be negative for most every auto sector group – carmakers, parts suppliers, dealers, retailers and transportation companies.

Relating specifically to Ford Motor Company ($F) and GM, it continued further:

US automakers would be negatively affected. Tariffs would be a negative for both Ford and GM. The burden would be greater for GM because it depends more on imports from Mexico and Canada to support US operations – 30% of its US unit sales versus 20% of US sales for Ford. In addition, a significant portion of GM's high-margin trucks and SUVs are sourced from Mexico and Canada. In contrast, Ford's imports to the US are almost exclusively cars — a franchise it is winding down. Both manufacturers would need to absorb the cost of scaling back Mexican and Canadian production and moving some back to the US. They would also probably need to subsidize sales to offset the tariffs for a time, with higher costs eventually passed on to consumers.

On the supply side, Moody’s continued:

Tariffs would also hurt major auto-parts manufacturers. The largest parts suppliers match automakers' production and vehicles and may struggle to adapt following any tariffs. Suppliers' efforts to keep cost down often result in multiple cross-border trips for goods and could incur multiple tariff charges. Avoiding those costs may disrupt the supply chain. Some parts makers have US capacity they could restart at a price. Companies with broad product portfolios, large market share, or that are sole suppliers of key parts will fare better.

And what about dealers and parts retailers? More from Moody’s:

Significant negative for US auto dealers, little change for parts retailers. Dealers heavily weighted toward imports (most of those we rate) will suffer. Penske Auto and Lithia would fare best. Many brands viewed as imports, such as BMW and Toyota, are assembled in the US, so there could be model shifting. Tariffs would be fairly benign for part retailers insulated by demand from the 260 million vehicles now on the road.

Upshot: perhaps its too early to give up on our predictions. Thanks to President Trump’s trade policy, there may, indeed, be auto distress right around the corner as big players adjust their supply chain and manufacturing models. Revenue streams are about to be disrupted.

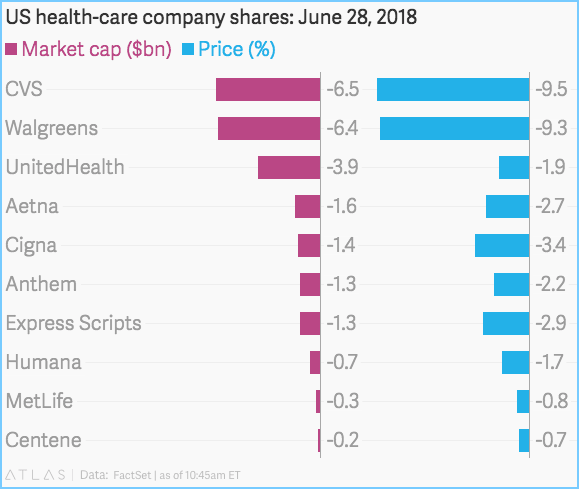

Scott Galloway likes to say that mere announcements from Amazon Inc. ($AMZN) can result in billions of dollars of wiped-out market capitalization. Upon this week’s announcement that Amazon has purchased Boston-based online pharmacy startup Pillpack for $1 billion — beating out Walmart ($WMT) in the process — his statement proved correct. Check this out:

We like to make fun of the Amazon narrative because we’re of the view that it’s overplayed — particularly in restructuring circles — and reflects a failure to understand broader macro trends (like the direct-to-consumer invasion noted below). Still, the market reaction to this purchase reflects the undeniable power of the “Amazon Effect” and we’d be remiss not to acknowledge as much. This purchase will likely be a turning point for pharmacies for sure; perhaps also, farther down the line, for benefits managers and pharmaceutical manufacturers. It also may provide Amazon with meaningful cross-pollination opportunities with its payments business — a subject that nobody seems to be talking about (more on this below).

