iHeartMedia 👎, Spotify 👍?

Channeling Alanis Morissette: In the Same Week that Spotify Marches Towards Public Listing, iHeartMedia Marches Towards Bankruptcy

In anticipation of its inevitable direct listing, we’d previously written about Spotify’s effect on the music industry. We now have more information about Spotify itself as the company finally filed papers to go public - an event that could happen within the month. Interestingly, the offering won’t provide fresh capital to the company; it will merely allow existing shareholders to liquidate holdings (Tencent, exempted, as it remains subject to a lockup). Here’s a TL;DR summary:

And here’s a more robust summary with some significant numbers:

Revenue: Up 39% to €4.1 billion ($4.9 billion) in ‘17, ~€3 billion in ‘16 and €1.9 billion in ‘15. Gross margins are up to 21% from 16% in 2014 - and this is, in large part, thanks to renegotiated contracts with the three biggest music labels. Instead of paying 88 cents on every dollar of revenue, the company now only pays 79 cents. Only.

Free Cash Flow: €109 million ($133 million) in ‘17 compared to €73 million in ‘16.

Profit: 0. Net loss of €1.2 billion in ‘17, €539 million in ‘16, and €230 in ‘15.

Funding: $1b in equity funding from Sony Music (5.7% stake), TCV (5.4%), Tiger Global (6.9%) and Tencent (7.5%). Notably, Tencent’s holdings emanate out of a transaction that converted venture debt held by TPG and Dragoneer into equity - debt which was a ticking time bomb. Presumably, those two shops still hold some equity as Spotify reports that it has no debt outstanding.

Subscribership. 159 million MAUs and 71 million premium (read: paid) subscribers as of year end - purportedly double that of Apple Music. Services 61 countries.

Available Cash. €1.5 billion

Valuation. Maybe $6 billion? Maybe $23.4 billion? Who the eff knows.

For the chart junkies among you, ReCode aggregates some Spotify-provided data. And this Pitchfork piece sums up the ramifications for music fans and speculates on various additional revenue streams for the company, including hardware (to level the playing field with Apple ($AAPL) and Amazon ($AMZN)…right, good luck with that), data sales, and an independent Netflix-inspired record label. After all, original content eliminates those 79 cent royalties.

Spotify for a long time was a great product and a terrible business. Now thanks to its friends and antagonists in the music industry, Spotify's business looks not-terrible enough to be a viable public company.

Zing! While this assessment may be true on the financials, the aggregation of 71 million premium members and 159 million MAUs is impressive on its face - as is the subscription and ad-based revenue stemming therefrom. Imagine the disruptive potential! Those users had to come from somewhere. Those ad-dollars too.

*****

Enter iHeartMedia Inc. ($IHRT), owner of 850 radio stations and the legacy billboard business of Clear Channel Communications. In 2008, two private equity firms, Bain Capital and Thomas H. Lee Partners, closed a $24 billion leveraged buyout of iHeartMedia, saddling the company with $20 billion of debt. Now its capital structure is a morass of different holders with allocations of term loans, asset-backed loans, and notes. The company skipped interest payments on three of those tranches recently. While investors aren’t getting paid, management is: the CEO, COO and GC just secured key employee incentive bonuses. Ah, distress, we love you. All of which will assuredly amount to prolonged drama in bankruptcy court. Wait? bankruptcy court? You betcha. This week, The Wall Street Journal and every other media outlet on the planet reported that the company is (FINALLY) preparing for bankruptcy. And maybe just in time to lend some solid publicity to the DJ Khaled-hosted 2018 iHeartRadio Music Awards on March 11.

For those outside of the restructuring space, we’ll spare you the details of a situation that has been marinating for longer than we can remember and boil this situation down to its simplest form: there’s a f*ck ton of debt. There are term lenders who will end up owning the majority of the company; there are unsecured lenders alleging that they should be on equal footing with said term lenders who, if unsuccessful in that argument, will own a small sliver of equity in the reorganized post-bankruptcy company; and then there is Bain Capital and Thomas H. Lee Partners who are holding out to preserve some of their original equity. Toss in a strategic partner like billionaire John Malone’s Liberty Media ($BATRA) - owner of SiriusXM Holdings ($SIRI), the largest satellite radio provider - and things can get even more interesting. Lots of big institutions fighting over percentage points that equate to millions upon millions of dollars. Not trivial. Would classifying this tale as anything other than a private equity + debt story be disingenuous? Not entirely.