Putting aside the losers for now, there are a variety of winners. First, obviously, are Pillpack’s founders, TJ Parker and Elliot Cohen. They stand to make a ton of money. Also its investors — Accel Partners, Atlas Venture, CRV, Founder Collective, Menlo Ventures, Sherpa Ventures and Techstars — at an 8x return, at least. Oh, and Nas apparently. And then there is Amazon itself. Pillpack isn’t a massive revenue generator ($100mm in ‘17) and it isn’t a big company (1k employees) but it packs a big punch: licenses to ship drugs in 50 sates. With this purchase, Amazon just hurdled over a significant regulatory quagmire.

So what is Pillpack? Per Wired (by way of Ben Thompson):

PillPack is trying to solve the problem of drug adherence by simplifying your medicine cabinet. Medication arrives in the mail presorted into clear plastic packets, each marked in a large font with vital information: day, time, pills inside, dosages. These are ordered chronologically in a roll that slots into the dispenser. Let’s say you need to take four different pills in the morning and two others in the afternoon every day: Those pills would be sorted into two tear-off packets: one marked 8am, followed immediately by the 2pm packet.

Put another way, Pillpack specializes in the convenience of getting you your medications directly with a design and user-experience focus to boot. The latter helps ensure that you’re taking the proper levels of medication at the right time.

Still, there are some limitations. Per The Wall Street Journal:

Amazon will be limited in what it can do, especially to start. PillPack’s specialty—packaging a month’s supply of pills for chronic-disease patients—is a small part of the overall market. It has said it has tens of thousands of customers versus Amazon’s hundreds of millions.

Current limitations notwithstanding, Thompson notes how much Pillpack’s service aligns with Amazon:

Amazon, particularly for Prime customers, is seeking to be the retailer of habit. That is, just as a chronic condition patient may need to order drugs every month, Amazon wants to be the source of monthly purchases of household supplies, and anything else one might want to buy along the way.

Like all aggregators, Amazon wins by providing a superior user experience, particularly when it comes to delivering the efficient frontier of price and selection. To that end, moving into pharmaceuticals via a company predicated on delivering a superior user experience makes total sense.

Thompson notes further:

The benefit Amazon will provide to PillPack, on the other hand, is primarily about dramatically decreasing the customer acquisition costs for a solution that is far better for consumers; to put it another way, Amazon will make a whole lot more people aware of a much more customer-friendly solution. Frankly, I have a hard time seeing why that is problematic.

To be sure, Amazon will benefit beyond its unique ability to supercharge PillPack’s customer acquisition numbers: just as Walgreen and CVS’s pharmacies draw customers to their traditional retail stores, PillPack’s focus on regular ordering fits in well with Amazon’s desire to be at the center of its customers day-to-day lives. This works in two directions: first, that Amazon now has a direct connection to a an ongoing transaction, and second, that would-be Amazon customers are dissuaded from visiting a retail pharmacy and, inevitably, buying something else along the way. This was a point I made in Amazon’s New Customer:

This, though, is why groceries is a strategic hole: not only is it the largest retail category, it is the most persistent opportunity for other retailers to gain access to Prime members and remind them there are alternatives.

A similar argument could be made for prescription drugs: their acquisition is one of the most consistent and predictable ways by which potential customers exist outside of the Amazon ecosystem. It makes a lot of sense for Amazon to reduce the inclination to ever go elsewhere.

It seems that Amazon is doing that lately for virtually everything. Consistently, further expansion beyond just chronic-disease patients seems inevitable. Margin exists elsewhere in the medical chain too and, well, Jeff Bezos once famously said “Your margin is my opportunity.” David Frankel of Founder Collective writes:

The story of the last five years has been that of bricks and mortar retailers frantically trying to play catch-up with Amazon. By acquiring PillPack, Amazon is now firmly attacking another quarter trillion dollars of TAM. Bezos is a tenacious competitor and has just added the most compelling consumer pharmacy to enter the game since CVS was founded in 1963.

TJ Parker understands the pharma business in his bones, has impeccable product sensibilities, and now has the backing of the most successful retail entrepreneur in history.

Expect some real healthcare reform ahead.

No wonder those stocks all sh*t the bed. That all sounds downright horrifying for those on the receiving end.

*****

Recall weeks back when we noted this slide in Mary Meeker’s “Internet Trends” presentation:

Healthcare spending continues to rise which, no doubt, includes the cost of medication — a hot button issue of price that even Donald Trump and Hillary Clinton have agreed on. This purchase dovetails nicely with Amazon’s overall health ambitions. Per the New York Times:

But Mr. Buck and others said Amazon might have a new opportunity. A growing number of Americans are without health insurance or have such high deductibles that they may be better off bargain shopping on their own. He estimated that 25 million Americans fell into that category.

Until now, he said, PillPack has not aggressively competed on price. With Amazon in charge, “how about they start posting prices that are really, really aggressive?” Mr. Buck said.

As Pillpack increases its scale, Amazon will be able to exert more leverage in the space. This could have the affect of compressing (certain) pharmaceutical prices. To get there, Amazon will undoubtedly seize the opportunity to subsume Pillpack/pharma into Amazon Prime, providing Members discounts on medicine much like it provides Whole Foods shoppers discounts on bananas.

There is other opportunity to expand the user base as well. People are looking to save money on healthcare as much as possible. With cash back rewards, Amazon can offer additional discounts if consumers were to carry and use the Amazon Prime Rewards Visa Signature Card — which already offers 5% back on Amazon.com and WholeFoods purchases (plus money back elsewhere too). Pillpack too? We could envision a scenario where people scrap their current plastic to ensure that they’re getting discounts off of one of the most rapidly rising expenditures out there. Said another way, as more and more consumer staples like food and medicine are offered by Amazon, Amazon will be able to entice Pillpack customers with further card-related discounts. And grow a significant amount of revenue by way of its card offering. No doubt this is part of the plan. And don’t forget the data that they would compile to boot.

Per Forbes shortly after Amazon launched its Amazon Prime Rewards Visa Signature Card,

Given that Amazon credit card holders spend the highest on its platform, the company is looking at ways to expand its credit card consumer base. CIRP estimates that approximately 15% of Amazon’s U.S. customers have any one of Amazon’s credit cards, representing approximately 21 million customers. However, growth of its card base has not kept pace with its growing Prime membership. In June 2016, it was estimated that Amazon has around 63 million Prime members. Assuming that only Prime members have an Amazon credit card, it would mean that only a third of its Prime customers have one of its credit cards. According to a survey by Morgan Stanley, Amazon Prime members spend about 4.6 times more money on its platform than non-prime members. Its credit card holders spend even greater amounts than what Prime members spend. By enticing its prime customers to own its credit cards, Amazon will be encouraging them to spend more on its platform. Its latest card is aimed at attracting Prime customers by offering deals not only on Amazon.com but on other shopping destinations as well. This can lead to higher spending by existing Prime customers and help convert the fence sitters into Prime memberships.

And those numbers are dated. Amazon Prime now has 100mm members. Imagine if they could all get discounts on their meds. 💰💥💰💥

All of which begs the question: who gets hurt and who benefits (other than Visa ($V)) from this potential secondary effect? 🤔

Go to Brookstone’s website for “Gift Ideas” and “Cool Gadgets” and then tell us you have any doubt. We especially liked the pop-up asking us to sign up for promotional materials one second after landing; we didn’t even get a chance to see what the company sells before it was selling us on a flooded email inbox. Someone please hire them a designer.

On Friday, Reuters reported that...

To continue reading, you must be a PETITION Member. Become one here.

Here’s a fact check if you’re of the view that there’s a tremendous amount of growth potential in the hedge fund world:

Yes, management and performance fees both continue to ratchet downward. If there’ll be an “active management” renaissance, it’ll have to happen at a discount, apparently.