*****

"It is telling when companies like Spotify hit the markets while more traditional players retrench. Like we've seen in retail, disruption is real and if you stand still and don't adapt, you'll be in trouble. It gets harder to compete when new entrants are delivering a great product at low cost." - Perry Mandarino, Head of Restructuring, B. Riley FBR.

Indeed, there is a disruption angle here too, of course. Private equity shops - though it may seem like it of late - don’t intentionally run companies into the ground. They hope that synergies and growth will allow a company to sustain its capital structure and position a company for a refinancing when debt matures. That all assumes, however, revenue to service the interest on the debt. On that point, back to Spotify’s F-1 filing:

When we launched our Service in 2008, music industry revenues had been in decline, with total global recorded music industry revenues falling from $23.8 billion in 1999 to $16.9 billion in 2008. Growth in piracy and digital distribution were disrupting the industry. People were listening to plenty of music, but the market needed a better way for artists to monetize their music and consumers needed a legal and simpler way to listen. We set out to reimagine the music industry and to provide a better way for both artists and consumers to benefit from the digital transformation of the music industry. Spotify was founded on the belief that music is universal and that streaming is a more robust and seamless access model that benefits both artists and music fans.

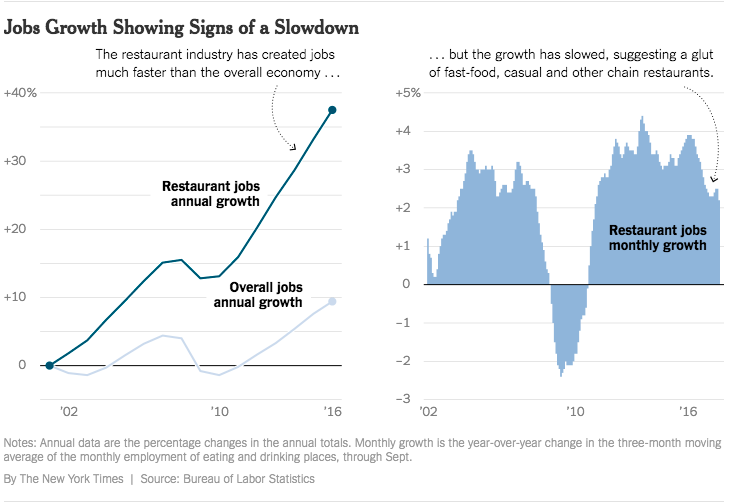

2008. The same year as the LBO. Guessing the private equity shops didn’t assume the rise of Spotify - and the $517 million of ad revenue it took in last year alone, up 40% from 2016 - into their models. Indeed, the millennial cohort - early adopters of streaming music - seem to be abandoning radio. From Nielsen:

Finally, Pop CHR is one of America’s largest formats. It ranks No. 1 nationwide in terms of total weekly listeners (69.8 million listeners aged 12+) and third in total audience share (7.6% for listeners 12+), behind only Country and News/Talk. In the PPM markets it leads all other formats in audience share among both Millennial listeners (18-to-34) and 25-54 year-olds. However, tune-in during the opening month of 2018 was the lowest on record for Pop CHR in PPM measurement, following the trends set in 2017, the lowest overall year for Pop CHR, particularly among Millennials. While CHR still has a substantial lead with Millennials (Country ranked second in January with 8.4%), it will be interesting to track the fortunes of Pop CHR as the year goes on, and music cycles and audience tastes continue to shift.

This is the hit radio audience share trend in pop contemporary:

And, consequently, radio ad revenues have essentially flattened. And if Spotify has its way, the “flattening” will veer downward:

With our Ad-Supported Service, we believe there is a large opportunity to grow Users and gain market share from traditional terrestrial radio. In the United States alone, traditional terrestrial radio is a $14 billion market, according to BIA/Kelsey. The total global radio advertising market is approximately $28 billion in revenue, according to Magna Global. With a more robust offering, more on-demand capabilities, and access to personalized playlists, we believe Spotify offers Users a significantly better alternative to linear broadcasting.

One company’s disruptive revenue-siphoning is another company’s bankruptcy. Now THAT’s “savage.”